Has the retail investor thrown up the white flag?

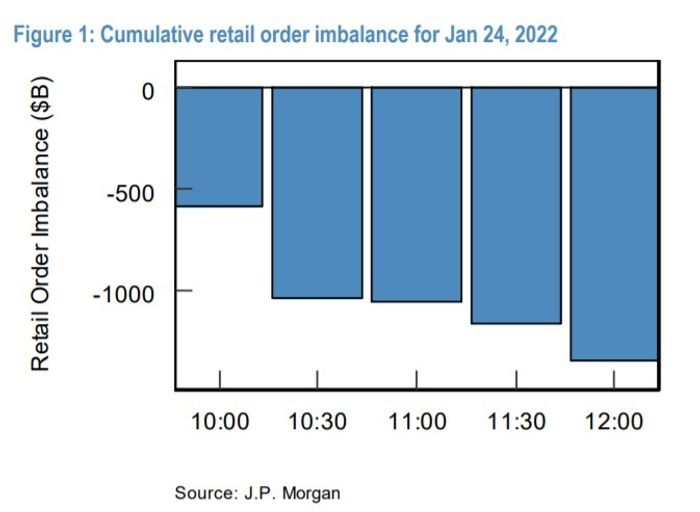

On Monday, they certainly did. According to Peng Cheng, a markets strategist at JPMorgan, retail investors aggressively dumped stocks at the beginning of the day. By noon, there was a retail order imbalance of $1.36 billion.

Retail investors sold companies including Apple AAPL, -0.49%, Nvidia NVDA, -0.01%, Netflix NFLX, -2.60%, Advanced Micro Devices AMD, -1.92%, Microsoft MSFT, +0.11% and Tesla TSLA, -1.47% — and their number-one purchase was the ProShares UltraPro Short QQQ SQQQ, -1.24%, which also is a bet against the stock market.

The analysis did not include the wild rally off the lows which turned the Dow DJIA, +0.29%, S&P 500 SPX, +0.28% and Nasdaq Composite COMP, +0.63% higher, and a message left with Cheng wasn’t immediately returned.

Over on the Reddit Wall Street Bets forum, there was gallows humor. One post had a meme of a Wendy’s fast-food chain, with the tagline, “Welcome back to work, Diamond Hands.” Diamond Hands is the internet slang for an investor who refrains from selling.

In the early hours of Tuesday, pessimism again engulfed markets, with futures on the Dow Jones Industrial Average ES00, -0.93% losing nearly 300 points.

If a rate-hike cycle is the proverbial removal of the punchbowl, it looks like retail investors might be leaving the party on the eve of Wednesday’s Federal Open Market Committee decision.

Add Comment