It is tough to imagine a man worth $6.5 billion having many regrets in his business life, but Leon Black, chairman and CEO of alternative asset and private-equity manager Apollo Global Management LLC, said that he has some regrets about taking his firm public eight years ago.

“Regrets? Absolutely. The public market doesn’t understand creatures like us very well,” Black told an audience at the Bloomberg Invest Conference in New York on Tuesday, referring to publicly traded alternative-asset managers like Apollo APO, +3.21% , Blackstone Group L.P. BX, +2.31% , KKR & Co. Inc. KKR, +3.74% and the Carlyle Group LP CG, +3.28% . The interview was conducted by David Rubenstein, co-founder of the Carlyle Group.

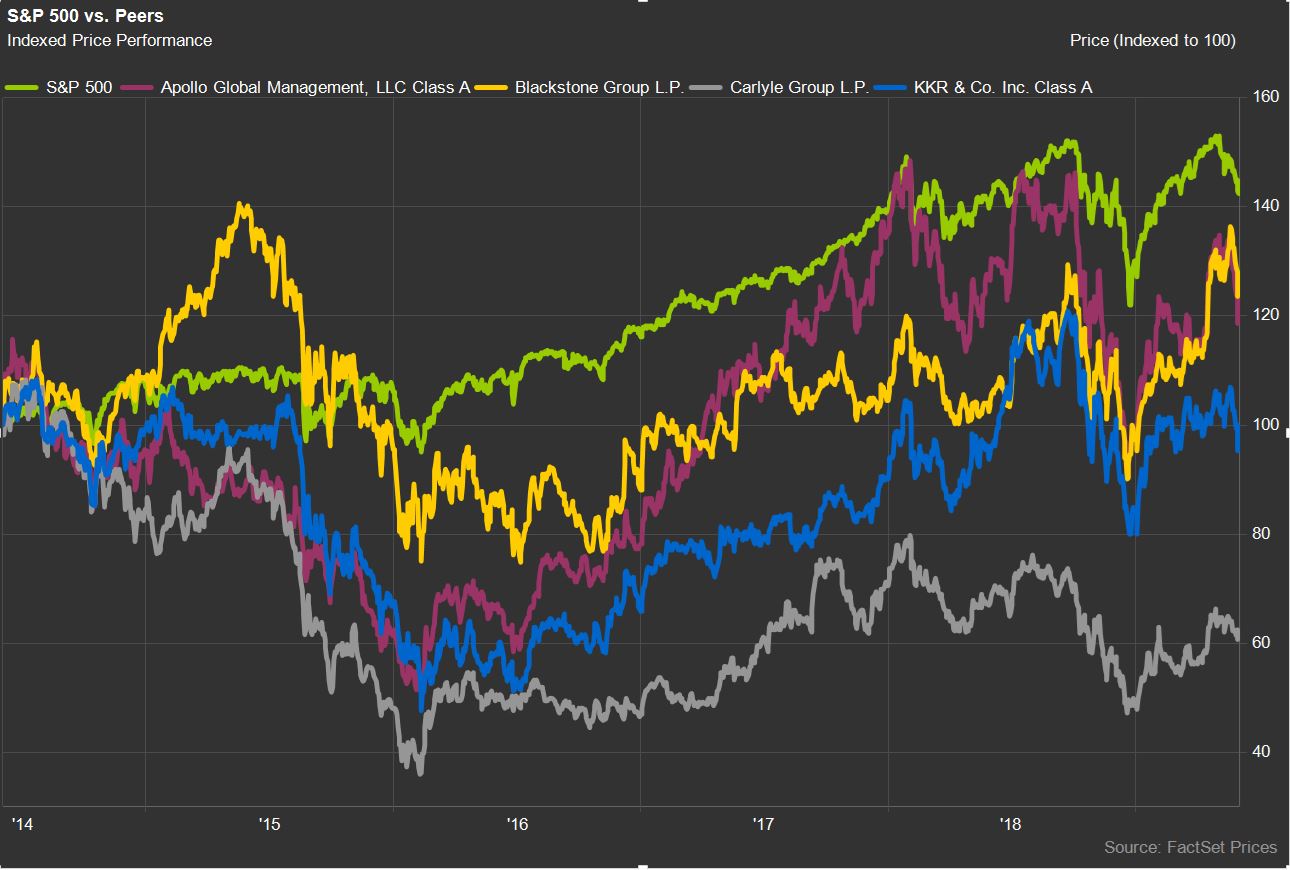

Since going public in March 2011, Apollo stock has risen 69.4%, while the S&P 500 index SPX, +2.14% has risen by 255%, according to FactSet data. Over the past five years, each of the major public alternative-asset managers have trailed the broader market.

Black argued that his company is both value-oriented, based on its track record of returns since Apollo’s 1991 founding, and a growth company that has increased its fee-related earnings by 20% per year for 20 years. He also lauded the stock’s 7% dividend yield that will perform well during downturns. “I think we trade at half where we should be,” he said. “It’s not just true of us, it’s true of Blackstone and others.”

Black didn’t take lightly the decision to go public. He said he consulted “a dozen people I had a lot of respect for,” including former junk-bond titan Michael Milken, investor Carl Icahn, lawyer Marty Lipton and Goldman Sachs’ Lloyd Blankfein.

According to Black, “Literally half of them said, ‘Of course you should do it. This is a way to monetize your equity, it’s a way to grow, it’s an incentive for compensation that you can add to the list to get better people,’ and the other half said, ‘What are you, out of your mind? Why do you want to live in a regulatory fishbowl with a focus on you? It’s nuts. Who needs it?’”

This split decision “wasn’t really helpful,” Black joked. He said he made his final decision based on the idea that public investment would be needed if he wanted to build a global alternative-asset management company, rather than focusing on just domestic private equity.

Last month, Apollo Global Management said it would abandon its partnership status in favor of becoming a corporation, following moves by Blackstone and KKR to do the same. The industry hopes that this structure will enable its stocks to be included in index funds and therefore benefit from the trillions of dollars invested in passive equity funds, and shake off what it sees as chronic undervaluation of its stock prices by public markets.

“The motivation there is to really expand the institutional shareholder base,” Black said.

Add Comment