You might have heard about the move to banish “manels,” or male-dominated panels, at industry conferences.

Now a corner of Wall Street that fueled the mortgage crisis a decade ago thinks a key to preventing the next blowup is putting more women and people of color in charge of calling the shots in finance.

“The real danger, in our view, is that having all white men making financing decisions makes it difficult to serve underserved communities,” said Michael Bright, chief executive of the Structured Finance Association, the main trade group for the securitization industry, which a decade ago was at the heart of a toxic subprime lending boom.

Underserved communities “don’t have the same access to credit as white communities and they don’t have the same terms or conditions,” Bright told MarketWatch in an interview. “If there is a bubble, they are preyed upon,” he said, adding that these same communities often are left awash in home foreclosures when credit tightens.

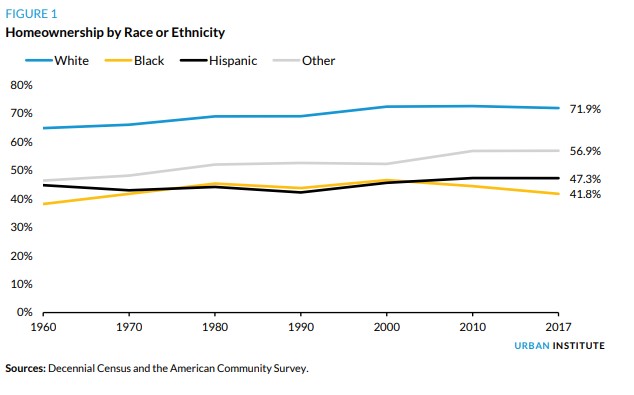

Black families lost the most ground in the U.S. housing market of any racial or ethnic group following the 2007-’08 financial crisis, a blow that left black homeownership at its lowest level in 50 years, according to a 2019 study by the Urban Institute, a Washington-based research group that focuses on economic and social policy.

This chart from the Urban Institute gives a breakdown of housing market share by racial or ethnic group for the past five decades:

Urban Institute

Urban Institute While gains in homeownership can be traced to the early 2000s, that period also saw “teaser” rates proliferate in subprime mortgage finance, which backfired on many borrowers after housing values plunged 33% from their 2006 peak, largely at the same time “introductory” rates reset higher.

A Federal Reserve study in 2012 estimated that some $7 trillion in household wealth was lost in the wake of the foreclosure crisis that impacted millions of borrowers.

Bloomberg News

Bloomberg News “There is a cycle of this happening,” said Bright. “We need women and people of color in the decision-making process, or we’re doomed” to repeat past mistakes, he said.

Bright, before taking over the helm of the SFA a year ago, was the chief operating officer at housing giant Government National Mortgage Association, or Ginnie Mae. Along with Freddie Mac FMCC, +0.00% and Fannie Mae FNMA, +0.88% , the housing agencies currently finance the bulk of the $11.1 trillion U.S. housing debt market, according to Urban Institute data.

How does he plan to make changes? For starters, none of the 12 keynote speakers at the securitization industry’s annual gathering in Las Vegas, which kicks off Sunday and is hosted by Bright’s SFA group, are white men.

The conference will feature W. Kamau Bell, a comedian and television host, to talk about race and diversity in finance.

But beyond the conference, Bright wants to call on the SFA group members, which include top Wall Street banks, companies that issue bonds, investors, broker-dealers as well as accounting firms, credit-rating firms and lawyers, to promote a more diverse workforce — ideally while producing results within the next five to seven years.

A report from Reps. Maxine Waters and Joyce Beatty earlier this month found that board seats at large banks were still 80% white and 70% male.

“We’re hoping there is a way to smash through that wall,” Bright said. “I’m really excited for this process. I want to move the needle.”

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment