Investors don’t care about impeachment — and that is unlikely to change unless there is a shift in widely held expectations that President Donald Trump will remain in office.

Trump late Wednesday became the third U.S. president in history to be impeached, as the Democratic-led House of Representatives approved abuse-of-power and obstruction-of-Congress charges against the Republican leader, as was widely expected.

However, stock-market indexes, meanwhile, aren’t anticipated to produce much of a reaction on Thursday after finishing near all-time highs., with futures trading on Wednesday showing muted declines for stocks. Equities weakened toward the end of Wednesday’s regular session, with the S&P 500 SPX, -0.04% and Dow Jones Industrial Average DJIA, -0.10% ending slightly lower to break a five-day winning streak that had taken them to a series of records, but Wall Street has mostly shaken off the prospect of impeachment.

See: Here’s what happens next in Democrats’ effort to impeach President Trump

Indeed, the S&P 500 has added substantially to year-to-date gains, which now stand at more than 27%, even as the impeachment proceedings have taken shape. The Dow is up more than 21% so far this year, while the Nasdaq Composite COMP, +0.05% has advanced around 33%.

Read: The S&P 500 is within striking distance of its best year since 1997

The Democratic-controlled House spent hours Wednesday debating impeachment, with the process concluding with a largely party-line vote in favor. No Republicans supported either charge and only a few Democrats broke ranks on both articles. The vote on abuse of power was 230-197 and on obstruction of Congress it was 229-198. The evening votes followed a monthslong investigation into Trump, who has consistently denied any wrongdoing and called the proceedings a “witch hunt.”

House Speaker Nancy Pelosi said Trump gave Democrats ‘no choice’ but to impeach him, as he called their effort an ‘assault’ on the country.

So why isn’t such a historic clash creating more unease in financial markets?

The answer lies with the Republican-controlled Senate, which will hold a trial in the wake of impeachment. All signs are that the Senate won’t vote to remove Trump from office.

Wednesday’s vote “is only step one out of two to complete the impeachment — and it is well understood that step two (a vote in the Senate) will almost certainly fail,” said Jasper Lawler, head of research at London Capital Group, in a note.

