“ ‘Risk to the downside is greater than the opportunity to the upside from this point where we stand today.’ ”

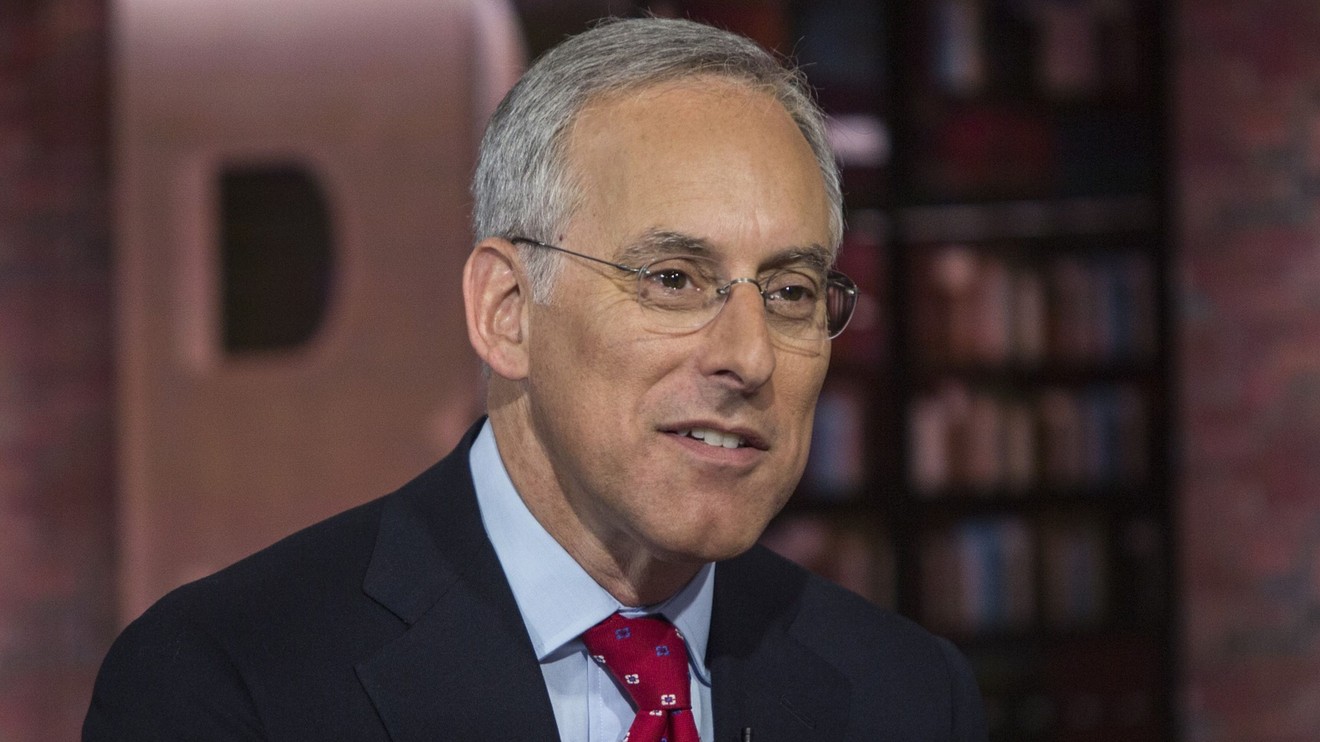

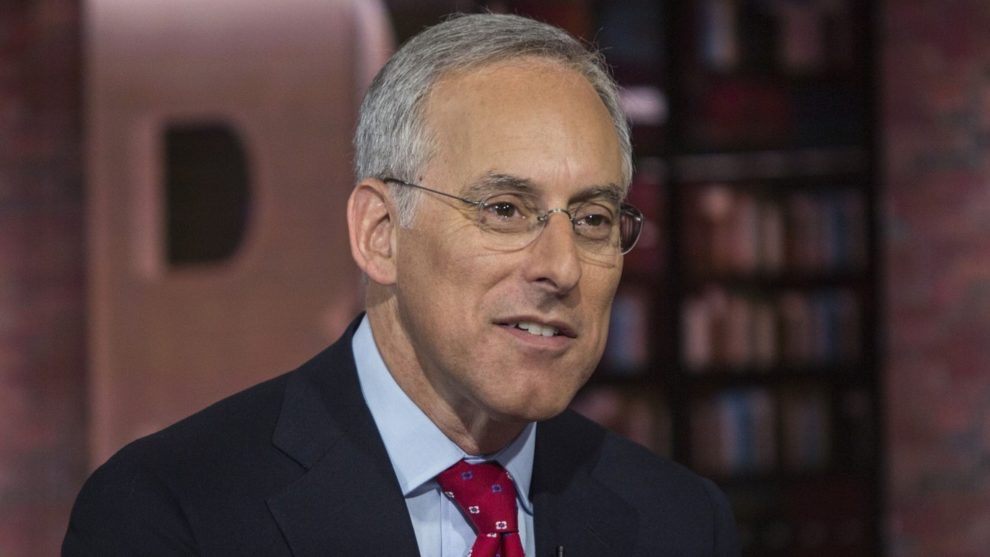

That’s Goldman Sachs’s chief equity strategist, David Kostin, explaining during a CNBC phone interview on Tuesday that recent enthusiasm for stocks don’t necessarily constitute an all-clear signal for bullish investors seeking a path higher for the pandemic-stricken markets.

“There’s a little bit of asymmetry in terms of the downside risk toward a level in the S&P 500 of around 2,000, which is down almost 25%, and upside of around 10% to a target at the end of the year of 3,000,” he explained on Tuesday’s edition of the channel’s “Squawk on the Street” program.

That’s quite a range of outcomes from Goldman but speaks to the uncertainty surrounding the economy and the markets once they reach the aftermath of the COVID-19, which is still wreaking havoc on domestic and global economies due to forced shutdowns of business and personal activity intended to mitigate the spread of the deadly coronavirus pathogen. The disease, which was first identified in China in December, has infected nearly 1.4 million people and killed nearly 80,000 world-wide, according to data aggregated by Johns Hopkins University, has resulted in some 10 million jobs lost over the past two weeks and has likely pushed the unemployment rate in the U.S., which stood near a 50-year low at 3.5% back in February, north of 10%.

However, glimmers of hope that the spread of the infection may be leveling off has buoyed stocks over the past two sessions—until stocks staged a dramatic U-turn late—and raised the question of whether the market is underestimating the near-term and lasting impacts of the pandemic.

