Stock-index futures pointed to more gains for Wall Street Tuesday, after investors kicked off the new year by pushing a pair of major benchmarks to record finishes.

What are major indexes doing?

- Futures on the Dow Jones Industrial Average YM00, +0.46% climbed 148 points, or 0.4%, to 36,603.

- S&P 500 futures ES00, +0.36% rose 16.50 points, or 0.3%, to 4,802.50.

- Nasdaq-100 futures NQ00, +0.19% were up 34 points, or 0.2%, at 16,519.50.

On Monday, the Dow Jones Industrial Average DJIA, +0.68% and the S&P 500 SPX, +0.64% closed at records, while the Nasdaq Composite COMP, +1.20% surged 1.2%, to finish just over 1% away from record territory.

What’s driving markets?

Traders were still in an upbeat mood after a strong start to the trading year.

Global strategists at JPMorgan argue there’s further upside for stocks despite the strong run, citing data indicating the omicron variant is milder and won’t hit mobility as much as prior variants, and the China activity deceleration is behind us. They also say consensus earnings projections for 2022 may be too low.

Investors continue to wave off concerns over the omicron variant of the coronavirus that causes COVID-19. Infections have surged, with the U.S. registering 1,083,948 cases on Monday, according to data collected by Johns Hopkins University — more than double the previous record of 486,428 set four days ago.

Hospitalizations for confirmed or suspected COVID-19 cases hit a seven-day average of 97,855 on Monday, according to data from the U.S. Department of Health & Human Services cited by The Wall Street Journal. That’s up 41% over the past two weeks but below the pandemic peak of 137,510 seen on Jan. 10, 2021, and a smaller peak of 102,967 seen on Sept. 4, 2021, amid the surge in the delta variant of the coronavirus.

“While the surge in omicron COVID cases continues to impact travel and public services around the globe, its milder nature keeps market participants optimistic that full-scale lockdowns could be averted,” said Charalambos Pissouros, head of research at JFD Group, in a note.

Economic data will be in focus, with the Institute for Supply Management’s closely watched gauge on U.S. manufacturing activity due at 10 a.m. Eastern. The ISM December manufacturing index is expected to fall to 60% from a reading of 61.1% the previous month. A level above 50% indicates an expansion in activity.

Data on job openings and leavings in November is also due at 10 a.m., ahead of other data due this week, culminating in the December jobs report on Friday, that will be watched to gauge the tightness of the labor market.

Minneapolis Fed President Neel Kashkari is scheduled to discuss the economic outlook at 11:30 a.m.

Which companies are in focus?

