If there are five stages of grieving over human death and dying, as suggested by the psychiatrist Elisabeth Kubler-Ross in 1969, the same may also be true for our economic stages.

Consider the current housing cycle.

We’ve had ongoing periods of denial: those bad numbers were because of weather, economists say every month. We’ve had plenty of bargaining, as seen in anecdotes from real-estate agents who see clients “waiting until next year to list,” “rushing to buy before further rate rises,” and so on. Last summer, when MarketWatch was the first publication to call the top in the cycle, there was likely depression in some quarters.

Now, it seems, we have finally reached acceptance.

See: This chart shows the haves and have-nots of the housing market, and it’s getting worse

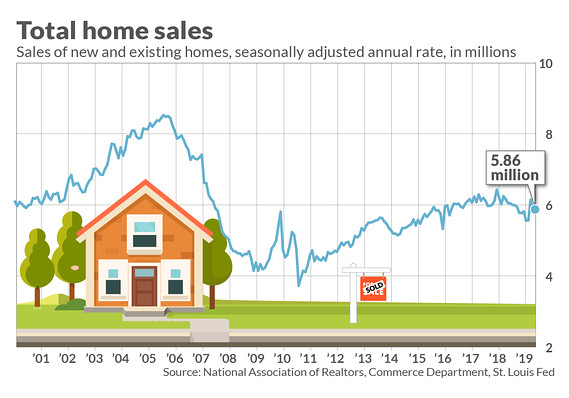

That’s because that “peak housing” call last year now seems to have been proven. Several weeks after it was published, combined sales of new and existing homes dipped below 6 million for the first time in two years. And in the nine months that have passed since then, total sales have only topped 6 million once.

It is possible that when the National Association of Realtors reports May sales of previously-owned homes this Friday, things will have turned around. Mortgage applications have been stronger, interest rates have been lower, and jobs are still plentiful.

As NAR Chief Economist Lawrence Yun insisted in a release last month describing yet another decline in home-contract signings, “it’s inevitable for sales to turn higher.”

Related: Mortgage rates hit a 4-month low, so what’s holding back the housing market?

But are they? There are signs that, as stock analyst Buck Horne put it in a note downgrading homebuilders, “there could be more cyclical risks ahead”. In other words, Americans don’t need to receive pink slips to shy away from making the biggest purchase of their lives with 30-year loans. They just need to be worried enough that it’s going to happen.

TS Lombard Chief U.S. Economist Steve Blitz explained how that all fits together in a note released late on Tuesday. The pace of job growth has slowed, making it less crucial for home builders to keep construction going at the same pace, possibly leading to some loss of jobs and putting less upward pressure on pricing, which may help convince the Federal Reserve to cut rates, and so on.

It’s worth noting that some analysts think differently. Wedbush last week gave builders an upgrade, and the Econoday consenus sees a rebound in May existing-home sales. Many measures of sentiment among would-be buyers are quite strong.

And, as MarketWatch noted last year, a “top” for housing need not be scary. If sales simply move sideways from here, it will mean some more Americans are achieving home ownership, builders are selling some of their products, and economists and analysts have plenty to say about it all.

Read: Here’s what mortgage rates will do next year, from the people who usually get it wrong

Add Comment