The stock market is in shambles to start the week, with the Dow Jones Industrial Average DJIA, -2.90% dropping more than 700 points after China retaliated against President Trump’s latest move in the intensifying trade war.

Charles Hugh Smith, known for his Of Two Minds blog, like many other market bears, has been calling for a painful end to this bull run for a while now.

“Nothing the Fed could do will restore a fragile, speculation-dependent, debt-bubble economy to any sort of health,” he wrote. “Whatever the Fed does, it further distorts a massively distorted system, increasing the odds of a catastrophic re-set.”

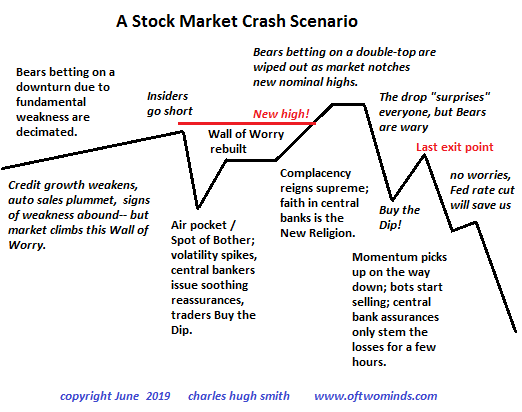

He posted this chart to give an idea of how bubbles typically end:

Are we about to see a bounce that provides that “last exit point?”

Soon enough, Smith says, the Federal Reserve, at the behest of President Trump, will attempt to save the market but will ultimately fail.

“The American lifestyle and economy depend on a vast number of implicit guarantees — systemic forms of entitlement that we implicitly feel are our birthright,” he wrote in a post on Monday. “Chief among these implicit entitlements is the Federal Reserve can always save the day.”

Read: The superrich are raising cash, selling stocks, buying property

In either an inflationary spiral or deflationary collapse of self-reinforcing defaults, Smith warned that the Fed’s “save” would destroy the economy.

“Other than the phantom ‘wealth’ of real estate and stock bubbles, the vast majority of the ‘wealth’ generated by the Fed’s actions of the past 20 years has flowed to the top 0.1%,” he said. “This will become self-evident once the phantom gains of speculative bubbles vanish.”

Read: There’s a lot more to this slide than the trade war

Add Comment