(Bloomberg Opinion) — Investors celebrating Meituan Dianping’s first quarterly profit have as much reason to cheer how the company got there as the numbers themselves.

Surging revenue, market-share gains against rivals such as Alibaba Group Holding Ltd. and success in controlling expenses all helped the Chinese food delivery and bookings provider post net income of 877.4 million yuan ($124 million) versus the 1.57 billion yuan loss analysts were expecting. Most encouraging, though, may be the signs that the company is creating the kind of virtuous cycle enjoyed by Amazon.com Inc.

Meituan’s business model is simple and familiar. Restaurants use the company to sell food. Meituan aggressively chases both consumers and merchants. Customers keep coming back because they know they’ll find a wide range, good prices and quick delivery. The more that food buyers flock to Meituan, the more restaurants realize they need to be on the platform.

Then comes the real magic. To get ahead of the competition, restaurants find they need to up their game by advertising or paying for priority listings. Because others are doing it, rivals have to as well. And so the cycle goes. That should sound familiar because it’s precisely what Amazon has been doing for years. My colleague Shira Ovide summed it up last month with a column titled: Amazon Advertising Is Just a Toll in Disguise.

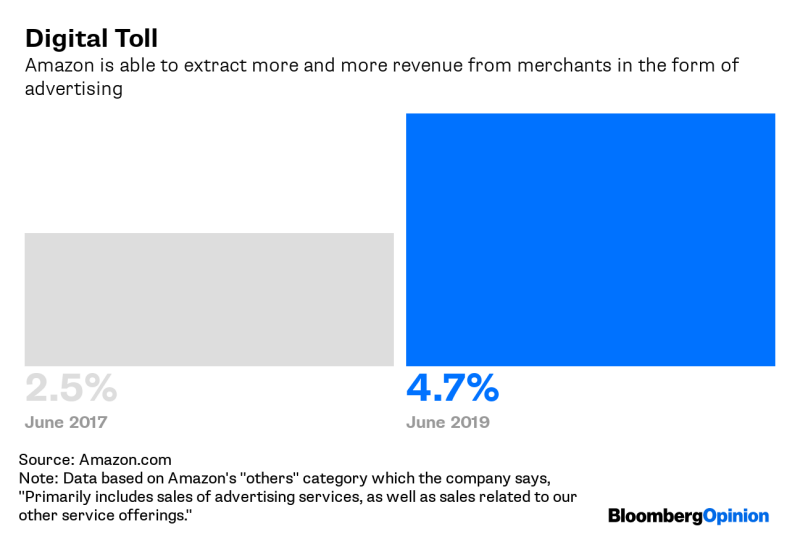

In just two years, the proportion of Amazon’s sales from advertising almost doubled to 4.7%. If you strip out the Amazon Web Services cloud and subscription businesses, the percentage contribution would be even higher.

At Meituan, online marketing services climbed to 8.6% of revenue from its food delivery business in the most recent period, from 5.4% a year earlier. Food delivery remains the company’s biggest and fastest-growing business, accounting for 57% of revenue, yet its travel and hotel-bookings division is no slouch at 43% growth from a year earlier and with an 89% gross margin.

Just as Amazon is enjoying tidy growth and profit at non-core businesses, Meituan appears to be having success in leveraging its relationship with food-delivery consumers to help them book holidays and hotels. While Alibaba-backed ele.me is Meituan’s chief rival in food, the travel division puts it head to head with Ctrip.com International Ltd.

A concern for investors has been the cost of gaining such traction and fighting off competitors. The company fought bitterly with ele.me to gain users, merchants and delivery riders. Meituan’s second-quarter numbers indicate this rivalry may have slowed. Sales and marketing expenses dropped as a ratio of revenue, helped greatly by declining proportions for driver costs and user incentives. Such pragmatism has become a feature: The company backed out of the bike-rental business last year and the stock has been rewarded accordingly. Meituan shares have gained more than 70% in Hong Kong this year, and climbed as much as 7.7% to a record on Monday.

If the company can remain nimble enough to seize new opportunities and ditch failures, there’s a good chance it’ll ride out China’s economic slowdown and emerge as dominant as Amazon is in the U.S.

To contact the author of this story: Tim Culpan at [email protected]

To contact the editor responsible for this story: Matthew Brooker at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”54″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment