The quality of bonds used to finance U.S. companies with ratings that are below investment-grade have never looked worse than they did in July.

So-called below-investment-grade debt, also known as junk bonds, are being structured with far fewer protections and made prospective investors increasingly uneasy about a trend of eroding standards in that area of the fixed-income market.

July may have marked a pivotal point for investors, representing the weakest terms yet for borrowers, according to a recent report from Moody’s Investors Service.

The credit-rating agency in a Wednesday report said weaker protections have elevated risks in junk bonds, which in one metric pegged only 4% of the junk rated date issued in July as having protections deemed “better than weak,” versus a historical average of around 20%.

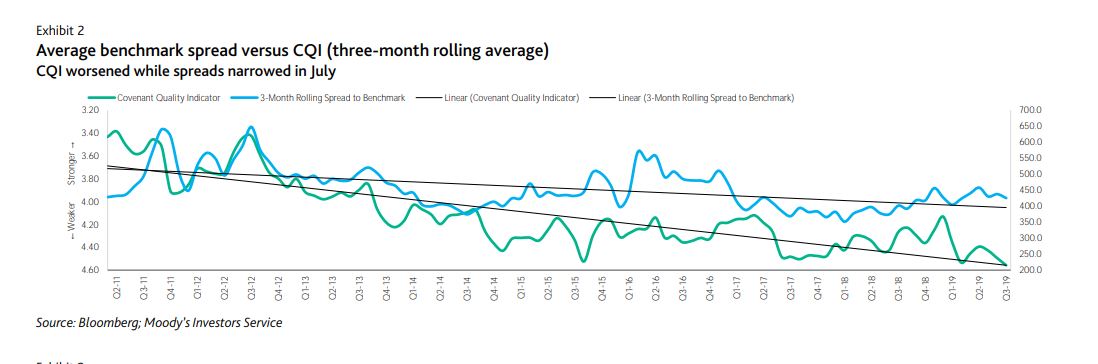

Taken in total, Moody’s Covenant Quality Indicator (CQI) showed that July issuance was the worst on record with a score of 4.56, with 5.0 being the worst possible reading in terms of protections.

And while high-yield bonds were getting, well, junkier, Moody’s said investors hadn’t been requiring a richer yield to compensate for the comparatively greater risk of holding junk paper.

This chart illustrates the sinking quality of bond protections, per Moody’s CQI, and the downward trajectory with spreads.

Moody’s Investors Service

Moody’s Investors Service

However, investor demands appeared to have been altered this week after the 10-year Treasury note TMUBMUSD10Y, -3.36% — used as a benchmark reference in underwriting corporate debt — and two-year Treasury rates TMUBMUSD02Y, -4.90% briefly inverted on Wednesday for the first time in more than a decade. Inversions are when shorter-dated debt offers a richer yield than the longer-term counterparts and is often viewed as an accurate predictor of a coming economic recession. Investors usually demand a richer return for lending money further out into the future.

Check out: Forget the yield curve, here’s who will prevent the U.S. from entering a recession

High-yield bond spreads widened on Wednesday following the inversion by 24 basis points — representing a mini selloff — but still 15 to 32 basis points below the steepest widening periods of the past decade, according to JPMorgan Chase data. Bond prices rise as yields fall.

A flight to the perceived safety of fixed-income, including Treasurys, continued apace Thursday, with the 30-year Treasury note yield TMUBMUSD30Y, -2.31% edging below 2% and carving out a fresh yield low for the so-called long bond.

Read: 30-year Treasury yield breaks below 2%

High-yield is often considered another canary in the [coal] mine in terms of predicting a recession.

“Credit is so important, and high-yield is a market we have to pay very, very close attention to,” said Bob Lang, co-founder and chief options analysts at Explosive Options, an options trading service, in an interview with MarketWatch. That is because high-yield debt is also used as a gauge of investor appetite for risk.

“Heading into a recession, high-yield is the last place you want to be,” Lang said.

U.S. corporations have loaded up on record levels of debt in the past decade, aided by a hunt for yield among investors. Companies maintaining sizable debt loads, however, as the economy is contracting is usually a recipe for problems, with borrowers unable to service their debt.

“You have more risk and not as much reward,” said Deron McCoy, chief investment officer at Signature Estate & Investment Advisors. “The two together doesn’t make for a good outlook in that part of the market.”

“We aren’t as protected as we were in the past 10 years,” McCoy said.

Despite those concerns, Lang believes that recent jitters in high-yield market were far from flashing signs of an imminent recession.

“Credit was a lot worse last year than it is now,” he said. “I think high-yield, as opposed to the yield curve inversion, is a more accurate indicator of whether a recession is coming or not.”

On Thursday, shares of the popular SPDR Bloomberg Barclays High Yield Bond ETF JNK, +0.36% were trading around $107.20 in afternoon trade, versus a recent high of $109.46 on June 21, according to FactSet data.

The larger iShares iBoxx $ High Yield Corporate Bond ETF HYG, +0.29% saw its shares trade at $85.85 versus $87.33 over the same period.

Add Comment