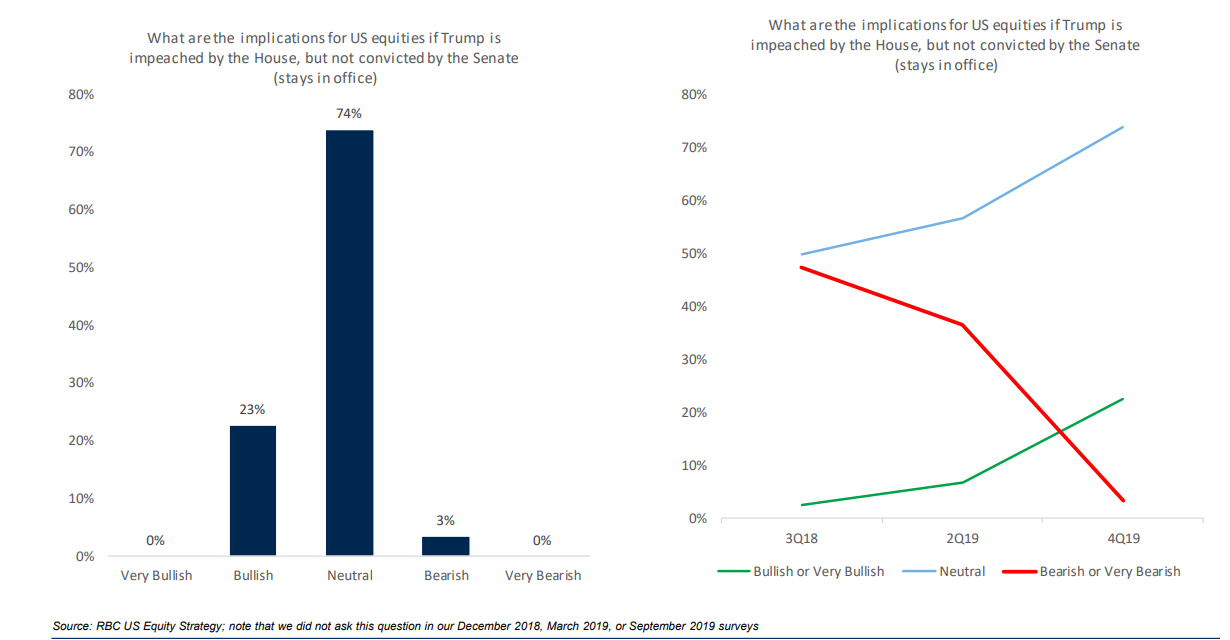

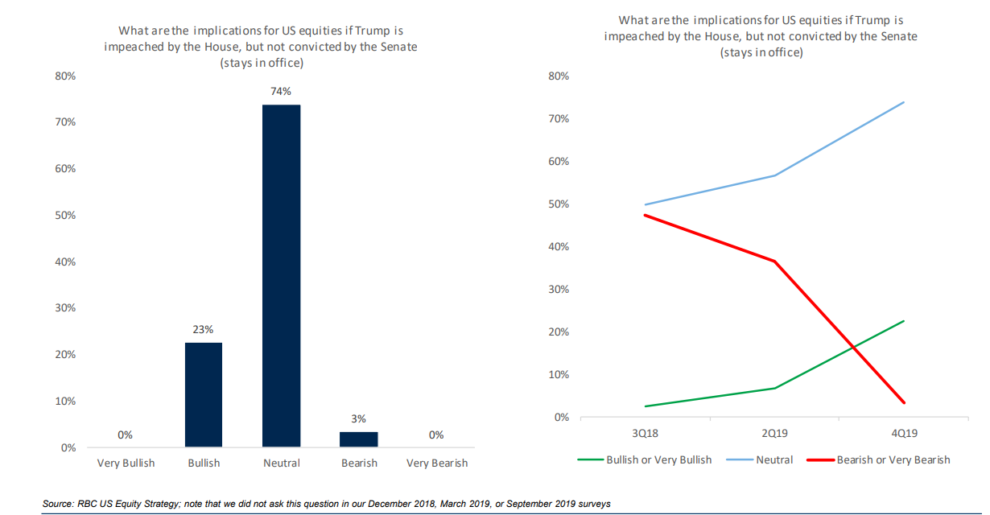

An investor survey conducted by RBC Capital Markets found that market participants have grown more comfortable over time with a scenario in which the president is impeached, but not convicted.

Senate Majority Leader Mitch McConnell, a Kentucky Republican, told Fox News last week that there is “no chance” Trump will be removed from office. A January trial would come shortly ahead of the first presidential primaries of the 2020 election season.

The bank’s December poll found that 74% of investors believe that such a scenario would be a neutral event for markets, up form 57% in June and 50% in September 2018, said Lori Calvasina, head of U.S. equity strategy, in a note. Meanwhile, the percentage of investors who believe such a scenario would be bearish has fallen, while those who believe it would be bullish has risen (see chart below).

RBC Capital Markets

RBC Capital Markets Meanwhile, 69% of investors believe an involuntary Trump exit or a resignation would be a negative for stocks, largely in line with September 2018 and June 2019 surveys, Calvasina noted.

In fact, part of the stock market’s upswing since October may have to do with shifting expectations around the 2020 election, Calvasina said. That coincides with a drop in expectations in prediction markets that Sen. Elizabeth Warren of Massachusetts, who has campaigned on a program of tax increases on wealthy Americans and increased regulatory scrutiny, would win the Democratic nomination, as well as a rise in expectations Trump would win re-election.

So perhaps the most relevant concern for investors is whether the impeachment damages Trump’s prospects in 2020. Some analysts contend the impeachment is more likely to benefit Trump.

At a rally in Battle Creek, Mich., on Wednesday night, Trump brushed off the House impeachment. “It doesn’t really feel like we’re being impeached,” he told supporters.

With the Senate poised to acquit, “there looks almost certain to be no political payoff for markets to worry about from this epic impeachment saga — except perhaps to enthuse U.S. Republican voters and make Trump 2020 more, not less likely,” said Michael Every, a strategist at Rabobank, in a Wednesday note.

That said, while polls show there has been a slight drop in support for impeachment, particularly among moderates, over half of Americans still believe Trump “did something wrong with Ukraine,” said Greg Valliere, chief U.S. policy strategist at AGF Investments, in a note. “The country is roughly divided on whether this warrants his removal, and that is unlikely to change.”

See: How support for impeaching Trump has risen and fallen — in one chart

But barring any unforeseen developments, the impeachment saga is likely to be in the rearview mirror by spring next year. “Super Tuesday on March 3 will be the next shiny object for the media to overanalyze, and Trump will still be in office,” Valliere said.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment