A jump in Treasury yields this month appears to be causing pain for trend-following traders who had previously benefited from this year’s bond-market rally.

Commodity trading advisors and other players that bet and surf on the continuation of price trends have taken full advantage of the bond-market’s rally year-to-date, even as more skeptical analysts maintained that the plunge in Treasury yields was unsustainable given the U.S. economy’s steady but slowing growth. Yields and debt prices move in opposite directions.

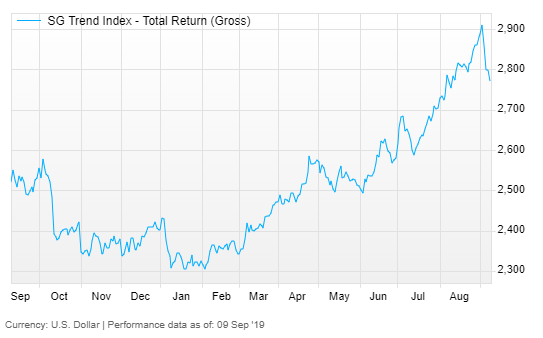

But the chart below indicates the recent surge in government bond yields has hurt these computer-driven investors who had piled into long positions on Treasury and European government bond futures.

The chart shows the SG Trend Index, which is down 4.8% since last Tuesday, still leaving it up 15% year-to-date. The index tracks the performance of commodity trading advisors that employ trend-following techniques.

The 30-year Treasury yield TMUBMUSD30Y, -0.21% is up around 30 basis points from its all-time low of 1.90% set on Aug. 14, while the 10-year yield TMUBMUSD10Y, +0.01% also climbed from its multiyear low of 1.43% by around 30 basis points to trade at 1.73%, Tradeweb data show.

Still, yields for both maturities have fallen substantially from the beginning of the year.

The move comes amid a heavy rotation in the stock market this week that has seen momentum-oriented shares fall sharply as investors piled into previously left behind value shares.

See: This bond-market strategy returned more than 30% this year in a sea of negative yields

Some analysts warned earlier this year that momentum traders had a habit of getting ahead of themselves, and could be the catalyst for a bond-market tantrum.

Nikolaos Panigirtzoglou of JPMorgan, in a July note, appeared to anticipate the selloff, envisioning a scenario where commodity trading advisors and other hedge funds sensitive to so-called value-at-risk metrics, or VaR, could be forced to roll back their bullish positions on long-term Treasury and European government bond futures.

Such investors ensure their trading positions show a stable value-at-risk metric, that is, the size of their positions times volatility. That means investors take bigger risks and increasingly leveraged positions when volatility is low, and smaller risks with less leverage when volatility is low.

When markets start to get choppy, commodity trading advisors can be forced to unwind their long positions on government bonds, triggering a feedback loop of further selling among other VaR-sensitive traders. The overall effect is a sharp climb in bond yields that may lack an obvious driver, such as a change in economic conditions or shifting expectations for central bank policy.

Read: JPMorgan says bond-market rally faces risk of ‘tantrum’ like 2013 and 2016

Add Comment