Major financial firms, such as JPMorgan Chase & Co. and Morgan Stanley, are back to forecasting a 2% and higher 10-year Treasury yield for 2022, backed by expectations for stronger U.S. growth.

Earlier calls for 2% in 2021 have been stymied by a year of uneven progress toward recovery as the result of new virus outbreaks like the omicron variant, which caused the widely followed 10-year yield TMUBMUSD10Y, 1.514% to languish below 1.65% for much of 2021.

The 10-year yield, which influences the cost of long-term borrowing on everything from mortgages to student loans and credit cards, hasn’t been at 2% since August 2019, falling repeatedly short of the level generally associated with a healthy U.S. economy. Even expectations that the Federal Reserve will kick off a faster pace of tapering bond purchases next week, to have enough flexibility to possibly deliver a sooner-than-expected 2022 rate increase, haven’t been enough to drive the 10-year rate sustainably higher. Investors usually sell Treasurys, pushing yields up and prices lower, in anticipation of richer rates.

Morgan Stanley Wealth Management, a division of Morgan Stanley MS, -0.72%, foresees a scenario next year that includes “a robust global recovery, a moderation of U.S. growth and inflation, and more balanced monetary and fiscal policies,” Chief Investment Officer Lisa Shalett wrote in a 2022 outlook released this week.

Even if the Fed delays its first rate increase until the fourth quarter of 2022 or first quarter of 2023, Morgan Stanley “estimates the US 10-year Treasury yield will be 2.1% by December 2022,” she wrote. That would be up more than 50 basis points from its 1.52% level on Wednesday.

The direction of travel for the 10-year rate has been a matter of debate for some time, with a few analysts such as Dimitri Delis of Piper Sandler Cos. PIPR, -2.86% in Chicago and Richard McGuire of Rabobank warning that the yield will continue to drift lower — as it has for each of the past three or four decades. One of the reasons has been continued demand from foreign buyers and U.S. corporations for Treasurys, which are still yielding more than the government debt of other countries.

Want intel on all the news moving markets? Sign up for our daily Need to Know newsletter. Use this link to subscribe.

But expectations for central-bank policy also matter and “the U.S. Federal Reserve has provided the most tangible and imminent indication of liftoff,” or the first rate increase, “to this point,” according to portfolio managers Erin Browne and Geraldine Sundstrom of Pacific Investment Management Co., or PIMCO. The firm, which managed $2.2 trillion as of September, expects “government bond yields to trend higher over the cycle as central banks raise rates.”

Still, they said in an outlook released Tuesday, “the risk of a policy mistake has increased as monetary and fiscal stimulus recedes and authorities attempt to engineer a growth handoff to the private sector.” That’s creating the potential for more divergent outcomes — such as sooner-than-expected tightening by central banks that ultimately hampers growth, or a “virtuous cycle” of greater consumption supported by higher personal savings which “would likely be a boon for economic growth.”

