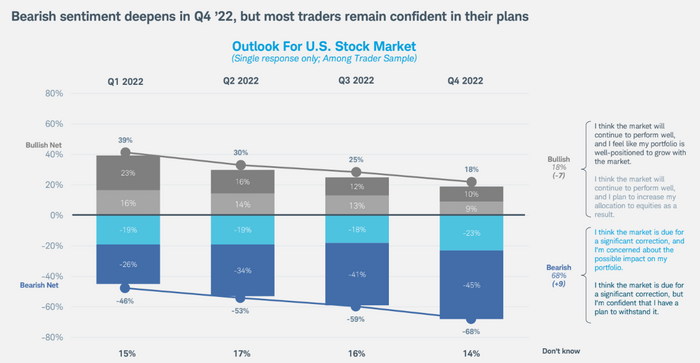

Traders have soured on the outlook for the U.S. stock market, leaving meme stocks out and value stocks in, according to Charles Schwab’s latest quarterly survey of trader sentiment.

The mood is bearish, said Barry Metzger, head of trading and education at Charles Schwab, in a media briefing ahead of the release of the survey’s results. Bearish sentiment, which was evident in the first quarter, deepened in the fourth quarter this year, the survey found.

Most traders said they expected a U.S. recession, with nearly 60% indicating they thought that the U.S. economy had already had fallen into a downturn or that one would begin by the end of 2022, the survey found. The survey of trader clients at Charles Schwab and TD Ameritrade was conducted Oct. 5-17.

Meanwhile, the U.S. labor market has remained strong, with historically low unemployment and with inflation in October showing signs of easing based on a softer-than-anticipated reading of the consumer-price index released last week. But investors generally have worried that the Federal Reserve’s rapid pace of interest-rate increases this year to combat high inflation still risks pushing the U.S. into a recession.

Traders in October reported being bearish on international stocks, cryptocurrencies and meme stocks, Metzger said, noting, “Engagement with crypto meme stocks is at a particular low that we’ve seen all year.”

Last week, woes across the crypto industry increased with the stunning collapse of FTX, once the world’s third-largest crypto exchange. FTX filed for bankruptcy protection in the U.S. on Friday.

Bitcoin BTCUSD, +4.07% prices were down 65% so far this year as of Monday, according to CoinDesk.

Read: If Sam Bankman-Fried committed fraud, he’ll face the music in the U.S., legal experts say

The U.S. stock market has tumbled in 2022 as the Fed has lifted interest rates, with the S&P 500 index SPX, +1.61% down around 17% through Monday.

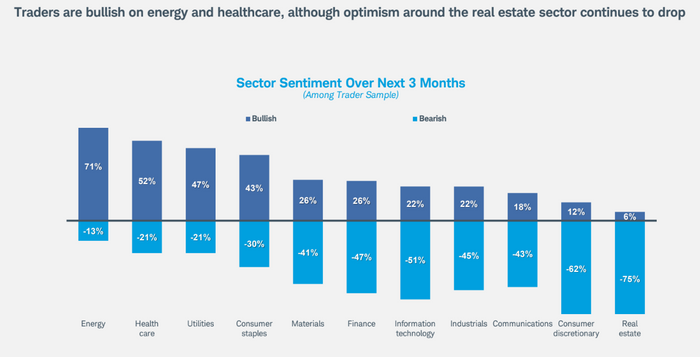

Still, traders “have their eyes open on a few different sectors and categories” that they feel are poised to do well, Metzger said, noting that they are bullish on value stocks and fixed income, as well as energy, healthcare, utilities and consumer-staples sectors.

The benchmark 10-year Treasury rate TMUBMUSD10Y, 3.813% was at 3.865% Monday, up from a 2022 low of 1.628% in January, according to Dow Jones Market Data.

The top concern cited by traders was the Federal Reserve’s raising of interest rates, followed by worries about inflation and about politics within and outside the U.S., the survey showed.

Meanwhile, traders will be listening to Fed speakers who are voting members of the Federal Open Market Committee for hints about the Fed’s potential path of rate hikes, Shawn Cruz, head trading strategist at TD Ameritrade, said during the media briefing. Cruz also pointed to economic data that he expects traders will likely focus on, such as the producer-price index for a gauge on wholesale inflation and readings from the purchasing managers’ index, known as PMI.

“Those give you a pretty good look across the board of what’s happening at the base economic level,” he said of PMI reports.

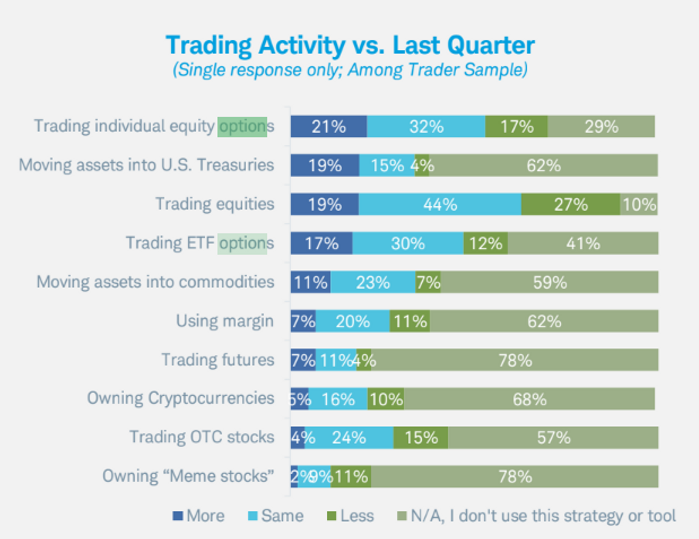

The Charles Schwab survey found that 21% of traders reported trading more individual equity options this quarter, while 19% were more engaged in moving assets into U.S. Treasurys.

“Looking at trading activity, a few strategies emerge as the most popular among traders right now,” Charles Schwab said in a statement on the survey. “They are trading more or the same of equities (63%), individual equity options (53%), and ETF options (47%).”

Add Comment