The Dow Jones Industrial Average on Friday briefly touched a psychological milestone at 29,000, as the blue-chip benchmark aims to cap a spectacular rally in the past couple of months by marking.

The Dow DJIA, +0.08% headed late-morning hit an intraday high at 29,909.07, after closing Thursday with a gain of 211.81 points, or 0.7%, at 28,956.90.

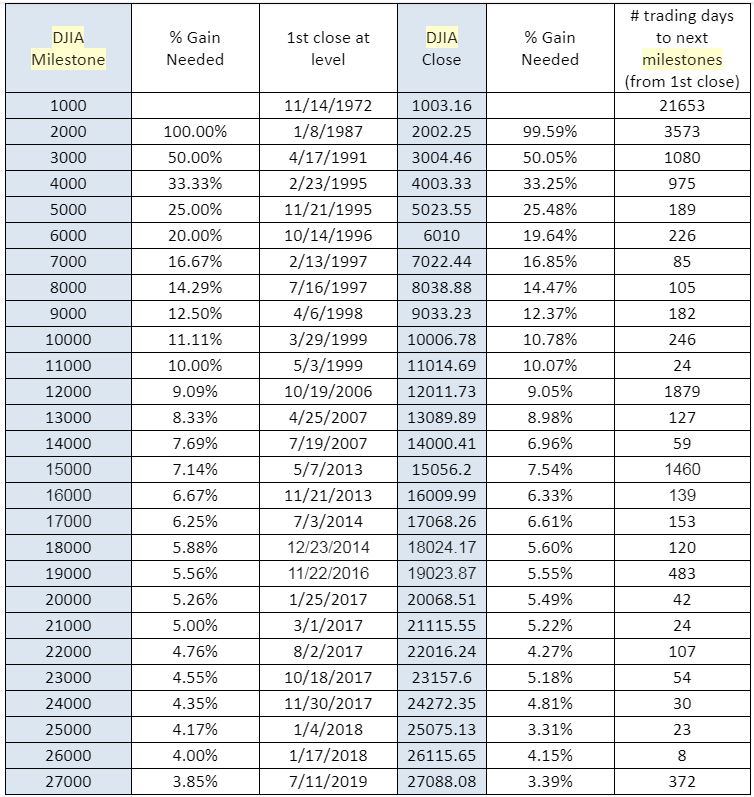

If the benchmark manages to close at or above that level Friday, it would mark the 37th trading day since its last milestone on Nov. 15, and the fastest such ascent for the Dow since January of 2018 when it took only eight trading sessions to close at 26,000.

Friday’s move comes after the Labor Department said the U.S. economy added 145,000 new jobs in December, below the 165,000 expected by economists. The unemployment rate, meanwhile, held near a 50-year low at 3.5%.

To be sure, round-number levels like 29,000 aren’t necessarily significant for the market, but they can help to reflect growing upbeat sentiment, despite a number of risks that have confronted investors in 2020.

For years, market experts had termed the bull market the “most hated” in history and increasing bullishness in this current phase of the run-up continues to feed fears that equity markets, and bond markets for that matter, are becoming too richly valued by some measures and that average investors aren’t necessarily benefiting from the upsurge.

The latest rally for the Dow comes as the S&P 500 index SPX, +0.19% and the Nasdaq Composite COMP, +0.33% also notched all-time closing highs after China said its top trade negotiator, Vice Premier Liu He, would travel to the U.S. on Monday to sign a phase-one trade accord.

That market-moving development came after the U.S. and Iran looked to be backing away from further military aggression, with President Trump signaling Wednesday that no new U.S. military strikes would follow an Iranian missile attack on U.S. bases in Iraq.

Of course, the higher the DJIA rises, the smaller each 1,000-point move is in percentage terms, but individual investors have tended to pay close attention to the Dow when it carves out fresh milestones.

Some investors say that a Federal Reserve that has provided a low-interest rate environment and liquidity for money markets creates a bias to the upside for equities. Last year, the Fed cut interest rates at three consecutive meetings to a 1.75%-2% range, citing growing concerns about the harmful effects from a Sino-American trade policy clash.

Add Comment