The Dow Jones Industrial Average DJIA, -0.11% finished lower on Tuesday but was nearly 7.6% higher in the week thus far, while the S&P 500 index SPX, -0.16% was up 6.9% over the span of the week’s two sessions, while the Nasdaq Composite Index COMP, -0.32% had advanced 7% over the nearly two-session period.

For Kostin’s part, it is important, he said, that investors not get overzealous, citing market moves during the 2008 financial crisis. The analyst recalled that the market 12 years ago took several months of violent moves up and down before ultimately putting in a lasting bottoming on March 9, 2009.

“I would just remind you that in 2008 in the fourth quarter there were many different rallies…but the market did not bottom until March of 2009,” Kostin told CNBC.

The Dow, S&P 500 and Nasdaq’s most recent bottom was put in on March 23, but the velocity at which the equity indexes crashed last month from all-time highs has been perhaps the hardest thing for strategist and investors to wrap their minds around. The Nasdaq and S&P, which stood at all-time highs on Feb. 19, remain 21.5% and 19.7% beneath those levels, respectively, while the Dow is down 23.3% from its Feb. 12 all-time closing high.

Back in early March, Kostin and his team accurately predicted that the longest bull market in U.S. history would run out of road as the global COVID-19 outbreak crushed corporate earnings and the overall economy.

In a note on Tuesday, Kostin said that stock-buyback activity among S&P 500 companies would decline by 50% to about $371 billion in 2020.

Add Comment