Perhaps the most important key to the long-term success of your stock market strategy is whether you will stick with it through a bear market. That’s because you can have the theoretically best strategy on the planet and still lose money if you bail at the bottom of the next bear market.

Yet determining your bear-market behavior is surprisingly difficult. Most investment firms try to do this by asking you to fill out one of the many “risk” questionnaires that may vary slightly in detail but for the most part are identical. They ask questions such as the length of your investment horizon and whether you worry more about not losing money than about not making lots of money.

These questionnaires are next to worthless, since we don’t know ourselves how to answer these questions. While we may genuinely think we will have the discipline and intestinal fortitude to stick with our strategy through thick and thin, the truth is that almost always we’re wrong.

Interestingly, most everyone at least implicitly recognizes how worthless those questionnaires are. Wade Pfau, professor of retirement income at the American College of Financial Services, recently conducted a survey of attitudes towards risk questionnaires and found that 95% of financial professionals found them ineffective, while 82% of individual investors shared that belief. (He reported these results in the latest issue of his Retirement Researcher newsletter.)

Why, then, are these questionnaires so ubiquitous? Pfau suspects that they continue to be used primarily out of convenience: “Risk questionnaires are used largely to ‘close prospects’ into an investment portfolio and subsequent advisory fee… The risk questionnaire is used by the advisor more for documentation on ‘suitability’ of why the client is in a portfolio rather than on the merits of the questionnaire’s validity.”

A far better indication of how you will react in the next bear market is how you behaved in the last bear market. If it’s applicable, go back and see how you actually behaved in the 2007-09 bear market, for example, during which the S&P 500 SPX, -0.26% lost 57%. How much lower was your equity exposure at the March 2009 bottom than where it was at the October 2007 market top?

There is no shame in realizing you don’t have the stomach to stick with an aggressive strategy through a bear market. The only shame, if there is any, is lying to yourself about it.

My hunch is that you will discover that you don’t have the discipline and courage to stick with a fully invested posture, or any aggressive strategy for that matter, through a major bear market.

If that’s the case, then trim your equity exposure now, when the stock market is at or near all-time highs, rather than wait until the bottom of the bear market to throw in the towel. You will forfeit some gains to the extent this bull market continues, but you will be far better off over the long run.

Read: Your 5-point plan for surviving the coming stock-market downturn

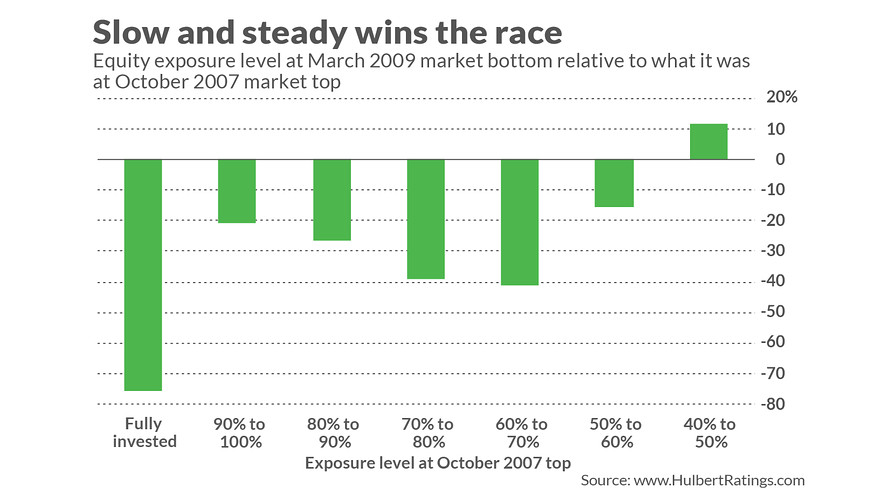

To illustrate this point, I recently analyzed the several hundred investment strategies monitored by my Hulbert Financial Digest tracking service during the 2007-09 bear market. Those that were fully invested at the October 2007 top were only 26.2% invested, on average, at the March 2009 bottom — or more than 70 percentage points lower. The bottom that month represented the best stock market buying opportunity in over a generation.

Those newsletter editors who were most aggressive at the market top were, on average, unable to take advantage of that opportunity. As Claude Erb, a former fixed-income and commodities manager at mutual-fund firm TCW Group, put it to me once in an email: “The people who can truly stomach the volatility of a 100% stock portfolio are either catatonic or dead.”

In contrast, consider the advisers whose recommended equity exposure level at the October 2007 top was in the 40% to 50% range. Their average recommended exposure level at the March 2009 bottom was 11.5 percentage points higher than it was at the top.

In other words, those less-aggressive investors responded to adversity more rationally. They thus were in a better position to recognize the incredible opportunity presented by the stock market in March 2009. (This overall pattern is shown in the accompanying chart, which reports the bear market behaviors across a wide range of October 2007 exposure levels.)

The bottom line? To find out how you’ll behave in the next bear market, investigate how you behaved in the last one. My bet is that, when you do, you’ll realize that you should be reducing your equity exposure now — before the next bear market begins.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Read: A review of money flows in popular tech stocks could save you pain this earnings season

More: There’s an easy explanation for why stock market predictions are usually wrong

Add Comment