(Bloomberg Opinion) — Gadget makers from Apple Inc. to Huawei Technologies Co. are turning to gimmicks like multi-lens cameras, folding screens, 5G connectivity and virtual-reality displays to juice sales amid a general upgrade apathy in the smartphone market.

I’m among those skeptical that these new specs will do a lot to make devices fly off the shelves. Investors in Asia, however, seem pretty convinced that at least the suppliers of this wizardry will be winners.

Information technology stocks are the top performers in the MSCI Asia Pacific Technology Index this year, climbing 21.8% through Oct. 3, compared with an 8.8% advance for the broader index. The outperformance was even more stark last quarter: the sector rose 5.5%, more than 3 points more than second-ranked healthcare stocks.

Goertek Inc. is the standout. Shares in the Chinese maker of AirPods for Apple and VR headsets for Huawei doubled in Shenzhen last quarter. The company ships to Apple from factories at its home base in Shandong province as well as from Vietnam, meaning it can skirt U.S. tariffs on Chinese-made goods.

China International Capital Corp. is among those bullish about Goertek. The brokerage has raised its price target at least three times in the past two months in the belief that in addition to AirPods, the company will reap rewards from providing smart speakers to Amazon.com Inc. and Apple.

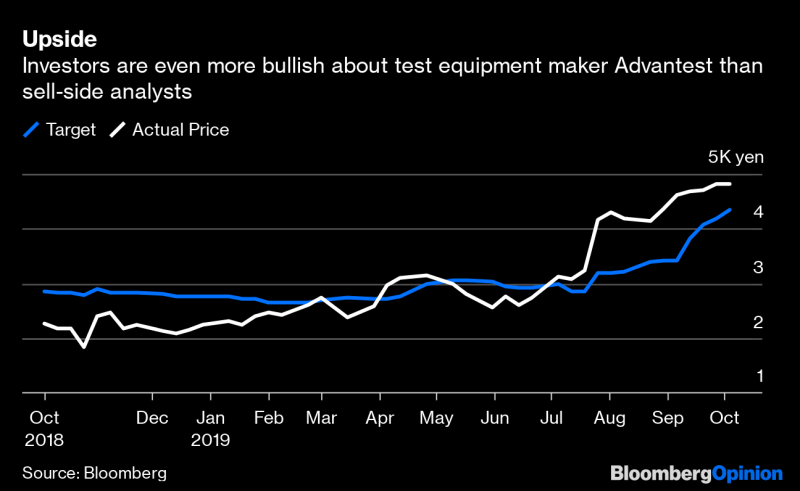

Japan’s Advantest Corp. is perhaps a surprising winner from the trend toward souping up old gadgets with new tech. The company makes testing equipment, with its customers being chip and component makers.

Smartphone-related testing machines were a major boost to Advantest last financial year, helping operating income more than double to the highest in almost two decades in the 12 months through March 31. The proliferation of chips used by a device and the increased number of sensors in smartphones have spurred demand for the equipment that checks all these parts are working correctly.

Continued weakness in the semiconductor market, however, prompted management in April to forecast a 19% drop in sales and 53% decline in operating income this year. It reiterated that forecast in July.

Neither the sell-side nor the buy-side are buying it. The stock shot up in mid-July after the company posted first-quarter earnings, to end the September quarter 61% higher. Analysts have been left struggling to keep up, raising their price targets by an average of 46% in the past three months. The consensus is still 10% below where the shares are trading.

Other top performers last quarter are a who’s who of niche component makers that help make touch-sensitive screens, 3D sensors, and crisper and more powerful cameras.

Chinese companies OFilm Group Co., Lens Technology Co. and Sunny Optical Technology Group Co. all climbed more than 40% during the quarter after big drops earlier in the year. Investors who bet that bad news had been overblown – from the trade war and concerns over a U.S. ban on Huawei to a sluggish smartphone market – were richly rewarded.

Each supplier offers a similar array of components, with investors betting that the move toward more lenses and curved and foldable displays is an irreversible trend. The iPhone 11 and Huawei’s Mate 30 are more famous examples of multi-sensor implementation.

What tends to happen is that as big companies launch gimmicky new features, smaller brands follow suit and rush to add the same whizz-bang technology. This cascade effect helps the whole supply chain even if some companies don’t sell to the marquee names.

With so many brand names competing to outdo each other in features it becomes difficult to guess which smartphone company will come out on top. In the past few months, smart investors haven’t bothered to try. Instead, they understand that the real winners will be those who supply the components.

Now it’s up to consumers to pick a device. Any device.

To contact the author of this story: Tim Culpan at [email protected]

To contact the editor responsible for this story: Matthew Brooker at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”61″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment