‘I want to make clear that we don’t have any such net bet that the stock market will fall.’

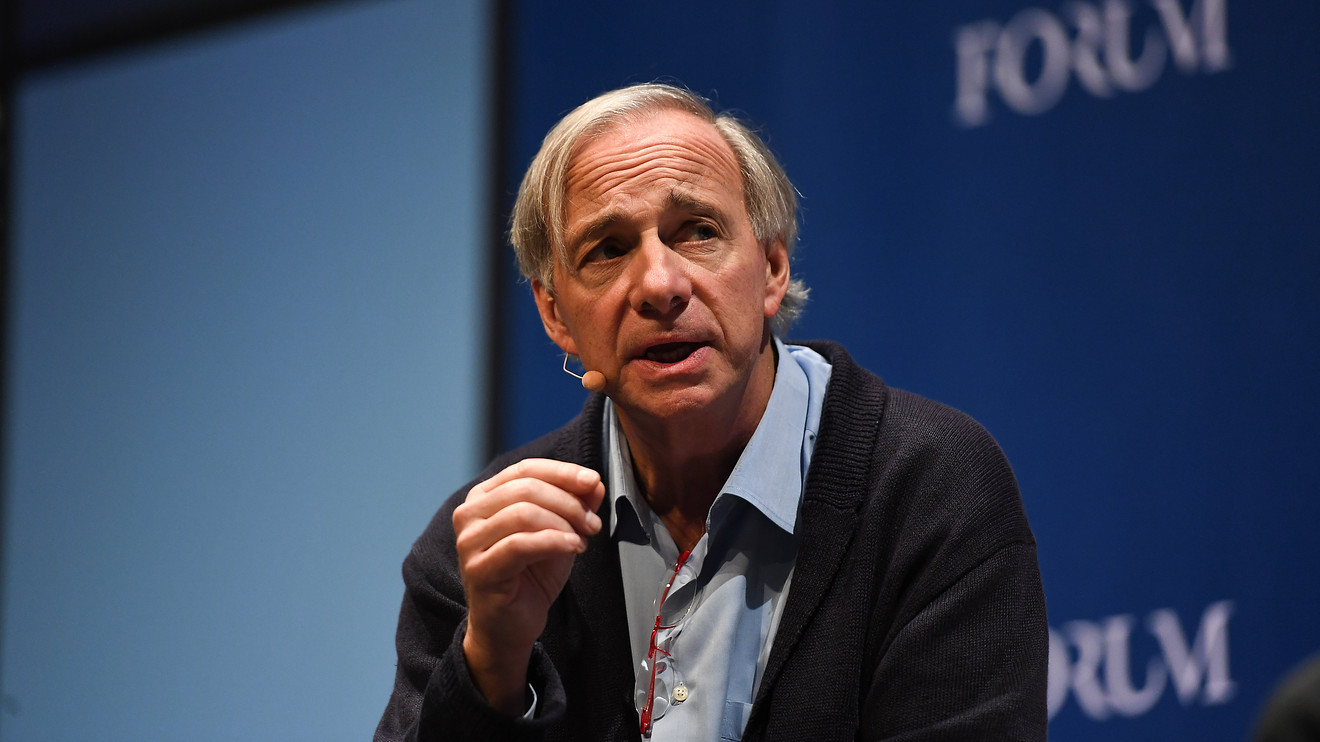

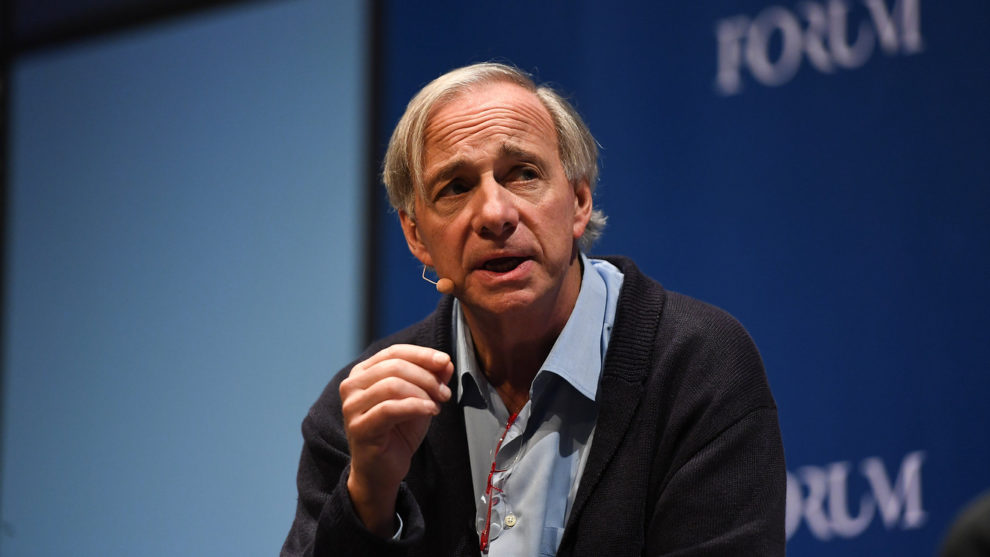

That’s Ray Dalio, founder of the world’s largest hedge fund, Bridgewater Associates, disputing elements of a Wall Street Journal report on Friday that indicated his fund was putting on a $1.5 billion bet that global stock markets would drop precipitously by March 2020.

However, Dalio took to Twitter to attempt to disabuse anyone of the notion that this reflected an outright bearish outlook for markets.

The Journal said the reported investment would represent about 1% of Bridgewater Associate’s $150 billion in assets.

Citing people described as familiar with the investments, the paper said the investment was made up of put options — derivative contracts that give investors the right but not the obligation to sell an asset at a specific time and price.

Bridgewater had explained to a Journal reporter, Dalio said via Twitter, “that to convey us having a bearish view of the stock market would be misleading, but it was done anyway.”

It isn’t uncommon for big investors like Dalio to purchase options as a way to hedge their portfolios, or simply to make purchases to take advantage of disparities in market trends.

For example, one measure of market expectations for falls in the coming 30-day period, the Cboe Volatility Index VIX, -6.02% , declines as markets rise and vice versa, and has recently been well below its historic average of around 19, implying that investors have grown complacent about a drop in equities as the Dow Jones Industrial Average DJIA, +0.39% , the S&P 500 SPX, +0.22% and the Nasdaq Composite Index COMP, +0.16% all trade near record levels on hopes that China and the U.S. will strike at least a partial trade pact in the coming weeks or months.

That dynamic has seen the VIX, often referred to as Wall Street’s fear index, lose half its value so far in 2019, according to FactSet data.

