London stocks struggled for traction on Wednesday, as investors waited for an interest-rate announcement from the Federal Reserve and mulled over a gloomy forecast for the U.K. while it battles to recover from the global pandemic.

The FTSE 100 UKX, +0.29% was flat at 6,340.59, on the edge of its third-straight loss. The pound GBPUSD, +0.38% rose 0.5% to $1.2789.

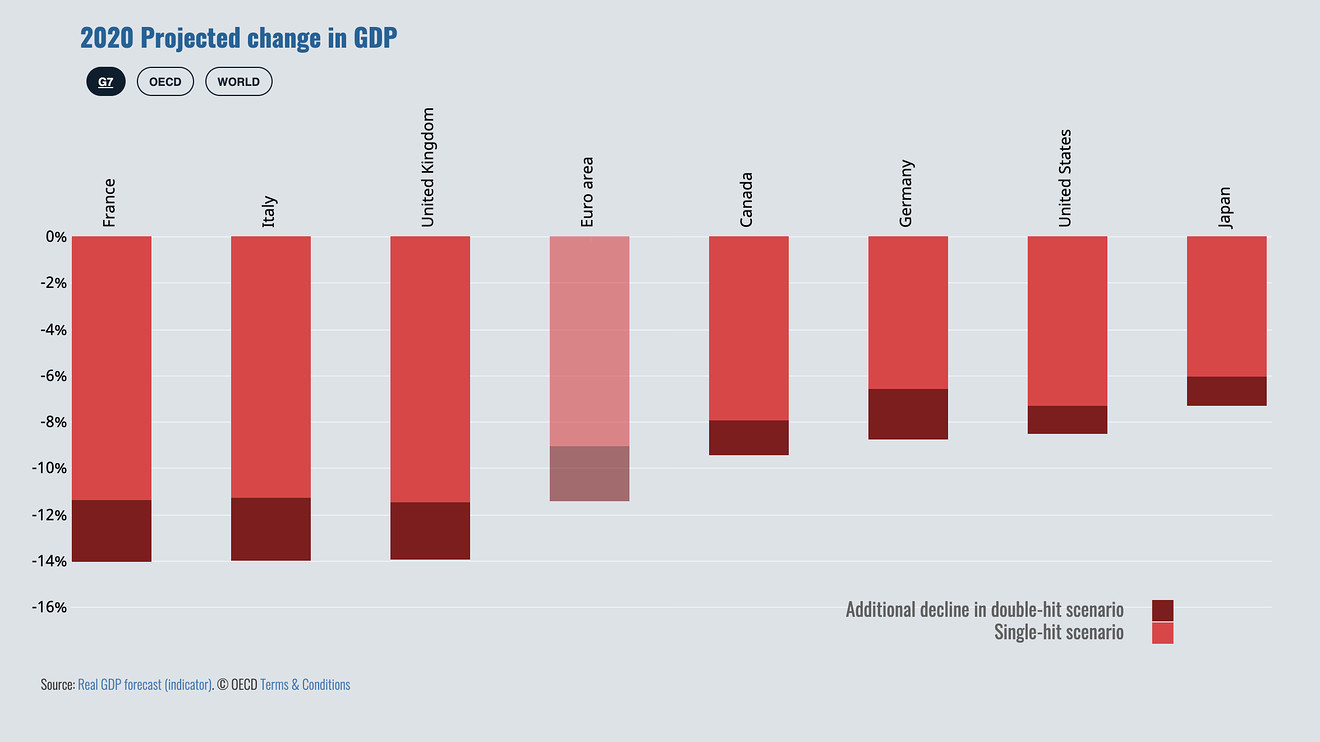

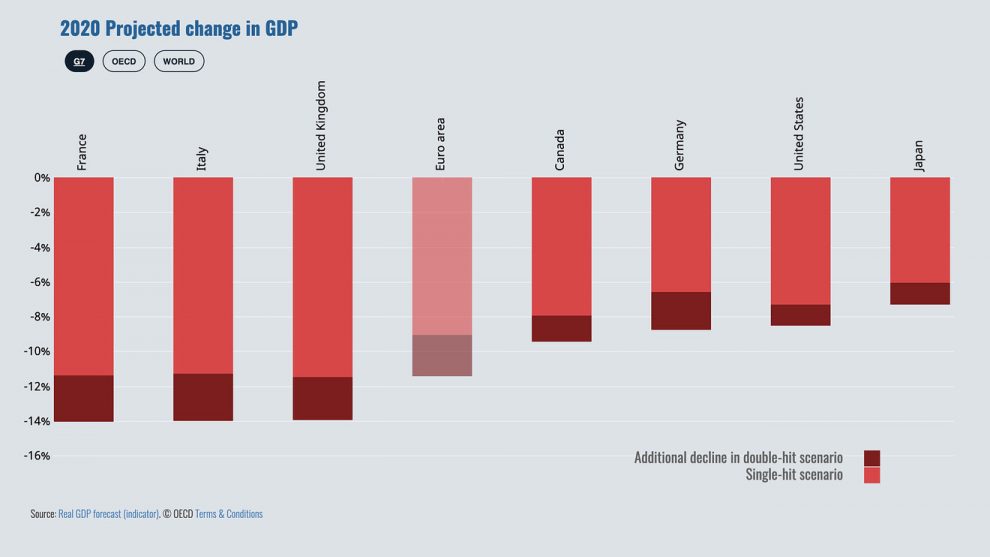

The Organization for Economic Cooperation and Development said U.K. growth will fall by 14% if there is a second virus outbreak later this year, but even without that, growth could fall by 11.5%. The best-case scenario means the U.K. economy will be the worst-performing of global developed nations. Its worst-case scenario puts it in the company of expected poor performers like Spain and Italy.

“In the double-hit scenario, the unemployment rate is set to more than double to 10% and remain elevated throughout 2021, despite widespread use of furloughing. Measures to limit the effects of the crisis in that scenario would push the fiscal deficit up to at least 14% of GDP in 2020,” the OECD said.

“Those U.K. projections are, technically, better than the Bank of England’s internal forecasts, which have the economy contracting by 14%. However, that’s small comfort given that the OECD has stated the U.K. will likely suffer more than any other country in the ‘developed’ world,” said Connor Campbell, financial analyst at Spreadex.

U.K. Prime Minister Boris Johnson is expected to confirm plans to allow nonessential shops to reopen from June 15, as well as zoos, but that most children won’t be back in school until September.

British American Tobacco BATS, +2.92% was among the gainers, with shares up 2.8%, while London Stock Exchange Group LSE, +2.57% climbed 2.8%. Shares of Standard Chartered Bank STAN, +2.80% rose 2.6%.

Add Comment