The Federal Reserve delivered a rare emergency interest rate cut to Wall Street on Tuesday in an attempt to limit economic harm from the COVID-19 epidemic, the infectious disease that was first detected in December in Wuhan, China and has sickened more than 91,000 people world-wide.

Check out: Coronavirus update: 92,303 cases, 3,131 deaths, at least 106 sickened in the U.S.

The Fed is due to hold a policy meeting on March 17-18 at which financial markets expected an interest-rate cut, but for the first time since October 2008 the central bank decided to go ahead with an inter-meeting cut of a half percentage-point to a range of 1%-1.25%.

In a late-morning press conference, Fed Chairman Jerome Powell emphasized that the rate cut was meant to offset risks to economic growth from disrupted trade and travel since the viral outbreak in China rather than because of any slowdown in U.S. economic growth yet.

“I don’t think anybody knows how long it will be. I do know the U.S. economy is strong and we will get to the other side of this,” Powell said, during his Tuesday news conference.

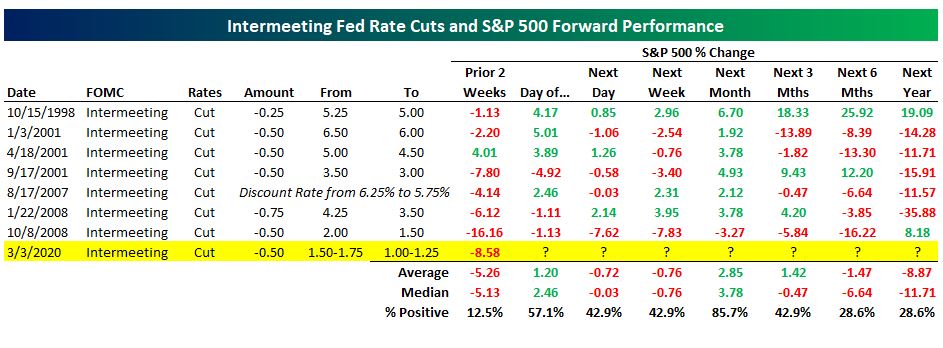

It is extremely unusual for the Fed to reduce interest rates between its regularly scheduled meetings. In fact, it is only the eighth such inter-meeting cut and only the first since the 2008 financial crisis.

Markets thus far haven’t responded well to the Fed move, the Dow Jones Industrial Average DJIA, -3.30% was off more than 600 points Tuesday afternoon, or 2.4%, to trade near 26,059, while the S&P 500 SPX, -3.18% was down 2.2%, and the Nasdaq Composite COMP, -3.40% retreated 2.2%.

Tuesday’s reaction isn’t usual according to recent data by Bespoke Investment Group, which indicates that on average inter-meeting cuts result in a gain of 1.2% in stocks on the day of the cut, but a decline of 0.72% in the day after.

Read: G-7 pledges to use ‘all appropriate policy tools’ to fight coronavirus

Also read: Buy the dip? Here’s how some analysts say investors should play it

“Over the next week (following an inter-meeting cut), the S&P has averaged a decline as well of -0.76%. It’s only over the next month where things turn more bullish. In the month following the prior seven intermeeting cuts, the S&P has gained six times for an average gain of 2.85%,” Bespoke’s researchers wrote.

Here’s how a brief look at how the markets have performed in the wake of other surprise cuts by the Fed, according to Fed.

Source: Bespoke Investment Group

Source: Bespoke Investment Group Powell acknowledged on Tuesday that the Fed rate cut wouldn’t decrease the risk of infection of U.S. citizens or improve broken supply chains: “We don’t have all the answers,” he said. Perhaps that is why markets are so far reacting poorly to the news conference and the cut on Tuesday.

“While an easing of financial conditions is always desirable in times of economic and market stress, it is questionable as to what other benefits will be derived from this action,” wrote Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, in an emailed note on Tuesday.

“Effectively the market demanded it because it was already priced into the Fed Funds futures,” he said.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment