President Donald Trump has never hesitated to criticize the U.S. Federal Reserve and the chairman he appointed, Jerome Powell, for, in Trump’s view, tightening too aggressively. Now it is European Central Bank President Mario Draghi’s turn.

Trump’s hostile response on Twitter to Draghi’s signal that the ECB could move to provide further monetary stimulus as early as next month is stoking fears that a potential U.S. trade war with its major trading partners could also be accompanied by a currency war, as policy makers work to cheapen their currencies in what’s often is described as a race to the bottom in an effort to enhance the appeal of their wares to foreign buyers.

Draghi, speaking at a central-banking forum in Portugal, sent the euro EURUSD, -0.1694% tumbling early Tuesday and gave global equity markets a lift after making clear that the ECB was prepared to cut interest rates and could restart the bond buying program at the heart of its quantitative easing effort if needed to support the eurozone economy. The euro was off 0.2% at $1.1199 versus the U.S. dollar in recent action, after sinking to a two-week low at $1.1181. Stocks were lifted, with the pan-European Stoxx 600 Europe index SXXP, +1.23% up 1.2%, while U.S. stock-index futures pointed to a higher start for the S&P 500 SPX, +0.09% Dow Jones Industrial Average DJIA, +0.09% and other major indexes.

Trump soon complained, tweeting that Draghi’s remarks “immediately dropped the Euro against the Dollar, making it easier for them to compete against the USA. They have been getting away with this for years, along with China and others.”

Read: Trump says ECB’s Draghi is depressing euro to benefit trade

Trump has long complained about the strength of the dollar and had hit out at the euro just last week, saying, via Twitter, that it and other currencies were “devalued against the dollar, putting the U.S. at a big disadvantage,” while also taking another swipe at the Fed.

Read: Why Trump’s tweets about the U.S. dollar might soon pack a lot more punch

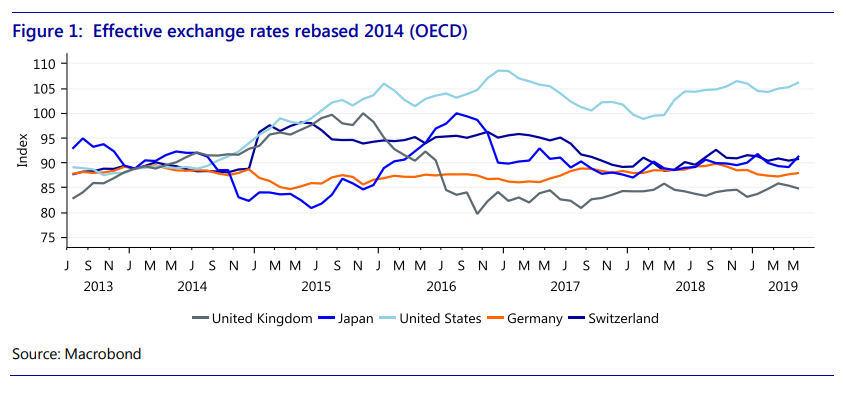

Is the dollar overvalued against the euro? According to a number of purchasing power parity models, the answer is yes, said Jane Foley, senior FX strategist at Rabobank, in a note. But that isn’t difficult to explain, she said, in light of the nine interest rate increases implemented by the Fed between late 2015 and 2018. The rise in U.S. interest rates relative to the eurozone, and other economies, made the dollar more attractive. And in partial defense of the Fed, the Trump administration’s tax cuts briefly accelerated the U.S. expansion, putting pressure on the Fed to normalize rates more quickly (see chart below).

Rabobank

Rabobank

Meanwhile, subdued global inflation pressures are potentially setting the stage for a currency conflict.

“Any economy that is suffering from a prolonged bout of undesirably low inflation is likely to favor a weak currency. If several economies find themselves in the same boat coincidentally, the prerequisite conditions for a currency war are set,” Foley said.

Add Comment