Advanced Micro Devices Inc. is putting all its chips in one basket: The holiday season.

AMD reported on-target second-quarter results Tuesday, but also gave a disappointing forecast for the third quarter, as sales of its custom chips for videogame consoles continue to decline. AMD AMD, +1.16% shares fell more than 4% in after-hours trading, after running up about 83% in 2019 on anticipation of new product launches, the second-biggest gain year-to-date in the S&P 500 index SPX, -0.26%

Those gains have been predicated on AMD promising a better second half, a common refrain among chip makers this year that has yet to be proved as several factors have combined to fuel a semiconductor downturn, including a memory-chip glut and a purchasing slowdown by cloud-computing companies. AMD’s forecast pushes out that rebound, which is counting on its newest versions of chips for PCs, servers and data centers to provide a big boost in the fourth quarter.

Related: Microsoft is killing it in all businesses except for one

Executives told analysts on the company’s conference call that they expect full-year revenue to grow 20%, minus its semicustom business, where the videogame-console sales lie. In total, AMD expects revenue will increase by “a mid-single-digit percentage.”

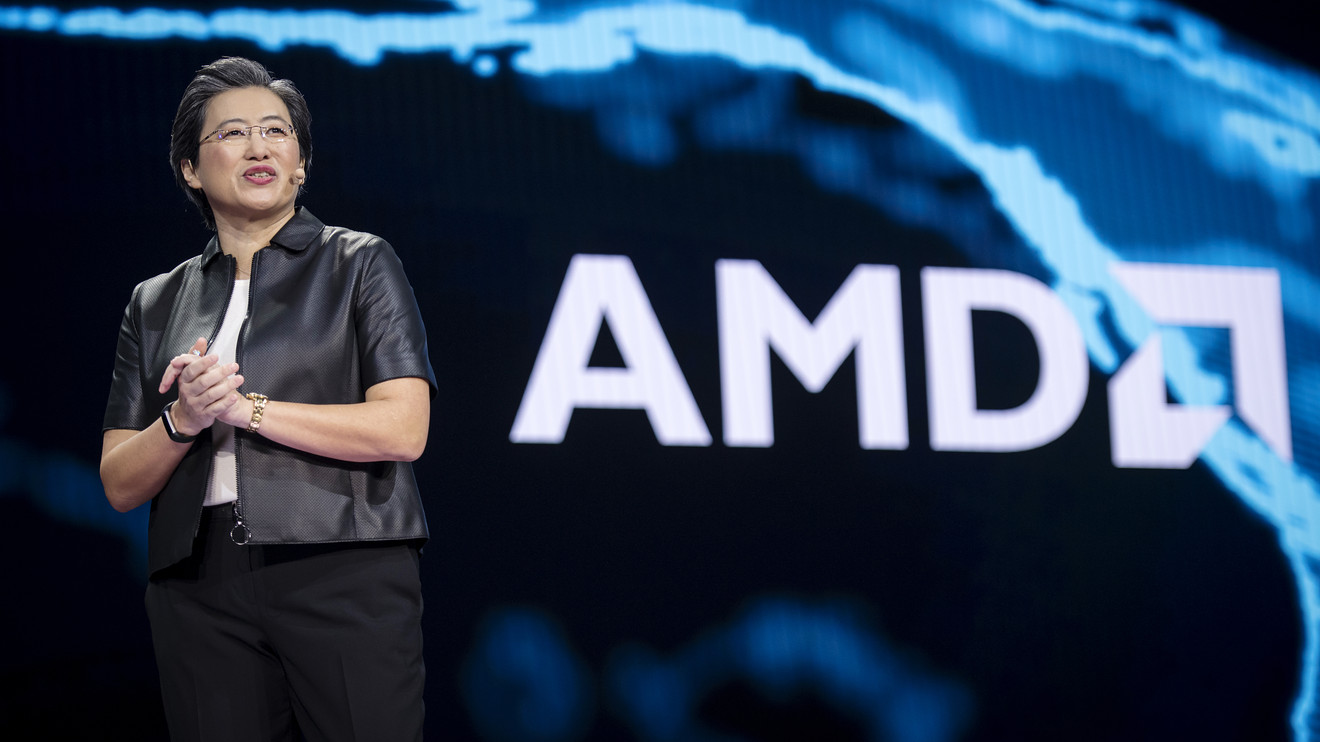

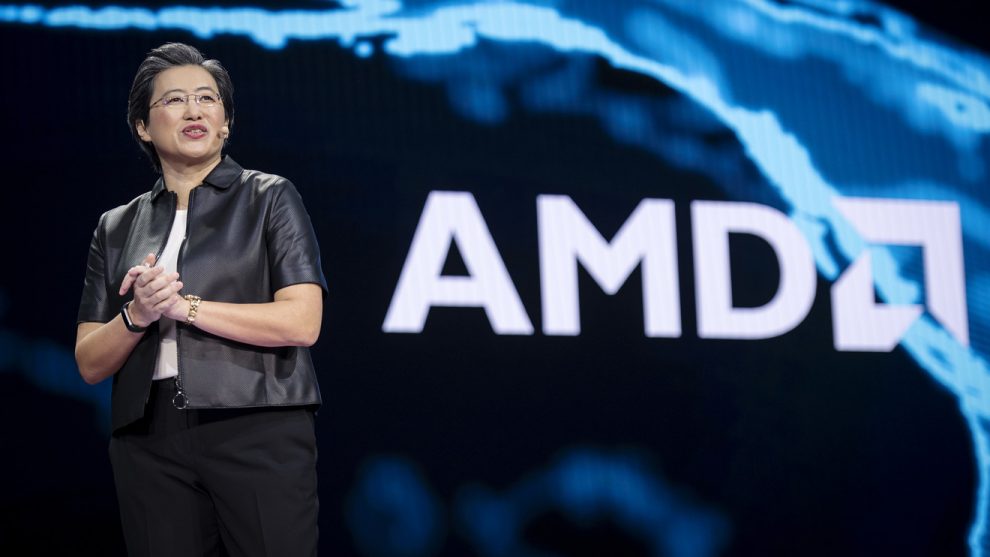

“What you should expect as we go from Q3 to Q4 is that the product mix will get better,” AMD Chief Executive Lisa Su said in response to a question from one analyst about a massive uptick in the fourth quarter.