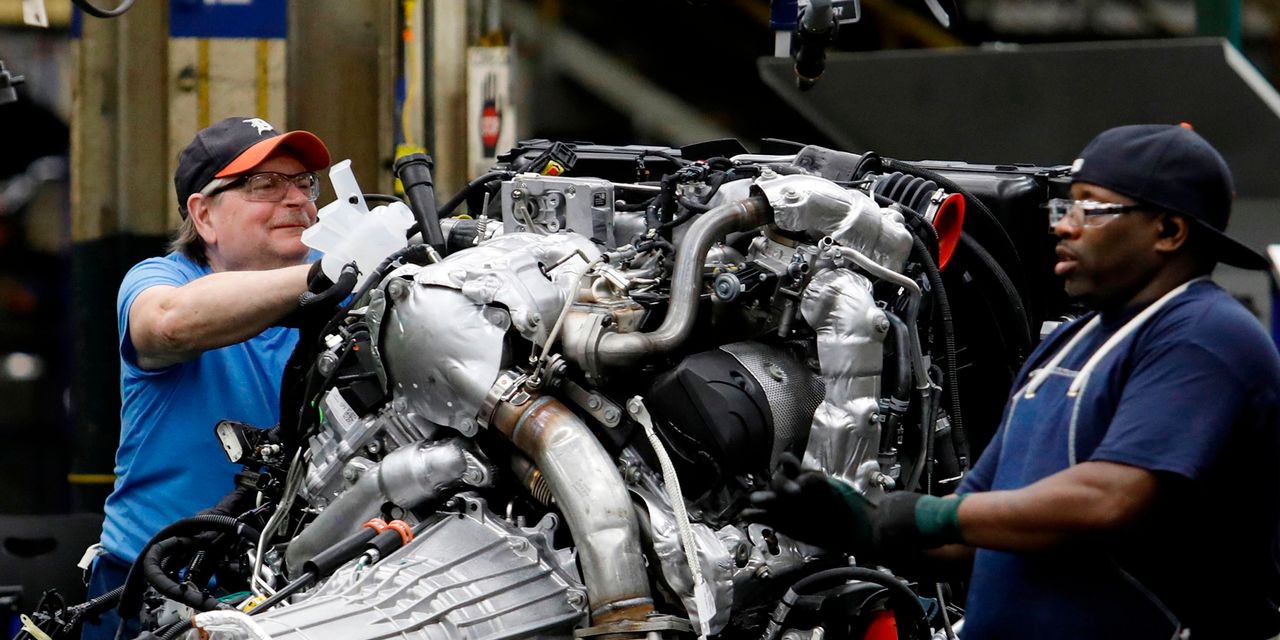

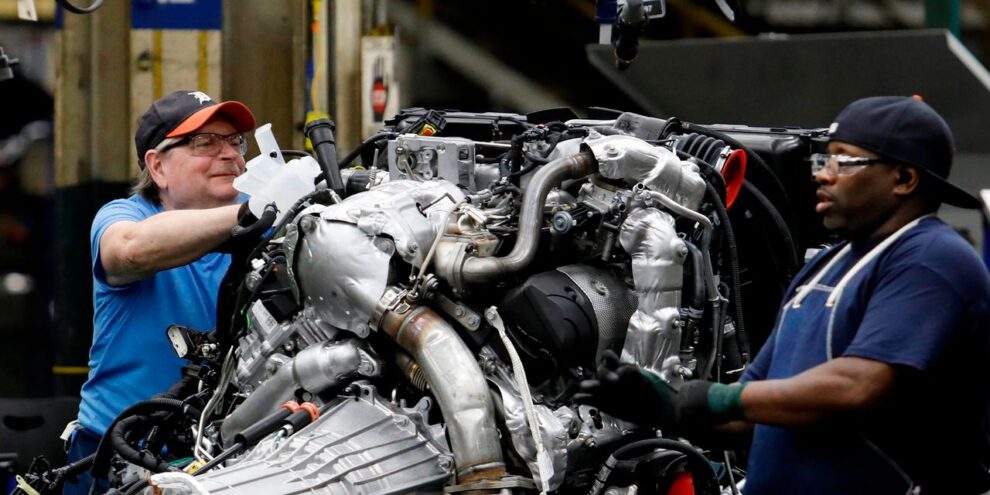

- Shares of Ford Motor Co. F, +4.81% rose more than 3% in premarket trade, heading toward a more-than-two-decade high, after the auto maker said it plans to nearly double production of its all-electric F-150 Lightning pickups at its Dearborn, Michigan facility to 150,000 trucks per year to meet “soaring customer demand.”

- Apple Inc. AAPL, +2.50% shares rose 0.3% in premarket action, after briefly crossing the threshold required for the company to achieve a $3 trillion market value Monday before ending the day below the mark.

What are other assets doing?

- The yield on the 10-year Treasury note TMUBMUSD10Y, 1.674% rose 3.9 basis points to 1.669%. Yields and debt prices move opposite each other.

- The ICE U.S. Dollar Index DXY, +0.12% was up 0.1%.

- Oil futures gained ground, with the U.S. benchmark CL00, +0.46% up 1%. Gold futures GC00, +0.47% edged up 0.2%.

- Bitcoin BTCUSD, +1.79% rose 0.8%.

- The Stoxx Europe 600 SXXP, +1.03% index rose 0.9%, while London’s FTSE 100 UKX, +1.47% jumped 1.4%.

- The Shanghai Composite SHCOMP, -0.20% fell 0.2%, while the Hang Seng Index HSI, +0.06% edged up 0.1% in Hong Kong and Japan’s Nikkei 225 NIK, +1.77% rose 1.8%.

Add Comment