Don’t expect a red-hot January jobs report to be followed by a February chill when an even more eagerly awaited than usual monthly employment report is released at the end of next week.

That’s because warmer-than-usual weather likely contributed to January’s blowout jobs reading — a phenomenon that history shows tends not to get reversed the next month, said economist Jens Nordvig, founder and chief executive of research firm Exante Data.

Temperature data, which the firm had previously used to forecast European demand for natural gas, was found to also come in handy in examining near-term labor market trends. In a video clip shared with MarketWatch, Nordvig told clients that the relationship between temperatures and payroll growth is real, though it’s not getting much attention.

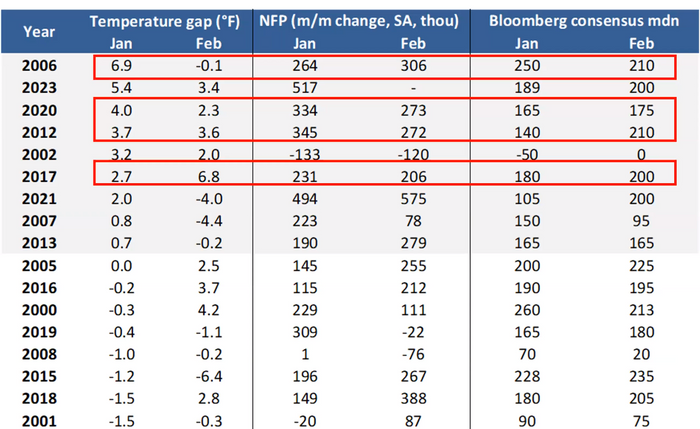

The chart below tracks the deviation in U.S. temperatures from normal in January and February. The highlighted rows show that in years with higher-than-normal January temperatures, payrolls exceeded forecasts for both January and February.

As the chart shows, January 2023 was 5.4 degrees warmer than normal, while payrolls saw a 517,000 rise, obliterating forecasts for a much smaller increase.

Warm weather may have added up to 200,000 jobs to January payroll growth, simply as a result of seasonal workers not being laid off, he said.

“So construction workers that normally have a hard time working in New York or other places where it’s typically cold in January, they stayed on,” he said, an effect that was likely seen in other sectors as well.

Look ahead: Stock market faces crucial test this week: 3 questions that could decide rally’s fate

So what about February? The chart shows temperatures remained warmer-than-usual, to the tune of 3.4 degrees, but not as warm relative to the average as in January. That means the weather in February is unlikely to have the same impact on the February jobs report, set for release on March 10, that warm January weather had on that month’s data, Nordvig said.

But the important takeaway from the data is that strong weather-enhanced January gains in the past haven’t been followed by February reversals, he said. In 2006, January temperatures were 6.9 degrees above normal but fell largely back in line in February. Payroll growth in February 2006, for example, blew away forecasts and outpaced January’s rise, coming in at 306,000.

The conclusion, Nordvig said, is that investors shouldn’t expect to see a reversal of the strong January figures in the February data. If so, that means the moving averages that Federal Reserve policy makers pay close attention to will remain robust.

Economists surveyed by The Wall Street Journal, on average, expect February payrolls to have grown by 225,000.

The employment report is often viewed as the most market-sensitive data of the month. Investors will be particularly focused on the February figures after the blowout January reading on Feb. 3, accompanied by a drop in the unemployment rate to its lowest since 1969, helped spark last month’s rapid reassessment of how high the Federal Reserve must take interest rates to rein in inflation.

See: Inflation data pushed the 10-year Treasury yield above 4%. How much higher can interest rates go?

Treasury yields, which had pulled back in January, pushed back to the upside, while stocks trimmed an early 2023 rally. Yields pulled back modestly on Friday, while stocks saw a strong rally. The S&P 500 SPX, +1.61% snapped a run of three straight weekly losses, while the Dow Jones Industrial Average DJIA, +1.17% ended a stretch of four straight weekly declines that had seen it temporarily erase its early 2023 gain.

Read next: Key question for stock-market investors: Take profits or sit tight in ‘make or break’ March

Add Comment