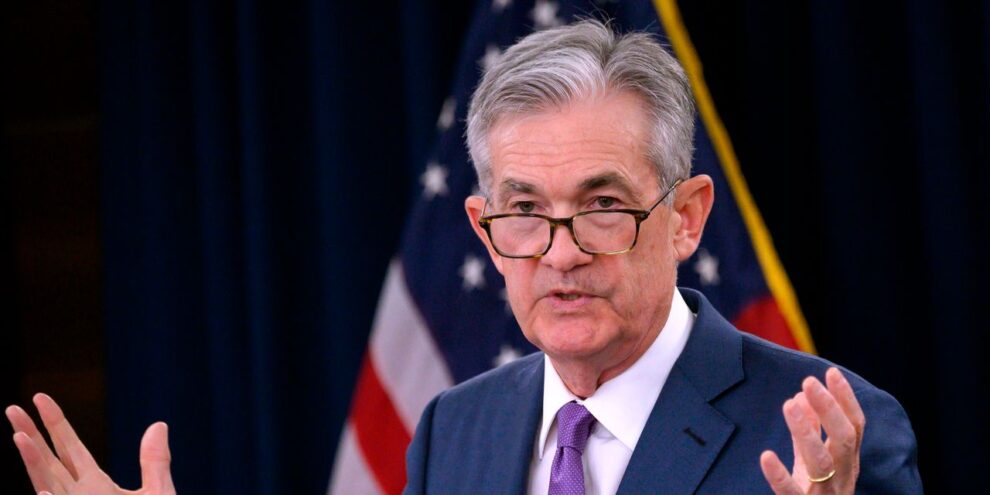

U.S. stock index futures were slightly firmer early Tuesday, though trading was muted ahead of testimony to Congress by Federal Reserve Chairman Jerome Powell.

How are stock-index futures trading

- S&P 500 futures ES00, +0.10% rose 6 points, or 0.1%, to 4058

- Dow Jones Industrial Average futures YM00, +0.02% climbed 18 points, or 0.05%, to 33469

- Nasdaq 100 futures NQ00, +0.20% advanced 34 points, or 0.2%, to 12357

On Monday, the Dow Jones Industrial Average DJIA, +0.12% rose 40 points, or 0.12%, to 33431, the S&P 500 SPX, +0.07% increased 3 points, or 0.07%, to 4048, and the Nasdaq Composite COMP, -0.11% dropped 13 points, or 0.11%, to 11676.

What’s driving markets

Markets remain focused on the prospects for U.S. monetary policy and consequently trading was muted ahead of Powell’s testimony to the Senate on Tuesday, due to commence at 10 a.m. Eastern.

Powell will also be quizzed by the House of Representatives on Wednesday, ahead of the always eagerly awaited official jobs data for February on Friday.

“Investors are largely unwilling to take the plunge ahead of two vital indicators…with most markets treading water in the meantime,” said Richard Hunter, head of markets at Interactive Investor.

“Federal Reserve Chairman Powell’s Congressional testimony and the nonfarm payrolls report are the undoubted highlights of the week. Taken together, the two events will provide the latest update on the immediate past, present and future of the world’s largest economy and will be crucial in determining market sentiment,” Hunter added.

Read also: What stock-market investors want to hear when Fed’s Powell testifies before Congress this week

The S&P 500 index sits near the middle of the 3,800 to 4,200 range within which it has meandered for about four months, with equity investors seemingly able to absorb a recent lurch upwards in bond yields TMUBMUSD10Y, 3.938%, which has come after a spate of data showing resilient economic growth, which may force the Fed to keep borrowing costs higher for longer.

However, some analysts are wary that the market is still vulnerable to any confirmation that interest rates may have to rise at a faster pace than hoped.

“For the most part, Fed speak recently has been chiefly hawkish; there has been no significant deviation from the 25bps path yet. But any such material twist would likely boost the USD higher and risk sentiment significantly lower,” said Stephen Innes, managing partner at SPI Asset Management.

[Mean]while sticking to the ‘higher-for-longer’, but in 25bps increments, it would help keep rates volatility contained and risk markets relatively supported,” Innes added.

U.S. economic updates set for release on Tuesday include January wholesale inventories at 10 a.m. and January consumer credit at 3 p.m.

Companies in focus

- Dick’s Sporting Goods Inc. DKS, +0.02% shares are up more than 5% in premarket trading after the retailer beat estimates on its fourth quarter results and offered a muscular full year earnings outlook. The national sports goods store had adjusted earnings per share of $2.93 versus a FactSet consensus of $2.88. The company’s “consistent performance” and “financial strength” will let it “increase the rate of investment in our business to fuel long-term growth opportunities, and also return significant capital to shareholders,” Dick’s Sporting Goods CEO Lauren Hobart said.

- Meta Platforms Inc. META, -0.19% shares up more than 2% in the premarket amid a report that the parent company of Facebook and Instagram is eyeing another round of layoffs. Any extra trim to the workforce, as reported by Bloomberg News, would follow layoffs late last year of more than 11,000 employees.

Add Comment