After a double whammy of a crypto-mining-influenced decline in its core gaming business and a slowdown in its previously surging data-center business over the past year, Nvidia Corp. says business is back to normal.

Nvidia reported fiscal-second-quarter results that topped Wall Street expectations Thursday, with revenue growing 17% sequentially to $2.58 billion, thanks to growth of 24% for the gaming business and 3% for data center.

“Essentially our business is normalized,” Nvidia Chief Financial Officer Colette Kress told analysts on a conference call. “We’ve reached normalized levels through the last couple quarters and this quarter, just very similar to what we will see going forward.” In a brief interview with MarketWatch after the call, Kress added, “We feel really good about sequential growth, we have sequential growth across all of our platforms.”

Shares NVDA, -0.87% jumped more than 6% in after-hours trading Thursday following the release of the results, showing excitement for the end of a punishing cycle. But a look into the numbers leads to an important question: What is the new normal?

Nvidia revenue was still down 17% from the year-ago period, with the gaming business down 27% and data-center business down 14%. Nvidia is forecasting a single-digit revenue decline in the fiscal third quarter, with its guidance of revenue of $2.90 billion, plus or minus 2%. That guidance represents an approximate 8.8% drop from $3.18 billion in revenue in the fiscal third quarter a year ago.

Nvidia investors who bought in during the growth surge that preceded the downturn of the past year expected better growth than that. To get back to that level, Nvidia must supercharge its two biggest businesses, gaming chips and server chips focused on artificial-intelligence uses.

