A single tweet by U.S. President Donald Trump helped bring home the bacon for bond investors in August.

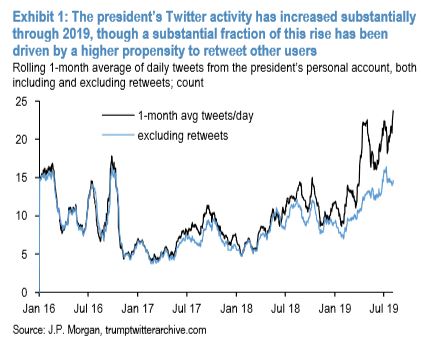

Indeed, the bond market roared higher last month, sending yields down, notably after President Donald Trump pledged to impose tariffs on all remaining Chinese imports, and as his Twitter activity picked up the pace.

So what are his tweets really doing for U.S rates markets? That’s what J.P. Morgan’s Volfefe Index, a play on that Trump “covfefe” typo from two years ago, aims to find out. Munier Salem, vice president of the bank’s U.S. interest rate derivatives strategy and his team created the index to gauge how Trump tweets — 10,000 since taking office — have influenced moves in implied rate volatility for two-year TMUBMUSD02Y, +0.01% and five-year TMUBMUSD05Y, -0.11% Treasury notes.

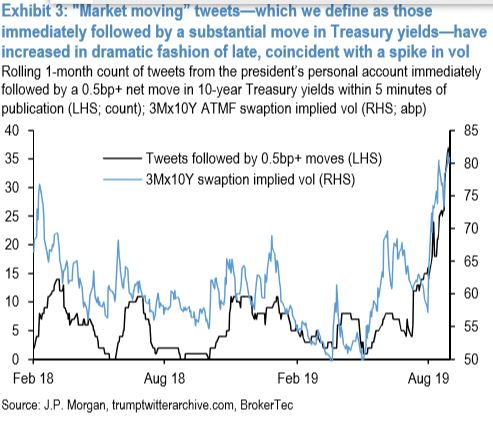

The index explains a “measurable fraction” of moves in implieds, particularly in shorter tails, that is 2-year rates and 5-year rates, as opposed to 10-year rates. Digging into the Twitter stream, they say the most impactful tweets have focused on trade, with those mentioning monetary policy of lesser influence. “China,” “billion” and “products” were among words topping the list on those market-sensitive tweets.

Their model finds that out of around 4,000 non-retweets occurring during market hours from 2018-present, only 146 moved the market. And quality is not quantity as they note that the Volfefe index ”strongly outperforms the sheer tweet count in periods headed into substantially elevated implied volatility.”

The bank’s research follows a report from Bank of America Merrill Lynch last week that found if Trump stays off the Twitter platform, the stock market fares better.

Add Comment