Improving the product mix doesn’t seem like enough to get AMD to its promised land, however. Through two quarters, the company’s revenue is down 17.6% from the previous year’s first half. If AMD hits the midpoint of its revenue guidance for the third quarter, it will head into the fourth quarter trailing the previous year’s sales total by 9%, a lot to make up even with an easier comparison after the cryptocurrency downfall at the end of last year.

“It’s a big ramp,” Bernstein Research analyst Stacy Rasgon bluntly stated in an interview Tuesday afternoon.

The potential for that rebound is because of the next version of AMD’s Epyc chips for servers and data centers, called Rome, which is set to launch next week, following the launch of new CPU chips. While server chips have a longer selling cycle, they will add more revenue and profits, and are ultimately providing a new revenue stream in an area AMD has been absent for the past few years, until it launches its new family of chips based on its Zen architecture.

More from Therese: Even Intel doesn’t seem to know what’s going to happen with Intel

“Consoles are falling, so the core stuff is ramping. If you want to be bullish, you can latch onto that,” Rasgon noted, also pointing out that AMD is including an extra $100 million from Samsung Electronics Co. Ltd. 005930, -2.90% in the 20% revenue growth estimate, after a recent deal with the South Korean company related to graphics chips.

While being optimistic about AMD’s new PC and server chips is fine, expecting those products to magically turn around AMD’s year in the final three months of sales is asking a lot. If you’re betting on AMD to follow through on that promise, know that it will have to execute to perfection to make it happen, and outside forces could still get in the way.

Add Comment