A surge in the shares of a number of well-known but smallish companies has been the talk of Wall Street in recent days.

Those including GameStock, AMC Entertainment and Beyondf Meat, to name a few, were often the target of hedge fund investors betting that their shares would continue to plummet in value.

However, bands of individual investors, using social-media platforms like Reddit and commission-free trading venues are beginning to create seismic upward moves in shares of those companies by purchasing out-of-the-money options and forcing short sellers to unwind bearish bets, thereby accelerating the upward share price swings.

Indeed, AMC Entertainment Holdings AMC, +260.89% on Wednesday was surging more than 262%, while GameStop GME, +117.16% was trading up more than 100% and on track for a 412% rise just this week.

Read: It isn’t just GameStop: Here are some of the other heavily shorted stocks shooting higher

In some cases, the price surges are creating disconnects between the valuations of these companies and their underlying businesses.

GameStop is a bricks-and-mortar retailer of videogames, a business that is increasingly going digital, while AMC is being hammered by the COVID-19 pandemic due to social-distancing measures that have stymied attendance in major movie theaters.

Still, the current trend of targeting heavily shorted companies is worrisome to traditional investors because it raises questions about possible knock-on effects for the market.

See now: How an options-trading frenzy is lifting stocks and stirring fears of a market bubble

Melvin Capital Management, which was down 15% injust three weeks into 2021, announced that it exited its GameStop short positions with heavy losses. Melvin had been one of the best-performing funds in recent years, the Wall Street Journal wrote.

How long this phenomenon plays out is the open question on Wall Street, with individual investors eagerly seeking the next shorted stock and veteran market participants hoping that the market becomes more rational and less volatile.

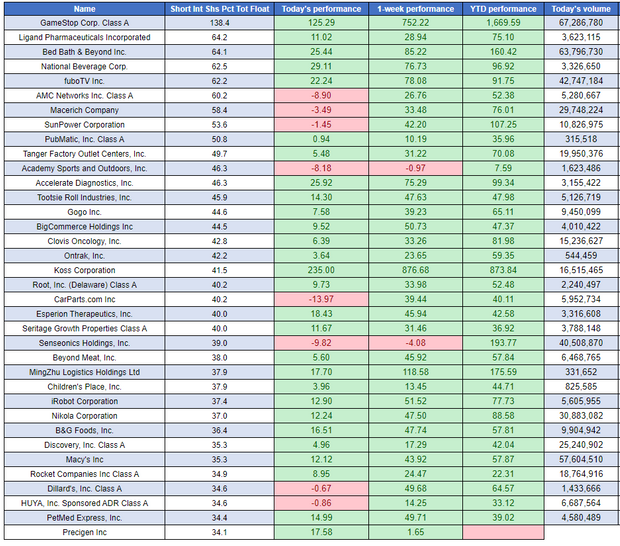

In either case, here are some of the most heavily shorted names this week, which also include Bed Bath & Beyond BBBY, +30.92%, Macerich Co. MAC, +12.44%, SunPower Corp SPWR, -4.49%, Macy’s Inc. M, +11.08% and Nikola Corp. NKLA, +9.13%

“GameStop’s recent surge has decimated short seller’s [profit and losses],” wrote Ihor Dusaniwsky—the head of predictive analytics at financial technology and analytics firm S3 Partners, in emailed comments on Wednesday.

“These large mark-to-market losses will be squeezing many existing shorts out of their positions but we are still seeing new short sellers taking their place as they look to short at the top and ride a windfall of profits on their expectations of GameStop’s stock price falling back to earth,” he wrote.

“So far the new short sellers have not seen the results they were looking for and have seen nothing but big fat red numbers in their trading accounts,” he said.

The success for the little guy, however, may not last forever and many retail-focused brokerages have recently interceded to curb speculative bets by raising requirements to obtain loans.

The stock market, meanwhile, has been shaken by the recent upsurges, with the Dow Jones Industrial Average DJIA, -2.01%, the S&P 500 index SPX, -2.48% and the Nasdaq Composite Index COMP, -2.38% headed sharply lower on Wednesday.

Add Comment