Qualcomm Inc. investors thought some of its biggest legal issues were abating after the company’s recent agreement with Apple Inc., but a federal court ruling has tossed the chip maker right back into a sea of uncertainty.

U.S. District Court Judge Lucy Koh late Tuesday sided with the Federal Trade Commission, which filed an antitrust lawsuit against the company in 2017. Koh ruled that Qualcomm QCOM, -10.86% violated antitrust law by charging unreasonably high royalties for its patents, and that its licensing practices “strangled competition,” and ordered the company to renegotiate all its agreements, and license its patents at “fair and reasonable prices.” She also said the company cannot sign exclusive supply deals with companies like Apple AAPL, -2.05%

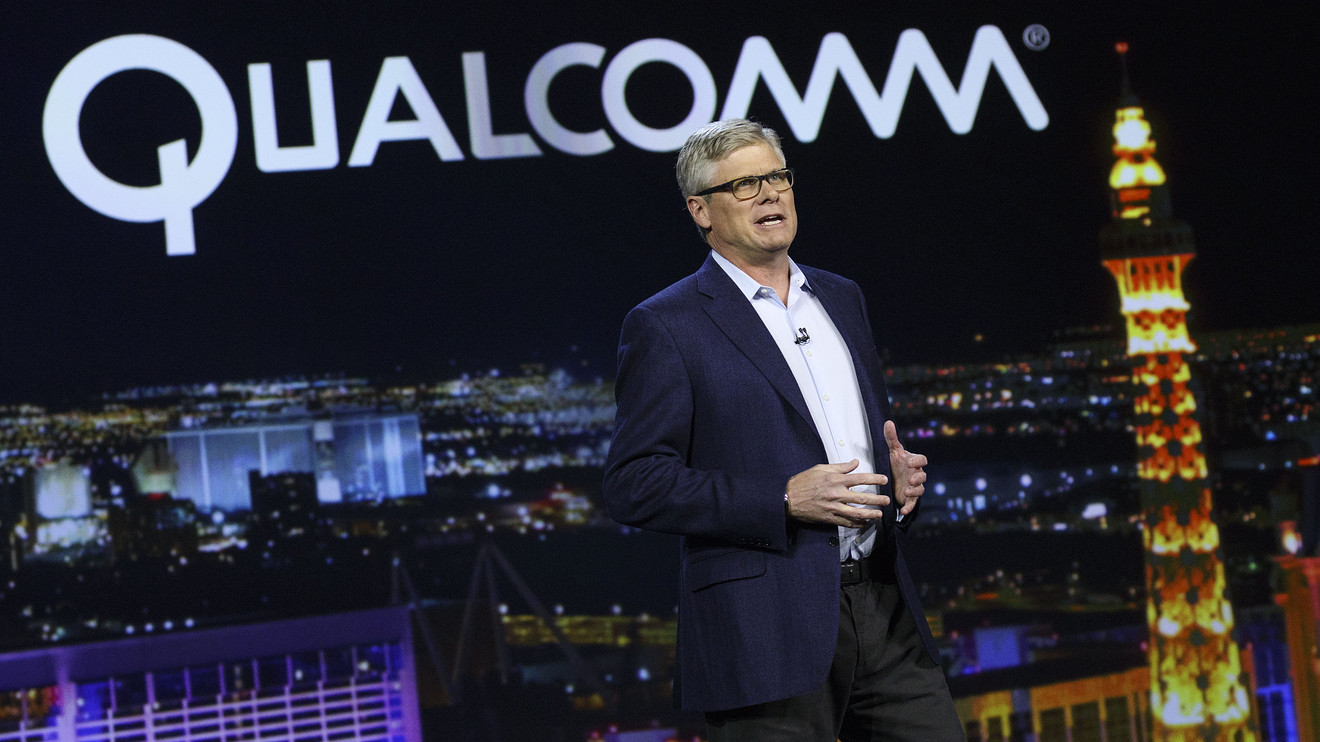

“We strongly disagree with the judge’s conclusions, her interpretation of the facts and her application of the law,” Don Rosenberg, executive vice president and general counsel of Qualcomm, said in a statement.

The ruling, and the immediate promise of Qualcomm to appeal the ruling and seek a stay in the 9th Circuit Court of Appeals, could not save Qualcomm’s stock from an uncertainty-fueled plunge of more than 10% on Wednesday. Investors were rightly rattled, as Wall Street analysts for once were short on predictions for what will happen amid the latest threat to the company’s licensing and royalty business, known as Qualcomm Technology Licensing, or QTL.

“Suggested remedies from the ruling are likely to hinder QTL profitability,” Susquehanna Financial Group analyst Chris Rolland wrote in a note to clients, in a note entitled, “Just When You Think You’re Out…They Pull You Back In.” Rolland said the exact changes to the business demanded by the judge were unclear, as well as what goes into effect immediately. He dropped his price target to $85 from $100. He also said Apple could have an opportunity to renegotiate its long-term agreement with Qualcomm, which the company said could add nearly $5 billion in revenue in the third quarter.

Uncertainty has been a cloud over Qualcomm’s stock ever since its big legal problems began in early 2017 with the FTC case. Stacy Rasgon of Bernstein Research believes renegotiating its license agreements is going to be “onerous.” He said that while investors should not have been surprised by the news, given the judge’s comments early on in the proceedings of this case, “some investors might have hoped that the judge might have softened her views in the wake of Apple’s recent capitulation.”

“Apparently not,” Rasgon wrote in a note to clients.

The appeals process can potentially take a few years, so until this case is resolved, it is going to be another cloud hanging over the stock. Qualcomm investors are right back where they were just two months ago, before the Apple trial began. Now, back in the sea of uncertainty, Qualcomm’s shares are not for the faint of heart.

Want this type of analysis sent to your inbox? Subscribe to MarketWatch’s free MarketWatch First Takes newsletter. Sign up here.

Add Comment