The C-suite has heard the Federal Reserve’s message on the need for restrictive financial conditions.

Major U.S. corporations facing higher borrowing costs and weaker quarterly earnings as the Fed keeps up its inflation fight have been responding by cutting back their debt load.

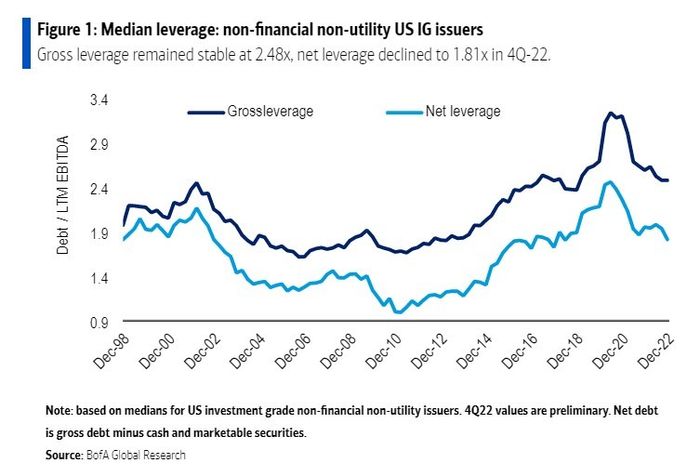

The trend of debt reduction, or deleveraging, from peak levels was taking shape already last year (see chart) at a spectrum of companies that issue U.S. investment-grade corporate bonds, according to BofA Global credit analysts.

Leverage is coming down in Corporate America

BofA Global Research

Now, there’s more evidence of a trend. Preliminary fourth-quarter corporate earnings results point to median net leverage of 1.81x as measured against earnings before interest, taxes, depreciation and amortization (EBITDA), down from 1.94x in the third quarter, the BofA team said in a Tuesday client note.

“On top of that the pace of gross debt reduction accelerated to -1.6% YOY in 4Q from -0.9% in 3Q,” the team wrote. “We look for companies to continue to deleverage in 2023 on the back of high borrowing costs and an uncertain economic outlook.”

The blended earnings growth estimate for S&P 500 index companies was pegged at minus 2.9% for the fourth quarter as of Wednesday, according to I/B/E/S data from Refinitiv. What’s more, the outlook is for a negative growth rate for the first and second quarters of 2023.

Stocks were lower Wednesday, with the Dow Jones Industrial Average DJIA, -0.61% off about 0.6%. Overall, however, optimism around the Fed potentially nearing the end of its rate-hiking cycle has helped lift stocks for the year. The S&P 500 index SPX, -1.11% was up 7.6% on the year through Wednesday.

The rally has come despite U.S. central bankers reiterating a need to keep borrowing costs high in the face of stubborn inflation.

Fed Chairman Jerome Powell said recently that the central bank was likely to raise its policy interest rate a couple of more times, which could potentially increase its fed funds policy rate to a peak of 5% to 5.25% in May.

Federal Reserve Gov. Christopher Waller on Wednesday said he’s “prepared for a longer fight to get inflation down” and said interest rates need to remain high for “some time” to make sure intense price pressures are eradicated.

Of note, borrowing costs for many U.S. companies hinge on the benchmark 10-year Treasury rate TMUBMUSD10Y, 3.623%, which was near 3.65% on Wednesday. The sharp rise in the Fed’s benchmark interest rate last year led to the worst bond market returns on record in many sectors.

The BofA review of leverage was based on roughly half of the companies in the ICE BofA US IG index that have already reported fourth-quarter results. It excluded companies with large captive finance subsidiaries like General Motors Co. GM, +0.41%, Ford Motor Co. F, -0.22%, and General Electric Co. GE, -0.18% and utilities, which tend to have higher leverage.

Add Comment