Technology stocks got wrecked Tuesday on Wall Street, and that bodes ill for the rest of the month, according to Dow Jones Market Data.

The decline in the Nasdaq Composite Index COMP, -4.11% pushed the tech-heavy index into a correction, commonly defined as a drop of at least 10%, but no more than 20%, from a recent peak, and reaffirmed the bearish view that tech-related stocks had mounted too brisk a run-up in the aftermath of the worst public-health crisis in a century.

Tuesday’s bitter slump, resulting in a 4.1% drop for the Nasdaq Composite, marked the worst start to the index in September, a notoriously weak month for U.S. equities, on record. The index has sunk 10% over the past three sessions, following a record close Sept. 2.

And the stats for the outlook for the market appear to show that it’s tough for the index to recover from the likes of the downturn it just faced.

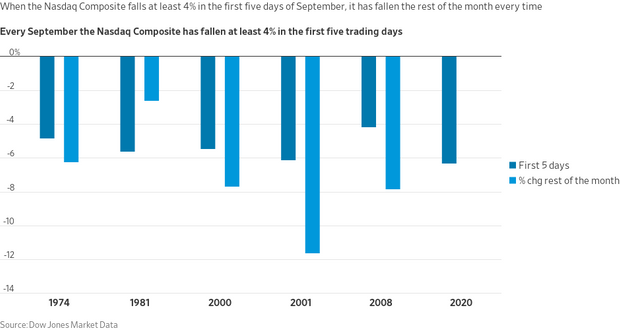

When the Nasdaq has previously tumbled by at least 4% in the first five days of September, it has ended lower. The Nasdaq has booked five Septembers since 1974 (not including Tuesday’s drop) in which it registered declines of at least 4%, and in four of those five declines — 1974, 2000, 2001 and 2008 — the equity benchmark added to its losses (see attached chart):

To be sure, that’ s hardly a significant sample size, but it’s still a stat worth considering as the market looks to right itself following three withering days for formerly high-flying tech stocks.

The moves by the Nasdaq Composite may also have broader implications for the market as a whole, since buzzy tech-related names like Tesla Inc. TSLA, -21.06%, Apple Inc. AAPL, -6.72%, Amazon.com Inc. AMZN, -4.39%, Facebook Inc. FB, -4.09%, Google parent Alphabet Inc. GOOG, -3.68% GOOGL, -3.64%, and Netflix Inc. NFLX, -1.75%, which have represented the handful of mega-capitalization companies that have all helped to power this resurgence in equities in the throes of a pandemic, all are sitting on multiday losing streaks.

Although bullish investors hope that the declines in the index helped to clear away some of the frothiness that had accumulated since the March lows for the stock market, there are some concerns that the tech wreckage could portend longer-term bad news for the Dow Jones Industrial Average DJIA, -2.24% and the S&P 500 index SPX, -2.77%, which also skidded by more than 2% on Tuesday.

Add Comment