The coronavirus is pressuring the global logistics industry and one San Francisco-based freight-forwarding company is more exposed than others, according to Panjiva, the supply chain research unit of S&P Global Market Intelligence.

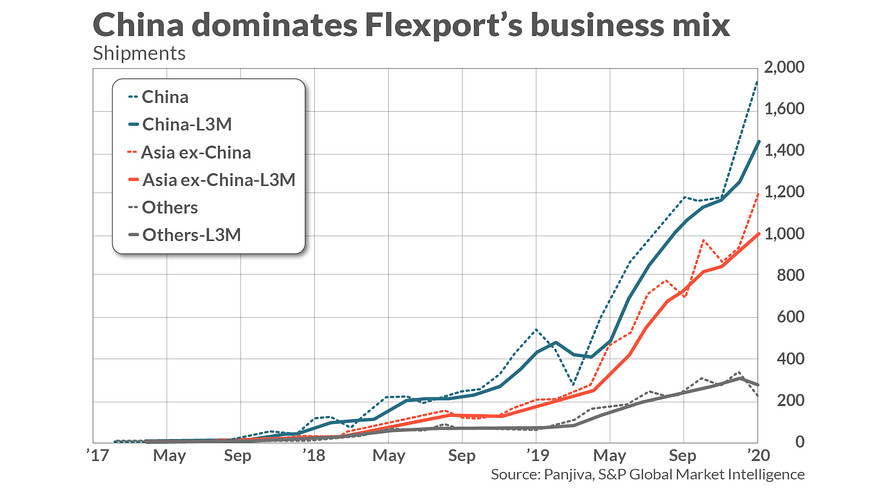

Privately held Flexport, which boasts more than 10,000 clients and suppliers across 116 countries, is more exposed to China than rival Deutsche Post-DHL DPW, +0.96%, the German logistics company, according to Panjiva.

As the chart demonstrates, China accounted for 52.2% of Flexport’s U.S. seaborne inbound handling in 2019, compared with just 31.9% for Deutsche Post-DHL. Both companies have warned of increased rate volatility for airfreight due to reduced “belly cargo” capacity on passenger jets, as well as marine shipping capacity cuts.

The coronavirus has now reached almost 25,000 cases with 99% of those in mainland China, mostly in the city of Wuhan in the Hubei province, where the disease is understood to have broken out at a seafood market.

Also: Coronavirus hopes drive airlines and oil companies higher in London

The disease is impacting container lines, freight forwarders and car carriers, with South Korea’s Hyundai Motor Co. Ltd. 005380, +6.45% announcing earlier Wednesday that it has suspended car production because of a shortage of Chinese parts.

Container lines Maersk MAERSK.B, +0.00%, CMA-CGM and ONE have all discussed cutting shipping capacity because of the illness, said Panjiva.

Flexport Chief Economist Phil Levy cautioned in a blog on the company’s website that the uncertainty about when Chinese travel restrictions will lift, or when factories will resume operations, make it hard to forecast the impact on air cargo rates.

“A prolonged delay in production would cause a negative demand shock,” he wrote. “With that in play, this would give us a clear indication of a decrease in trade volume, with ambiguity about the price movement.”

Unlike air freight, ocean freight is typically independent of passenger traffic and accounts for most supply chain shipments, said Levy.

“But the Yangtze is a very important internal waterway running through Wuhan,” he wrote. “When traffic is disrupted, the effect can be significant.”

Flexport was founded in 2013 with a focus on serving the U.S.-China market, although it has diversified its operations following the trade tensions and tariff battle between the two countries.

See: Ralph Lauren has closed about half of its stores in China due to the coronavirus

Deutsche Post-DHL calls itself the world’s leading mail and logistics company with about 550,000 employees in more than 22- countries and territories worldwide. The company had revenue of more than 61 billion euros ($67 billion) in 2018.

Add Comment