Bond-market guru Jeff Gundlach says he’s watching a few areas of the market to gauge whether the current bullish dynamic is starting to unravel in earnest. On Wednesday afternoon, during a CNBC interview, he said that he’s sees some early cracks that are worth investors’ attention.

Those include readings of consumer sentiment and a disparity between gauges of volatility in the bond and the stock markets.

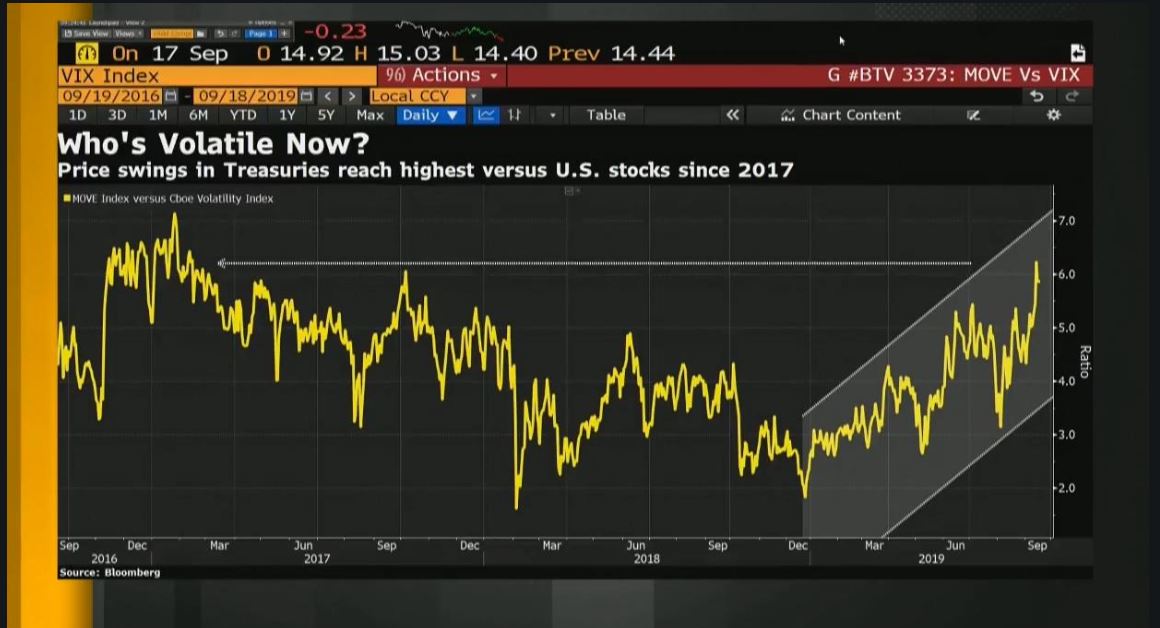

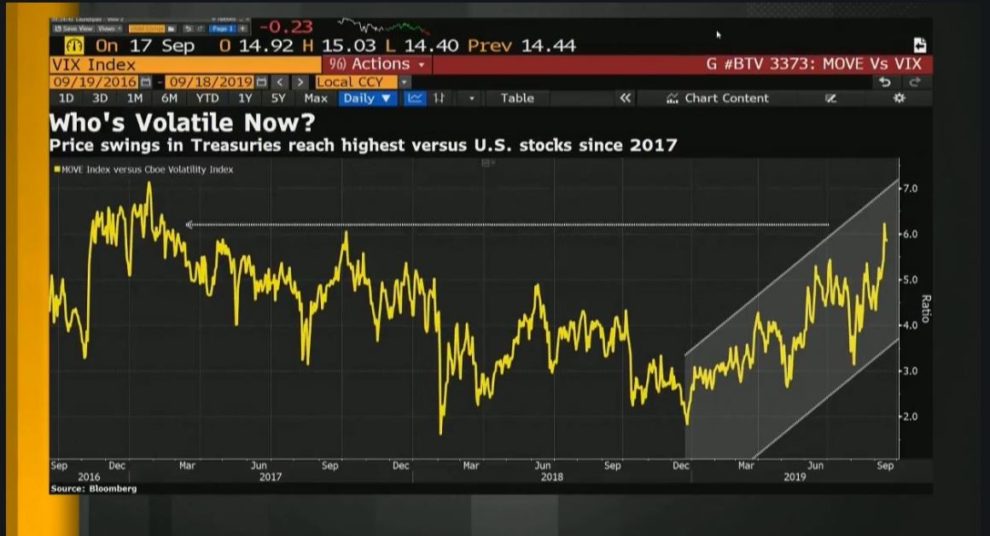

‘The VIX index has settled down to about 15 but the MOVE index…remains incredibly elevated despite the fact that bonds have really kind of stabilized, which kind of suggests that there’s a belief in the bond market that volatility is not going to go away.’

The bond market pro says that a closely watched measure of expected volatility in the S&P 500 SPX, -0.49%, the Cboe Volatility VIX, +9.04%, which uses bullish and bearish options bets on the index to help gauge expected swings in stocks in the coming 30 days, has been fairly quiescent of late, suggesting that equity-market investors have become somewhat complacent.

The VIX stood at around 14.61 Wednesday afternoon, below its historic average of around 19, while Merrill Lynch’s MOVE Index, an indicator of volatility in 10-year U.S. government bonds TMUBMUSD10Y, +0.00% in coming month, has remained elevated since reaching a 2 ½-year high In June.

Earlier, the disparity between the VIX compared to the MOVE Index was its widest since 2017 (see chart below):

Bloomberg via @acemaxx on Twitter

Bloomberg via @acemaxx on Twitter Gundlach’s takeaway from the gap in the stock and bond volatility measures is that the bond market, a group of investors viewed as the “smart money,” is betting that turbulence will continue to swirl in markets.

Read: Gundlach sees 75% recession chance, has a warning about the corporate bond market

The DoubeLine founder also said investors should watch for shifts in consumer sentiment. Particularly, he said market participants should pay attention to breakdowns in how consumers feel about the future and expect that to eventually coincide with a deterioration of their view of present conditions.

Gundlach described that as one of the “most compelling” measures of the economic health in the U.S.

As for the Fed, the prominent investor said he doesn’t believe the central bank should cut interest rates but thinks they likely will at Wednesday’s meeting. “I don’t think the Fed should cut but they will,” he said.

Wall Street is expecting a quarter of a percentage point cut but the language of the Fed’s statement at 2 p.m. Eastern Time, and Chairman Jerome Powell’s news conference could be a key driver of trading in the S&P 500, the Dow Jones Industrial Average DJIA, -0.59% and the Nasdaq Composite Index COMP, -0.80%.

Check out: Fed decision and Jerome Powell press conference: live blog and video

Add Comment