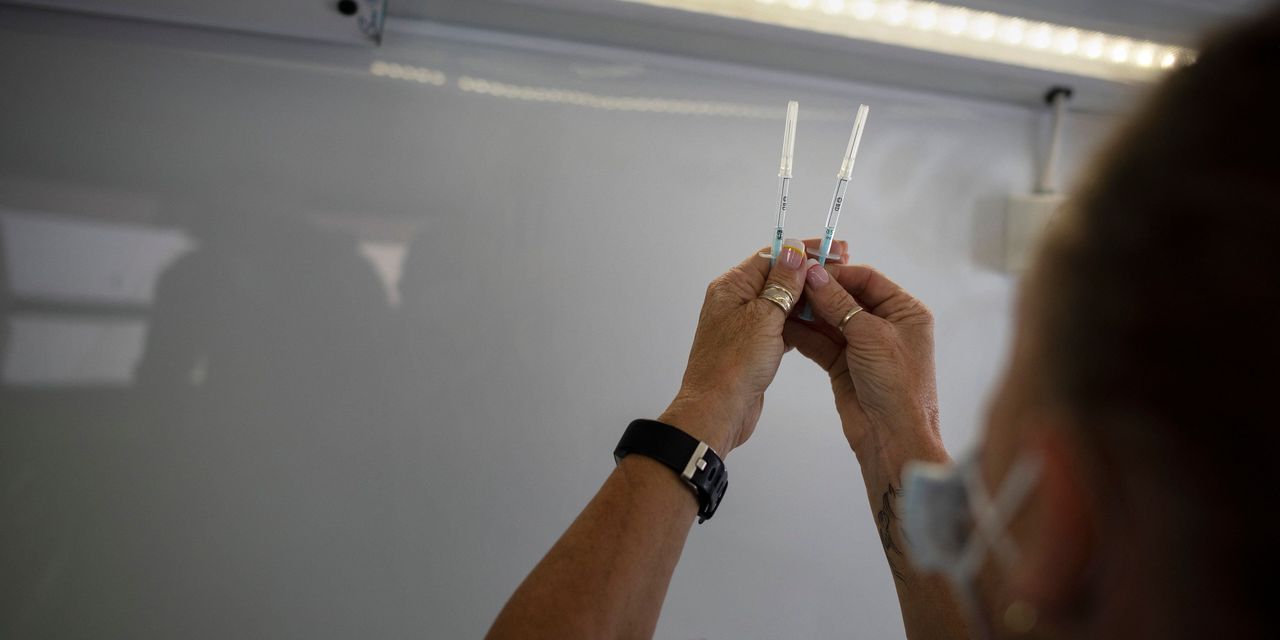

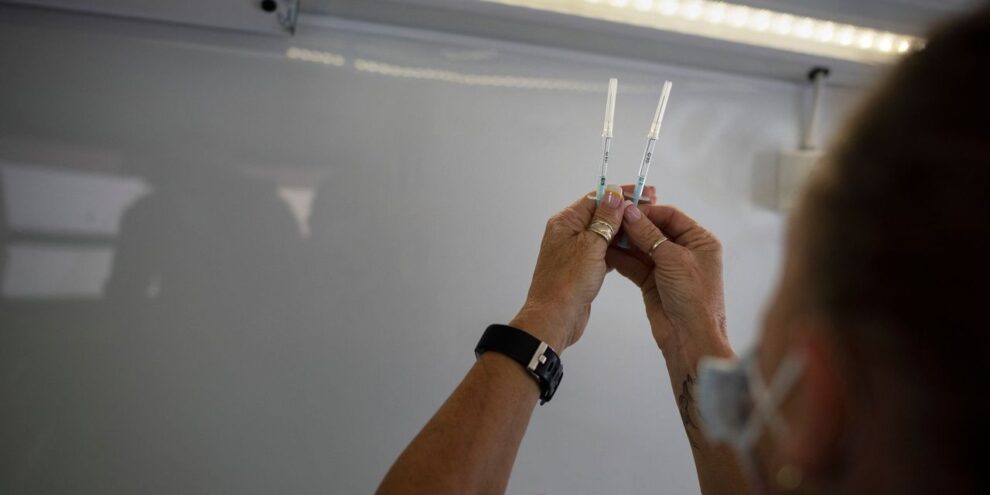

On Wednesday, most Treasury yields moved higher as investors digested news suggesting the omicron variant of coronavirus that causes COVID-19 may not impact the economy as much as feared. Rates on 10- TMUBMUSD10Y, 1.514% and 30-year Treasurys TMUBMUSD30Y, 1.876% rose, though the 2-year rate TMUBMUSD02Y, 0.683% slipped, after a report from Pfizer Inc. PFE, -0.62% and BioNTech SE BNTX, -3.16% said results from an initial lab study showed that their COVID-19 vaccine neutralized the omicron variant of the coronavirus after three doses, or the full two-dose regimen plus a booster shot.

JPMorgan is heralding 2022 as the year of “a full global recovery, an end of the global pandemic, and a return to normal conditions we had prior to the

COVID-19 outbreak,” according to Marko Kolanovic, chief global markets strategist, and Hussein Malik, who is global co-head of research along with Kolanovic.

“In our view, this is warranted by achieving broad population immunity and with the

help of human ingenuity, such as new therapeutics expected to be broadly available in 2022,” they wrote in a report released Wednesday.

They said they expect Treasury yields to rise in 2022, with the 2-year rate hitting 0.7% in the second quarter before getting to 1.20% by the end of next year. “Meanwhile, we believe the curve has room to steepen for a short period in early 2022, and we project 10-year yields will rise to 2% by mid-year and 2.25% by the end of 2022.”

Add Comment