But that also means that buying insurance in case of a downturn in the market or expecting risk to pick up even slightly might make for a profitable play for hedge funds like Dalio’s, experts say, while not entirely reflecting a bearish view of the markets in the coming months.

That could be the point that Dalio is trying to drive home. In other words, he isn’t disputing the investment but may be taking issue with how it is being characterized.

Bridgewater representatives didn’t immediately return MarketWatch’s request for further comment.

The Journal did note that it couldn’t determine why Bridgewater had made the investment. “Several clients said it may simply be a hedge for significant exposure to equity markets the firm has built up. Funds often hedge, or take offsetting positions, against other exposure to protect against losses,” the report said.

However, even if Dalio were to be making a bearish bet on the market. Those bets don’t always pan out for the so-called smart money on Wall Street.

For example, the Wall Street Journal reported back in 2016 that George Soros, who looks after some $30 billion via his Soros Fund Management, bought gold and gold mining shares and sold stocks in anticipation of a rout in markets. However, it isn’t clear that the bet bore fruit for the legendary investor, who earned fame for successfully betting against the British pound GBPUSD, -0.0078% in 1992.

More recently, the Financial Times reported back in September that Paul Singer’s Elliot Management was tapping investors to raise funds for a $5 billion war chest in anticipation of a “market meltdown.” To be sure, he has reportedly been trying to raise this so-called rainy day fund since 2017.

Talk of efforts by hedge funds to time big equity-market drops come as the group has lagged behind the performance of the broader market.

According to the Journal, Bridgewater’s macro fund has lost 2.7% this year through October. Another fund it manages, its so-called All Weather fund, is up 14.5% for the period.

Meanwhile, the Dow has gained 19.4% in 2019 to date, the S&P 500 has climbed 24% and the Nasdaq Composite has advanced 28% over the same period.

Add Comment