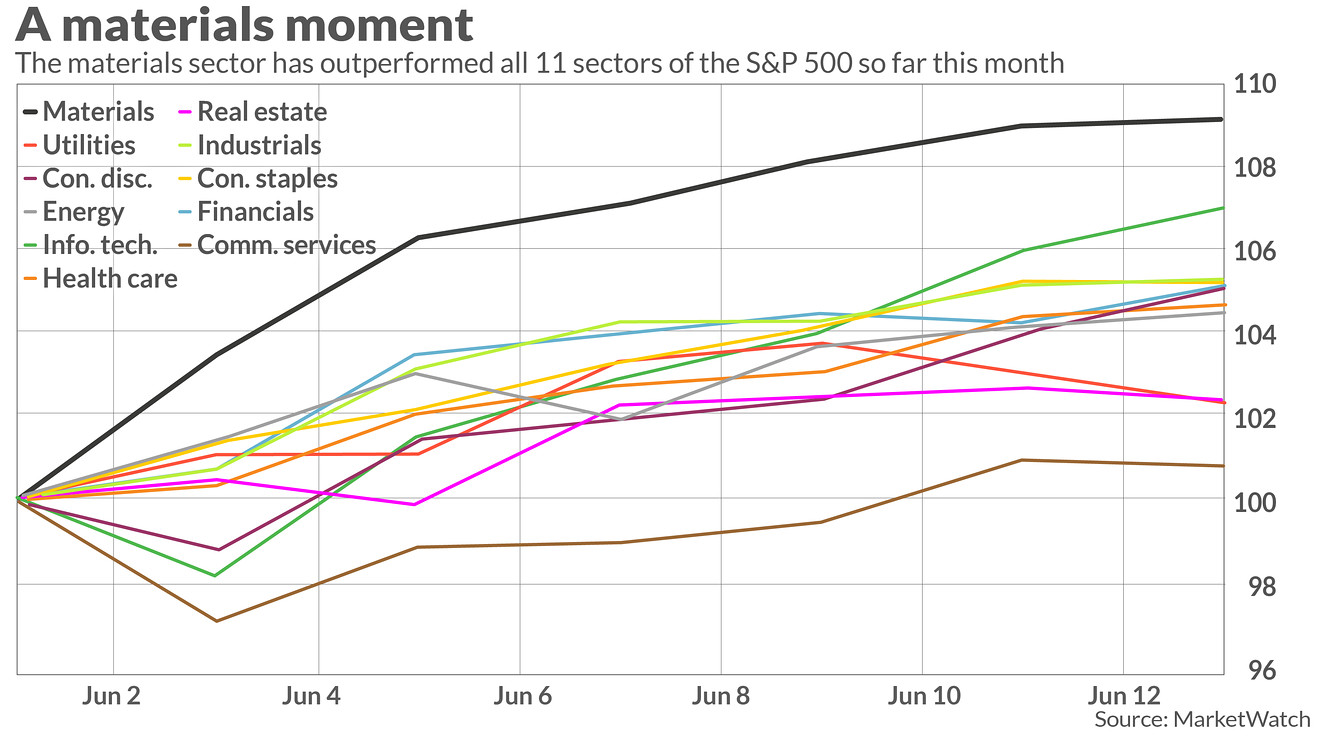

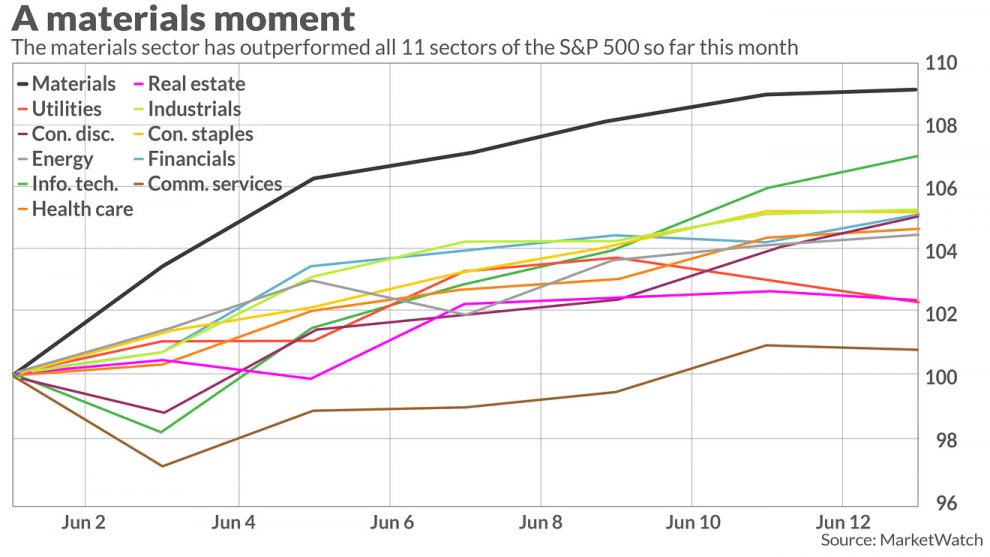

Quick — what’s the best performing sector in the S&P 500 so far in June? No, it isn’t the highflying information technology sector — that’s second best.

The materials sector is by far having the best month of any of the 11 sectors in S&P 500 groups, up 9.5% in the June to date, according to FactSet data, as of Wednesday afternoon trade (see charted attached).

In fact, the materials group, the sector that tends to be the most sensitive to global economic growth expectations, is on track for its best monthly gain since October of 2015, when it soared 13.45%, according to Dow Jones Market Data.

The sector represents shares of companies most closely tied to production of raw materials used in manufacturing, including steel, aluminum and chemicals.

By comparison, the information technology sector XLK, -0.56% is up 6.3% so far in June, while consumer discretionary shares XLY, -0.03% and consumer staples XLP, +0.15% are both set for monthly gains of at least 5%.

The exchange traded Materials Select Sector SPDR ETF XLB, +0.33% which offers investors the easiest way to bet on materials shares, is up 9.6% in June and about 14.4% this month.

So, why is the materials sector rallying, even as a tariff tit-for-tat between the U.S. and some of its largest trading partners is threatening to erode economic expansion?

The materials sector had been the most beaten down as stock prices fell in May, but has started to show an outsize rebound because there is growing hope that global central banks will ease monetary policy, some Wall Street analysts argue.

Expectations in the U.S., as reflected by bets made on federal-funds futures, shows that investors are pricing in at least two rates cuts in 2019. And while the Federal Reserve hasn’t committed to cutting interest rates, Chairman Jerome Powell did say that he would consider adjusting policy to help sustain the economic expansion if trade policy tensions continue to intensify.

“The market started to sense that the Fed was starting to transition from a pause to a more actively dovish stance,” Quincy Krosby, chief market strategist at Prudential Financial, told MarketWatch. She said anything that is seen as bolstering the economy-sensitive sector can deliver a jolt to shares of the materials sector.

Stocks of companies tied to aluminum and steel manufacturing were oversold last month and are now bouncing back, Karyn Cavanaugh, senior market strategist at Voya Investment Management, said.

Beyond trade tensions with China, in the past month the market also had to digest a threat by President Donald Trump to raise tariffs against Mexico if it didn’t help stem the flow of immigrants flowing into the U.S.

Krosby said that valuations after the earlier selloff may have made materials even more compelling.

Hope for an easy-money stance by the Fed and other central banks has partly helped the Dow Jones Industrial Average DJIA, -0.17% S&P 500 index SPX, -0.20% and Nasdaq Composite Index COMP, -0.38% return at least 4.5% so far in June.

Add Comment