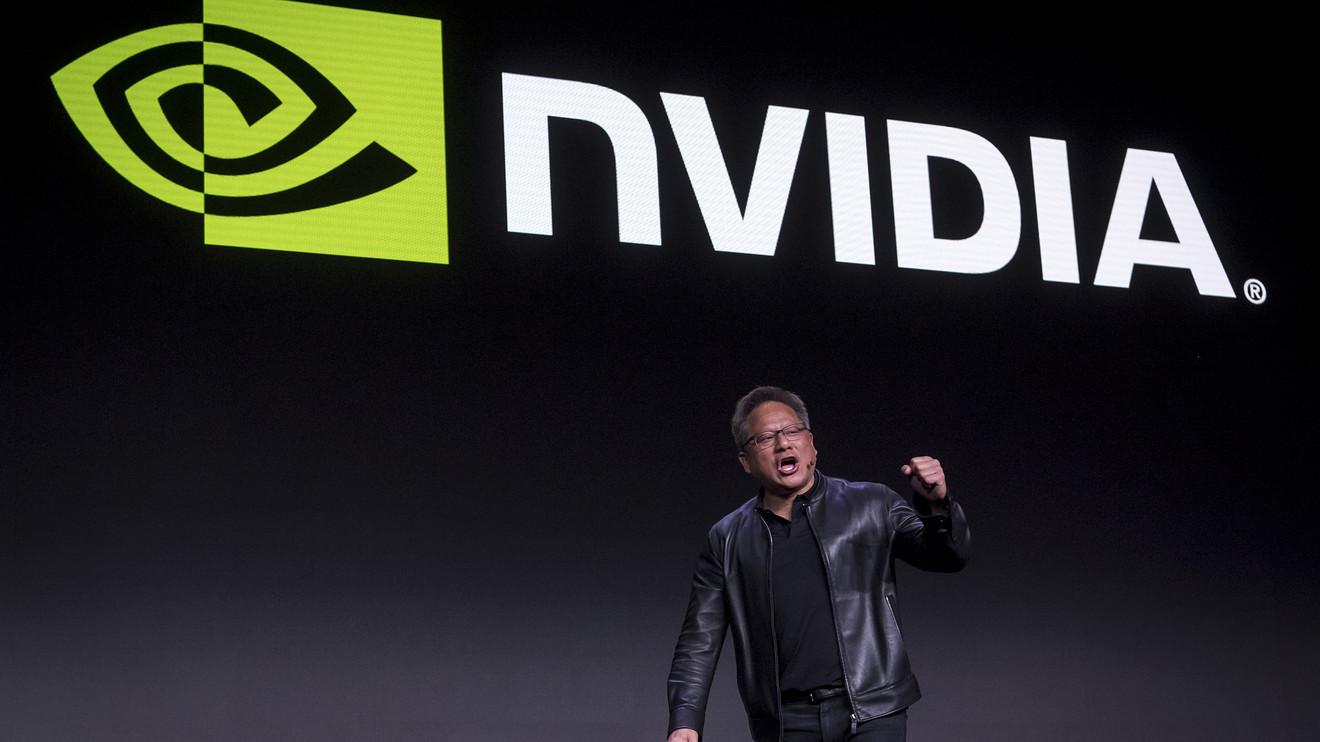

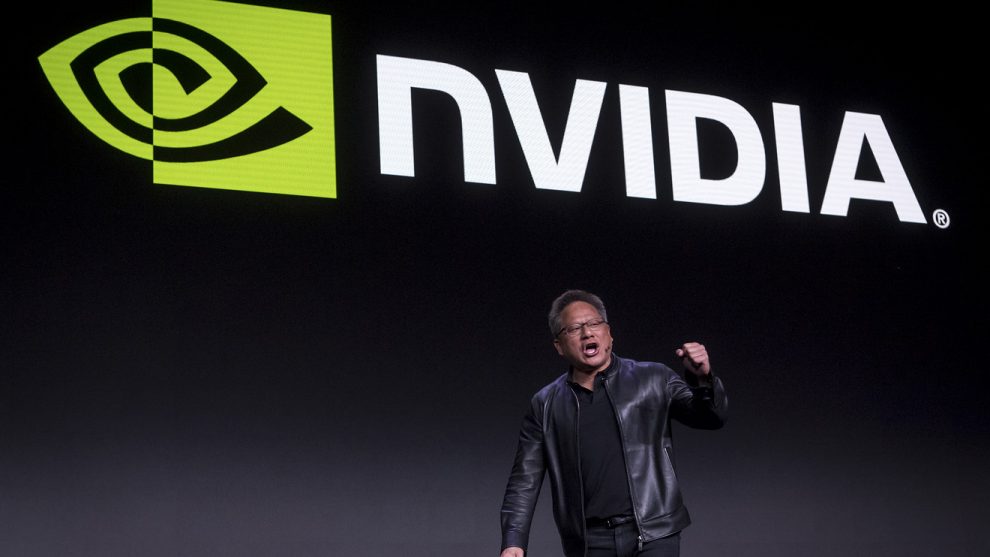

Nvidia’s gaming business was hurt by a transition to its new Turing architecture late last year, as there were not many videogames adopting its new ray-tracing technology. Nvidia Chief Executive Jensen Huang told analysts that demand for Nvidia’s new chip architecture for gaming is improving and that more games are coming out that utilize ray tracing.

Data center, though, remains a thorn in Nvidia’s side from Wall Street’s view, based on how many analysts asked about that business. One analyst noted that it was the hardest business for them to predict.

Bernstein Research analyst Stacy Rasgon noted that while Nvidia said it saw broad-based growth in data center, revenue only grew 3% sequentially.

Kress said the broad-based growth was in the number of customers beyond the large cloud-computing providers and other large data-center customers that have begun to leverage machine learning. She also noted that a couple of the company’s big hyperscale customers are not buying right now, nor growing, because they are focusing on research and absorbing previous purchases.

“It can get very lumpy when they buy and when they absorb,” Kress told MarketWatch. “We know that will eventually turn into revenue.”

The biggest bright spot in the quarter actually was Nvidia’s automotive business, where quarterly revenue was a record of more than $200 million, handily beating the previous quarterly record of $177 million and roughly $30 million more than average analyst estimates. Nvidia investors have been waiting for years for the promise of autonomous-vehicle revenue to come true, but Kress noted that the outperformance was due to one big development-services deal being recognized in the quarter, and again said that revenue there can be “lumpy.”

After almost two years of high double-digit revenue growth and a year of pain, Nvidia claims it is back to normal. But that normal doesn’t appear to be either the high-growth era nor the inventory pain of the past year. As the rest of the year plays out, investors should look for Nvidia to answer the question of exactly where the future will end up.

Add Comment