Main Street is paying attention to Wall Street — and that might not be a good sign for the stock market.

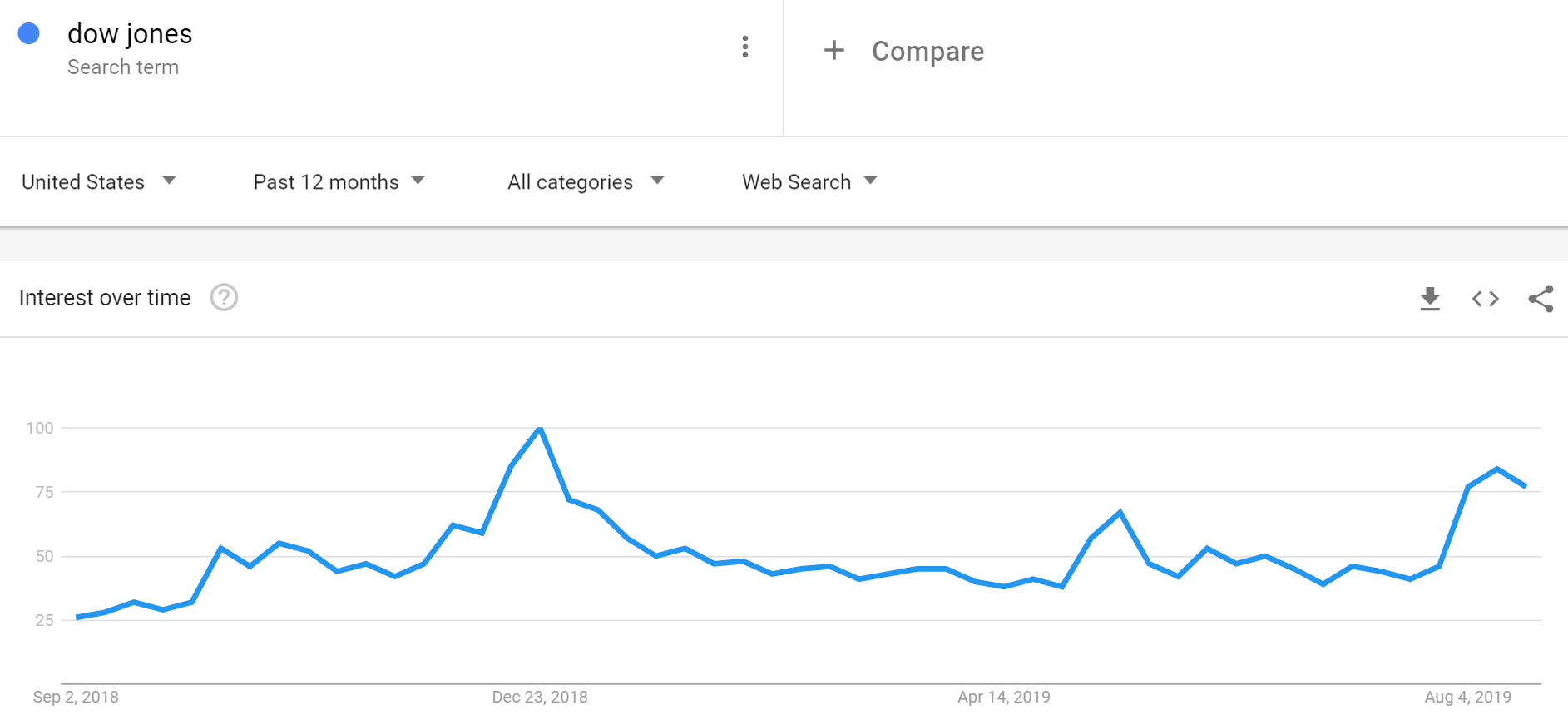

Nicholas Colas, co-founder of DataTrek Research, observed on Aug. 8 that Google searches for “dow jones” were higher than they were in May, when the blue-chip Dow Jones Industrial Average DJIA, -0.26% retreated 6.7% and the S&P 500 index SPX, -0.18% suffered a 6.6% decline due to a flare-up in U.S.-China tensions over trade policy. Through Monday, the Dow was down 3.6% this month, while the S&P 500 was down 3.4%.

In a Tuesday note, he wrote that Google searches for “dow jones” for the week of Aug. 11-17, the last full week of data, are up 28% from the peak May week (see chart below).

So what? While the S&P 500 index is indeed the preferred measure of U.S. stock-market performance and the benchmark for funds, Colas said that “Main Street googles ‘dow jones’ when they are worried about stock-market volatility.” The concern for investors is that stock market volatility and more chatter about recession indicators flashing warning signs could lead to make U.S. consumers more cautious headed into the 2019 holiday season, he said.

There might be a small bit of comfort in that search volumes are still 14% below the 12-month high seen during the last week of December, when markets suffered a sharp rout. Attention turned away from the market in January as the market recovered, Colas noted.

The main take-away from the current search interest, he said, is that even if average Americans don’t own equities, they know that volatile stock markets signal the potential for job losses and even recession.

“We’ll have to wait to see how markets perform over the rest of 2019,” Colas wrote, “but one thing is sure: Americans are watching.”

Add Comment