It isn’t just the U.S. outlook that is dependent on the consumer right now.

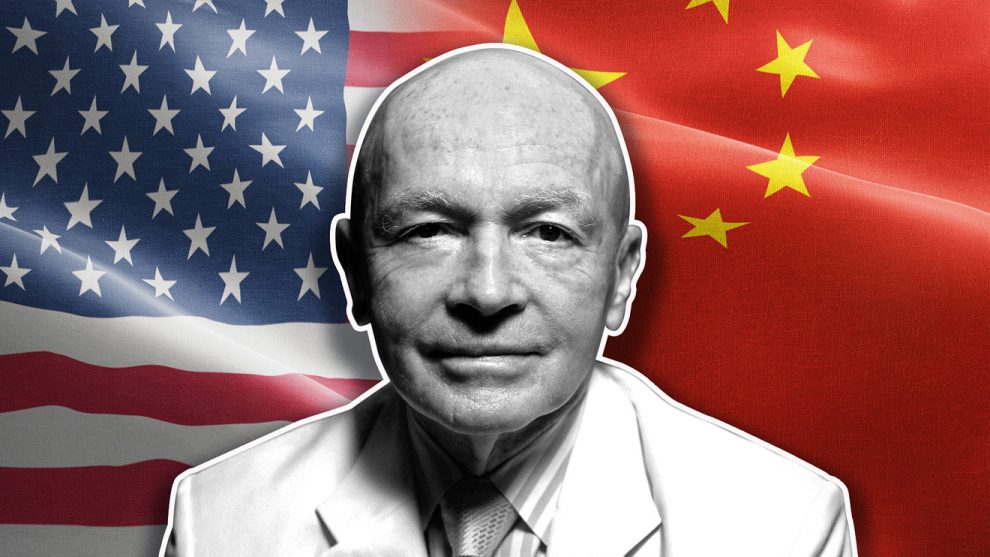

With U.S.-China tensions and other geopolitical uncertainties casting a cloud over global trade growth, emerging-markets pioneer Mark Mobius said it is important to focus on companies in developing countries that are focused on homegrown demand.

“As a result of uncertainty on the trade front, we are focusing more on domestic demand in these countries,” Mobius said, in a phone interview.

That is a continuation of a trend that was in place before U.S.-China trade tensions escalated this spring, said Mobius, 82, who co-founded Mobius Capital Partners last year after a three-decade run at Franklin Templeton Investments.

‘I would say the China-U.S. trade thing has been expanded into something more strategic and critical.’

The investor has highlighted the appeal of India and its potential for strong domestic growth. And he isn’t writing off China, but is focusing on companies that are geared more toward domestic consumption rather than exports. The same is true in other emerging markets, he said.

As of April 30, the Mobius Emerging Markets Fund’s top holdings were South Korea-based biopharmaceutical firm Hugel Inc. 145020, +0.54% and Taiwan chip-equipment maker eMemory Technology Inc. 3529, +0.14% followed by China-focused fast-food operator Yum China Holdings Inc. YUMC, +1.27% Poland retailer Eurocash SA EUR, +2.09% and Mexican dairy company Grupo Lala SAB de C.V. LALAB, +0.42%

While Mobius is upbeat about the potential for emerging-market consumers to continue to open their wallets, he isn’t optimistic the U.S. and China will resolve their differences soon.

“I would say the China-U.S. trade thing has been expanded into something more strategic and critical,” he said. “I think most people realize this is not going to end soon.”

Even if President Donald Trump and Chinese leader Xi Jinping manage to come to some sort of near-term agreement, tensions over China’s policies on technology transfers and U.S. access to Chinese markets are likely to continue, he said.

But that is good news for other lower-cost producers, like Vietnam and Bangladesh, which had already seen a pickup in manufacturing as a result of rising labor costs in China before the trade fight erupted, Mobius said.

Read: Why Vietnam could emerge as a surprise winner from U.S.-China trade battle

On the downside, China’s travails are having an undue influence on the MSCI Emerging Markets Index, Mobius said. China’s weighting makes up around 30% of the index. The iShares MSCI Emerging Markets ETF EEM, +1.04% which tracks the index, is up 6.7% in the year to date, trailing a 15.6% rise for the S&P 500 SPX, +0.47%

Meanwhile, Mobius said the continued shift in export-oriented manufacturing away from China to other low-cost countries will help cushion the blow of increased tariffs on U.S. consumers. A weaker Chinese yuan USDCNY, +0.3068% which has fallen around 8% versus the U.S. dollar since trade tensions first escalated in the spring of 2018, is also taking some of the sting out of the tariffs on Chinese imports.

“Importers absorb some (of the cost), exporters absorb some and then the currency” serves as a cushion, he said.

But could China get more aggressive on the currency front, moving to substantially devalue the yuan from its current level near 6.931 to the dollar? Analysts have focused on the 7.000 yuan level as a crucial line that, if breached, could amplify trade tensions and upset global markets.

“That would mean a lot…for U.S.-China relations because you better believe the Trump administration is watching what the Chinese are doing in that regard, and if you follow the movement of the renminbi you see it is directly related to the trade talks,” Mobius said.

Meanwhile, China is constrained by it is desire for a “very stable” yuan and its longer term goal of making it a reserve currency.

“It’s a big dilemma for them,” he said.

Add Comment