Uber Technologies Inc. — one of the most hotly anticipated IPOs of 2019 — produced an unusual woeful stock performance on Friday for a company of its magnitude.

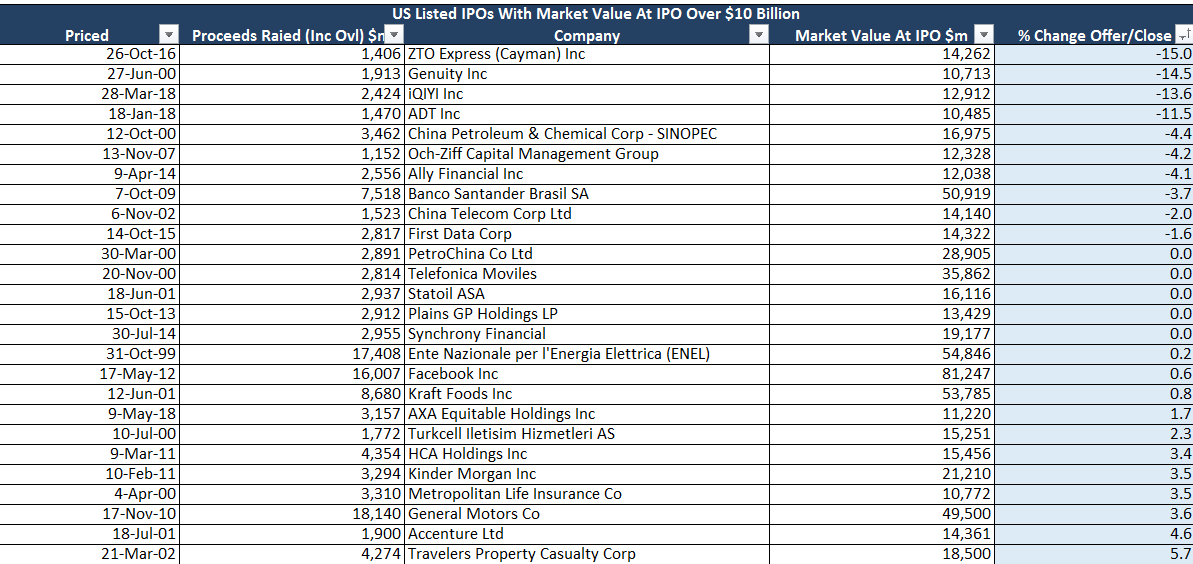

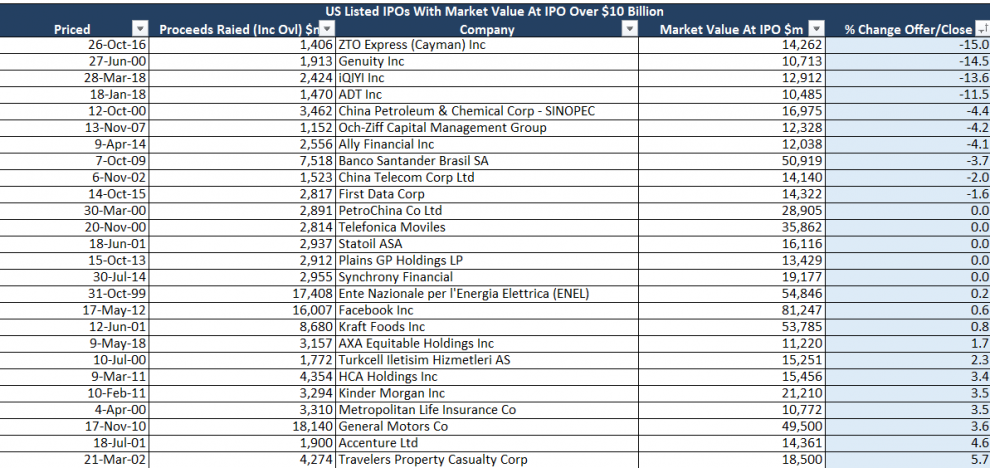

By at least one measure, the initial public offering was the fifth weakest one-day return of a company with a value of at least $10 billion of the past 24 years, according to data from Dealogic.

Uber’s stock UBER, -7.62% finished Friday trade off 7.6% at $41.57, giving it a valuation of $69.71 billion, according to FactSet data, after pricing its shares the day before its official public debut at $45.

Read more: 5 things you need to know about the Uber IPO

The first-day skid puts Uber’s return better than only four other companies sized at least $10 billion: ADT Inc. ADT, +0.31% which raised about $1.5 billion on January of 2018 but booked a first-day slide of 11.5%; and U.S. listed shares of Chinese company IQIYI Inc. IQ, -2.56% described as the Netflix Inc. NFLX, -0.47% of China — which saw its shares close off 13.6% in its debut.

Here’s a brief list of the one-day return of companies with a valuation of at least $10 billion since 1995:

Source: Dealogic

Source: Dealogic

Notable is that of the companies of Uber’s ilk in terms of size, Facebook Inc.’s FB, -0.16% notoriously glitch-stricken IPO, resulted in a better one-day return, gaining 0.6% on May 17, 2012.

Uber’s IPO on the New York Stock Exchange came against the backdrop of heightened tariff tensions between China and the Trump administration, which helped to unravel a recent updraft in stocks that had pushed the Nasdaq Composite Index COMP, +0.08% and S&P 500 index SPX, +0.37% to records just last Friday.

Some viewed the timing of Uber’s offering as inopportune.

Uber CEO Dara Khosrowshahi told the Wall Street Journal that the ride-hailing giant had expected chop in the market. “We knew we’d have a volatile day ahead of us.”

Still, even as the U.S. market recovered, on perceived improvement in Sino-American trade negotiations throughout the session, share performance of the ride-hailing giant founded in 2009 foundered.

For example, the Dow Jones Industrial Average DJIA, +0.44% finished the session up 114 points, or 0.4%, at 25,942.37, after hitting an intraday low at 25,469.86, shedding as many as 358.5 points at its nadir. It was one of the worst weeks for equity markets of the year.

Matthew Kennedy, senior IPO market strategist at Renaissance Capital, said the average return for IPOs recently has been a gain of 14%.

WSJ said at its IPO price, Uber was valued at roughly $82 billion on a fully diluted basis, below indications of a $90 billion to $100 billion valuation. Last year, the company’s bankers Morgan Stanley and Goldman Sachs estimated its value at $120 billion.

Many investors have been impressed by the scale of Uber’s business, which includes Uber Eats and other ventures, compared against that of rivals Lyft Inc. LYFT, -7.41%

Read: Uber Jackpot: Inside One of the Greatest Startup Investments of All Time

However, neither company appears to have a clear path toward profitability. In 2018, Uber reported an operating loss of $3 billion on revenue of $11.3 billion, and its accumulated deficit reached nearly $8 billion at the end of last year.

See also: Lyft stops providing key data after IPO, then insults investors’ intelligence

That said, one-day performance isn’t the only factor in grading an IPO. Uber sold some 180 million shares, amid a market rocked by uncertainty, which is commendable in that context.

Moreover, even companies that have seen some early snags in listing publicly have managed to stage a turnaround over time. Facebook, for example, is up 392% since its IPO, despite the social-medial platform’s more recent stumbles.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.

Add Comment