Economic uncertainty needs to lessen significantly in order for the U.S. bull market to continue. That’s a tall order. With uncertainty surrounding the outcome of this November’s election (both presidential and congressional), as well as a lack of progress with the COVID-19 pandemic, economic uncertainty in the U.S. is likely to stay elevated — if not go higher— at least until Election Day.

Stock investors hate uncertainty. Until recently, this inverse correlation between uncertainty and the stock market had made sense theoretically, but was impossible to confirm empirically. Uncertainty would seem to be a subjective matter, and therefore difficult to measure. But this challenge was successfully hurdled several years ago when three finance professors — Scott Baker of Northwestern University, Nick Bloom of Stanford University, and Steven Davis of the University of Chicago — created an Economic Policy Uncertainty (EPU) index.

The EPU reflects the number of occasions in which the words “uncertain” or “uncertainty” appear in six major newspapers along with the words “economic,” “economy,” “business,” “commerce,” “industry” or “industrial” and one or more of the following terms: Congress, legislation, White House, regulation, Federal Reserve, deficit, tariff, or war.

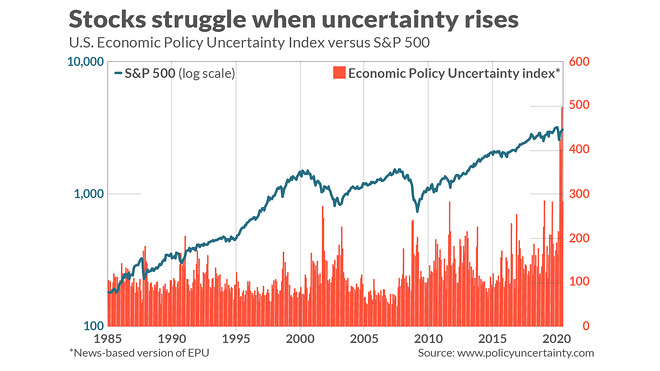

As you can see from the chart below, which plots the EPU back to the mid-1980s, the stock market usually struggles whenever the index rises.

According to my PC’s statistical package, a statistically significant correlation exists between the EPU’s trailing three-month rate of change and that of the S&P 500’s SPX, -0.57% . The r-squared is 22%, which means that changes in the EPU predict 22% of contemporaneous changes in the S&P 500. While that is considerably lower than 100%, it is much higher than the r-squareds for most other indicators that capture Wall Street’s attention.

The past three months are a major exception to this pattern. The EPU recently rose to an all-time high and yet the U.S. stock market turned in one of its strongest three-month stretches in its history.

Does this mean the correlation between the EPU and the stock market has been permanently broken? That seems doubtful. That would be the case would be only if investors stopped caring about uncertainty and actually wanted more of it. That would stand on its head almost every investment theory — whether statistical or behavioral.

“ The stock market’s usual decline in the face of a rising EPU may only have been postponed. ”

Baker speculates that, far from indicating that investors no longer are averse to uncertainty, the stock market’s exceptional recent strength instead may reflect nothing more than “the immense amounts of fiscal and monetary stimulus that have been doled out by the government.”

If so, then the stock market’s usual decline in the face of a rising EPU may only have been postponed. That in turn suggests the stock market may well struggle between now and Election Day (or longer). As Bloom put it to me in an email: “My fear is this will end in tears.”

Baker added: “It is like Warren Buffett’s quote about ‘When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact.’ I think the reputation of EPU as a predictor of economic growth will remain strong while the market as a measure of economic performance will not.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Read:Stock market crash? It would have happened by now, trader says

Add Comment