Volatility exploded across the bond market this week amid growing contagion fears originating from U.S. banks, with the fallout gripping both sides of the Atlantic Ocean.

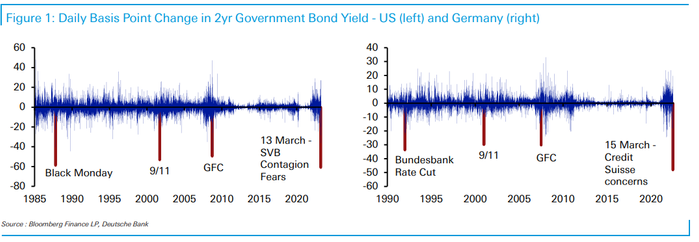

Analysts described the impact on the U.S. and German bond market as a rolling one in nature over the past five days, producing the biggest single-day drops in yields in well over a quarter of a century.

To recap: On Monday, following a weekend government intervention to protect the depositors of California’s Silicon Valley Bank and Signature Bank in New York and to backstop deposits at other institutions, the policy-sensitive 2-year U.S. note yield TMUBMUSD02Y, 3.694% experienced its biggest one-day fall since Oct. 20, 1987 by the end of New York trading — though, outside of U.S. hours, the rate dropped by the most since 1982. That intraday drop of almost 60 basis points exceeded the declines seen during the 2007-2009 financial crisis/recession; the Sept. 11, 2001, terrorist attacks; and 1987’s Black Monday stock-market crash.

See: Here’s how Silicon Valley Bank collapsed

Two days later, as troubles emerged at Swiss banking giant Credit Suisse CS, -6.94%, the 2-year German yield TMBMKDE-02Y, 2.376% saw its biggest daily decline based on available data going back to the country’s reunification period in 1990, according to macro strategist Henry Allen and Jim Reid, head of global economics and thematic research, at Deutsche Bank DB, -4.17%.

This week’s decline in 2-year U.S. and European yields came as the result of “de-risking of portfolios and draining of liquidity, stemming from concerns about the health of the U.S. banking system, exacerbated by questions about the future of CS [Credit Suisse] and repercussions in Europe,” said Gregory Staples, head of fixed income North America at DWS Group in New York, which oversaw $876.3 billion (821 billion euros) in assets as of December.

All of this is “raising the issue of recession and calling into question the trajectory of central banks,” Staples said via phone. “This can feed on itself as the dealer community reduces market making capacity. Right now, the larger macro question has more to do with financial stability than price stability.”

The ICE BofAML Move Index, a gauge of bond-market volatility, soared on Wednesday and Thursday to its highest levels since the fourth quarter of 2008, or the height of the Great Financial Crisis. Volatility continued on Friday as concerns swirled around another bank: Efforts to rescue San Francisco’s First Republic Bank FRC rattled financial markets — sending Treasury yields plunging once again, a day after they had spiked on the news of a funding deal.

Read: ‘We need to stop this now.’ First Republic support is spreading financial contagion, says Ackman.

To understand the wild swings in the policy-sensitive 2-year note yield, it helps to step back a bit.

Remember that the past year’s central-bank efforts to fight inflation have produced the fastest and most-aggressive jump in interest rates in about 40 years, causing both yields to rise and the underlying prices of notes and bonds to fall in dramatic fashion. A flavor of that dynamic briefly came into play on Tuesday, when February’s consumer-price index, which offered little sign that inflation was easing, seemed to put the 2-year rate on track for its biggest advance in more than a decade. Of course, that bump up didn’t last for long.

Instead, financial-sector fears have led to a tremendous flight to safety in government bonds, underscoring the two-way risks of trading. On one hand, existing bondholders have been burned by the past year’s rise in yields. But on the other, rates are finally at generally appealing levels for a swath of investors seeking cover from the banking fallout, a possible recession, and a falling stock market — all of which have pushed Treasury yields back down again.

Interestingly, equity volatility has remained relatively subdued by comparison, with the Cboe Volatility Index VIX, +10.96% rising, but still below its 2022 peak. Investors were bracing for more stock-market volatility Friday, with $2.8 trillion worth of option contracts set to expire.

On Friday, Treasury yields ended the U.S. session broadly lower, with the 2-year rate falling 28.4 basis points to 3.846% and posting its biggest one- and two-week declines since October 1987. Meanwhile, all three major U.S. stock indexes DJIA, -1.19% SPX, -1.10% COMP, -0.74% also finished lower — led by Dow industrials, which fell almost 400 points or 1.2%.

Also see: Why Silicon Valley Bank’s ‘safe’ investments turned into a problem for banks and the Fed

Add Comment