Former Vice President Joe Biden’s strong showing on Super Tuesday is getting a lot of credit for the stock market’s sharp Wednesday bounce. But a look at prediction markets casts doubt on the idea that worries the earlier ascendancy of Vermont Senator Bernie Sanders in the race for the Democratic presidential nomination was a major factor in the market’s recent pullback, says one Wall Street analyst.

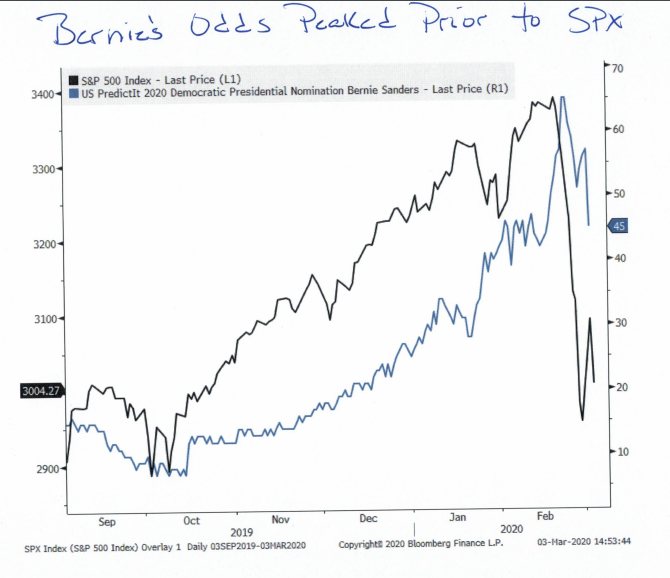

The simultaneous early success of Sanders, campaigning on an agenda promising increased regulation and higher taxes on wealthy Americans, in the Democratic primaries and the spread of COVID-19 made it hard to disentangle which factor was the bigger driver for the stock market or even bond yields, said Jeff deGraaf, founder and chairman of Renaissance Macro Research, in a Thursday note. But a look at the chart below indicates that, based on prediction market forecasts, the odds of a Sanders nomination had started to fall a few days after the S&P 500 SPX, +4.22% peak on Feb. 19.

Renaissance Macro Research

Renaissance Macro Research Related: Is fear of a Sanders presidency bern-ing the markets?

Those odds continued to decline, making lower lows, after Biden’s Saturday victory in South Carolina, he noted, while Republican odds, still above 50%, moderated only slightly.

If anything, the stock market’s retreat from record levels has coincided with Biden’s rise in the polls, de Graaf said. That doesn’t mean Biden’s gains are spooking investors — the relationship is likely spurious, he said, but it does “underscore the challenges of ‘knowing’ what exactly Mr. Market is responding to at any given point in time.

“In this case, we’re more comfortable that COVID-19 is the larger culprit than Bernie (or Joe), and less impactful to intermediate or long‐term dislocations,” deGraaf wrote.

Stocks last week suffered their biggest weekly loss since October 2008, with major indexes tumbling into a correction in a move that was blamed largely on fears the global spread of the coronavirus would cause a global economic shock. Stocks saw renewed pressure Tuesday after the Federal Reserve delivered an emergency, intermeeting rate cut that investors said did more to unnerve than soothe investors.

See: Why stocks tanked despite the Fed’s emergency rate cut

The Dow Jones Industrial Average DJIA, +4.53% soared more than 1,170 points, or 4.5%, on Wednesday, while the S&P 500 jumped 4.2%.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment