Long-suffering stock market bears have to be eating up Thursday’s nasty action, with the Fed’s grim economic outlook and troubling coronavirus headlines sending the Dow DJIA, -6.89% down more than 1,800 points on its way to one of its worst showings in a long time.

Leading up to the steep drop, John Hussman of Hussman Investment Trust HSTRX, -0.69% , who hasn’t shied away from addressing his misfires in recent years, once again offered up his gloomy take on the market’s prospects in his latest note to clients.

“In the face of a breathtaking disconnect between Main Street and Wall Street, largely based on overconfidence in free money, my sense is that there remains a crisis ahead that will emerge ‘gradually, then suddenly,’” he wrote, referring to Ernest Hemingway’s famous quote from “The Sun Also Rises” about going bankrupt, “gradually, then suddenly.”

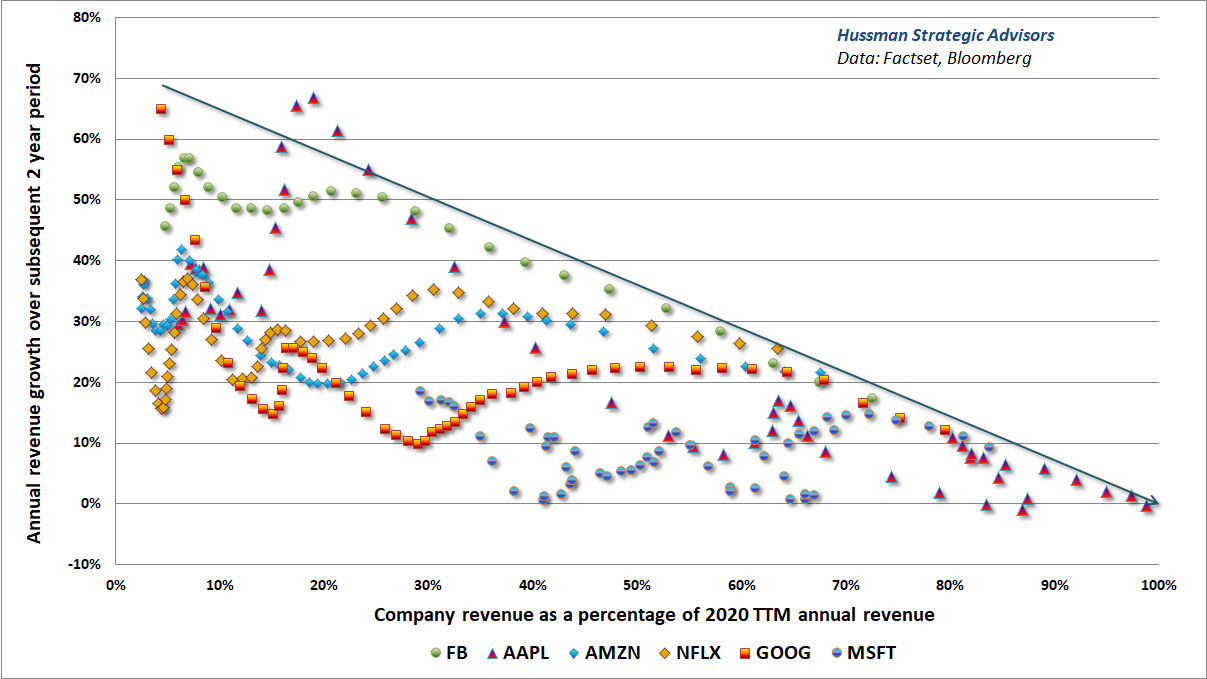

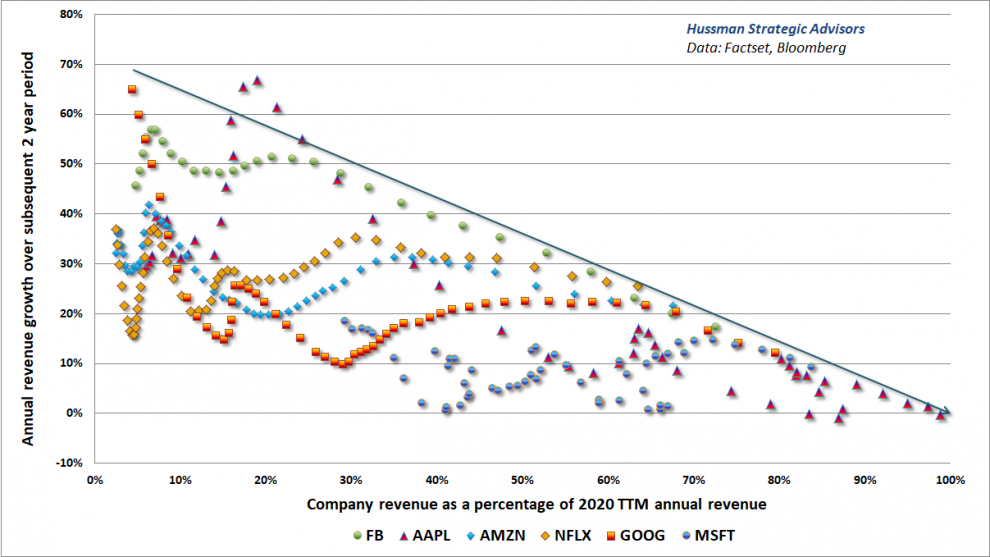

Hussman singled out six widely held stocks, in particular, he believes are vulnerable when the mood turns to risk-off: Facebook FB, -5.19% , Apple AAPL, -4.80% , Amazon AMZN, -3.38% , Netflix NFLX, -2.05% , Google GOOG, -4.23% and Microsoft MSFT, -5.37% .

Hussman used that chart to show how the two-year revenue growth of some of those massive companies has “slowed remarkably” compared with the “spectacularly high” rates of prior years.

“All of these companies are headed toward growth rates that are likely to converge toward single-digit rates similar to the growth rate of the overall economy,” Hussman predicted. “That’s not how investors are pricing these large-cap glamour stocks.”

This is reminiscent of the “Nifty Fifty” stock boom of the 1970’s and the high-flyers of the tech bubble in 2000, he explained, adding that every indication is that the same process of unwinding is underway today which could have sweeping implications for the health of the market.

“The wide dispersion between richly-valued, mega-cap components of the S&P 500 and the broader market is likely to create an enormous headwind for passive index investors over the coming decade, but will simultaneously create enormous opportunities for investors with the flexibility to pursue broad, value-conscious stock selection,” Hussman said.

In Thursday’s selloff, with the S&P 500 SPX, -5.89% closing off almost 6%, all the “glamour” names were in the red, led by Microsoft’s 5.4% drop.

Add Comment