Wall Street had Georgia squarely on its mind overnight, with equity futures and bonds mostly in the crosshairs as investors eyed dual contests for key Senate seats coming down to razor-thin margins in early returns.

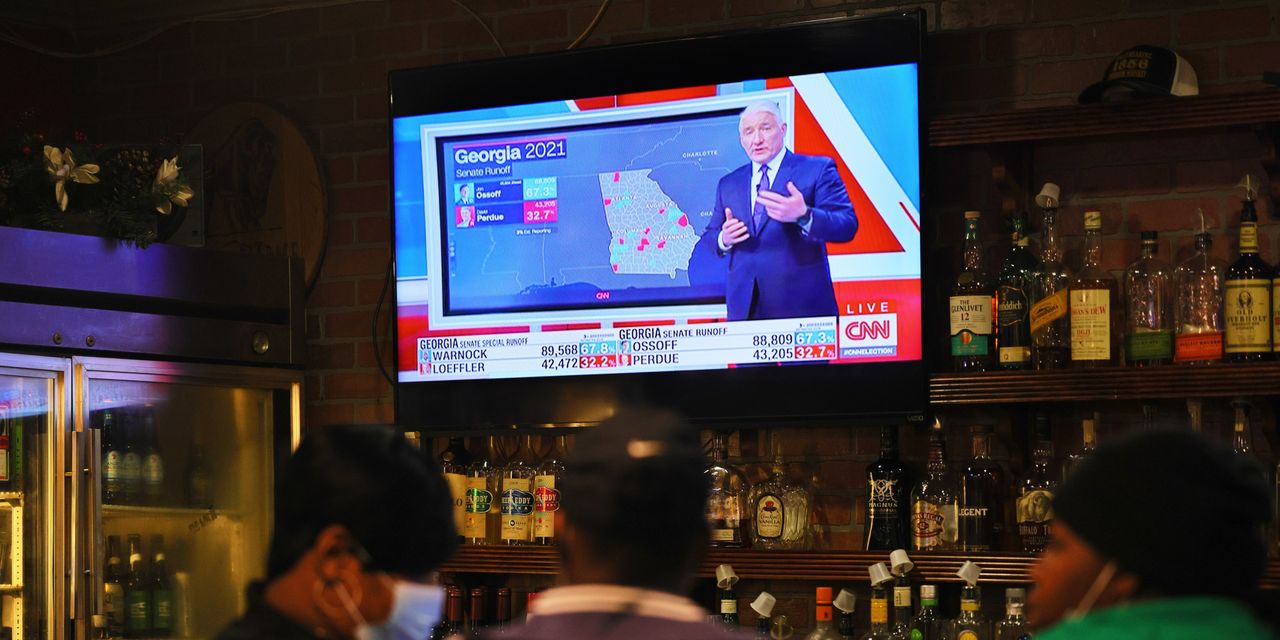

The Associated Press called one of the two races for Democrat Rafael Warnock early Wednesday morning, while fellow Democrat Jon Ossoff had a slim lead in a race that was still too close to call.

MarketWatch’s Victor Reklaitis reported that analysts are describing the Georgia races as “about as close as you can get.”

At last check, tallies from populous Democratic-leaning counties, particularly in Dekalb, which could swing the vote tally, were looming.

With 97% of the expected vote total reported, Democratic challenger Ossoff was leading Republican Sen. David Perdue by just 0.22 percentage point, according to data aggregated by the Associated Press.

In the other runoff, the AP called the race for Warnock over GOP Sen. Kelly Loeffler at about 2 a.m. Eastern.

The Senate races are runoffs from the November general election, when none of the candidates hit the 50% threshold required to be declared winner.

At stake for the markets is the prospect of a slim Democratic majority in the Senate if candidates can upend GOP incumbents.

A Democratic sweep in Georgia would give that party virtual control of that chamber because Vice President–elect Kamala Harris would cast tiebreaking votes as the chamber’s president.

Futures for the S&P 500 index ESH21, -0.74% ES00, -0.74% were down 0.1%, while those for the Dow Jones Industrial Average YMH21, -0.20% YM00, -0.20% shot 0.4% higher after the race was called for Warnock. Nasdaq-100 futures NQH21, -2.29% NQ00, -2.29% were off 1.3% early Wednesday.

“The initial reaction by markets to the Georgia Senate runoffs has been logical,” Stephen Innes, chief global market strategist at Axi, wrote in a note early Wednesday. “US 10y is through 1% on anticipation of additional stimulus … Conversely, the S&P and Nasdaq futures are weaker driven by fears of increased taxes and regulation.”

In the regular session, the Dow DJIA, +0.55%, S&P 500 index SPX, +0.71% and the Nasdaq Composite Index COMP, +0.95% finished the session solidly higher ahead of the political face-offs.

However, some of the biggest moves were emanating from the bond market, with the 10-year Treasury yield TMUBMUSD10Y, 1.005% topped 1% as prices fell, after rates finished at 0.955%, marking its highest 3 p.m. Eastern close since Dec. 4, according to Dow Jones Market Data. The 30-year Treasury bond TMUBMUSD30Y, 1.770% also was up nearly 4 basis points yielding 1.744% vs. an afternoon close at 1.705%, also its highest rate in a month.

For the bond market, Democratic wins could add to the bearish pressure on Treasurys as analysts say inflation expectations have risen in response as Congress may be more inclined to pass additional fiscal spending measures with a majority, which would weigh on bond prices, dragging yields up.

“It looks like a couple of the larger democratic counties haven’t been totally counted yet so my belief is this may very well swing to the Democrats,” Tom di Galoma, managing director of Treasurys trading at Seaport Global Securities, told MarketWatch.

“If that does happen rates will continue to rise over the next few days. We could very well see 10yr yields near 1.2% shortly,” he wrote.

It is nearly impossible to surmise what outcome Wall Street deems is best suited to push stocks further higher in 2021. Last year, market participants had been wagering that a Biden presidential victory, coupled with Democrats achieving a majority in the Senate, would provide the best scenario for additional financial relief measures to help sustain the economy’s recovery from the Covid-19 pandemic.

However, a blue wave failed to manifest and markets surged into the final weeks of 2020 regardless.

Add Comment