Lyric Young’s financial experience in community college was luckier than most.

Yet she is now struggling to afford to continue her education at a public four-year college.

Young, who lives in Manhattan, was part of the City University of New York’s Accelerated Study in Associate Program, while she attended Borough of Manhattan Community College. Known as ASAP, the program covered her tuition, books and transportation during her time at BMCC.

The idea behind the program: If students’ college expenses are covered, they’ll be able to keep up their grades and complete their associate’s degree relatively quickly.

That was the case for Young, 21, who finished her associate’s degree in liberal arts in two years and one semester. “The only reason I had managed to go to community college in the first place was because there was that sense of security knowing that I would have my classes covered,” she said.

Though Young’s college costs were covered during that period and she lived at home, she still worked in retail and as a barista to make sure she had enough money to deal with a financial emergency and to help her family afford groceries and other costs.

Just 27% of public, four-year schools are affordable for low-income students

More than half of the nation’s most affordable colleges are still unaffordable for low-income students.

That’s one takeaway from a report released this month by the National College Access Network, a membership group for organizations committed to college access. Less than half, or 48%, of the nation’s community colleges are affordable for students who qualify for Pell grants, the money the federal government provides to low-income students to attend college.

At the public four-year level, the picture is even worse — just 27% of these schools are affordable for low-income students, NCAN found.

“These are not the engines of college accessibility that we need them to be for individual and national success,” said Bill DeBaun, the director of data and evaluation at the National College Access Network, and the author of the report. “We’ve signaled to students that they should be considering post-secondary education and we don’t make it affordable for them.”

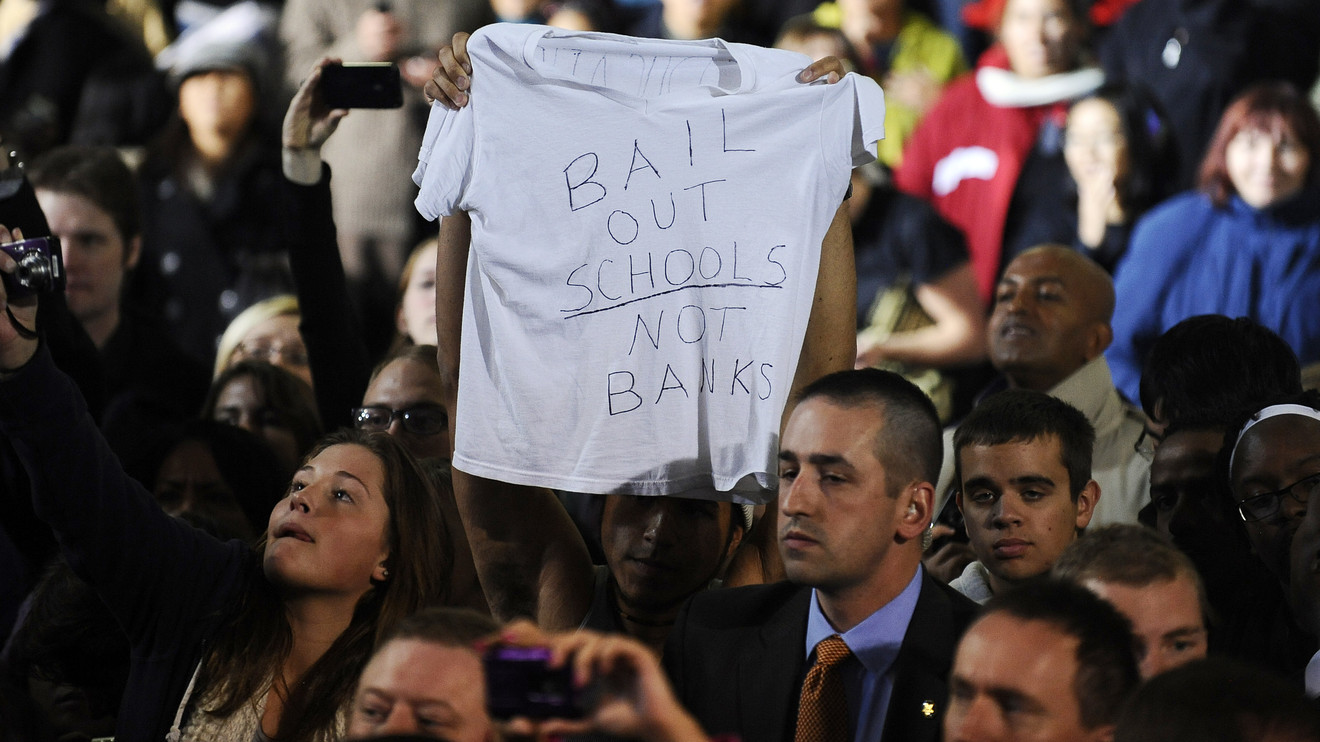

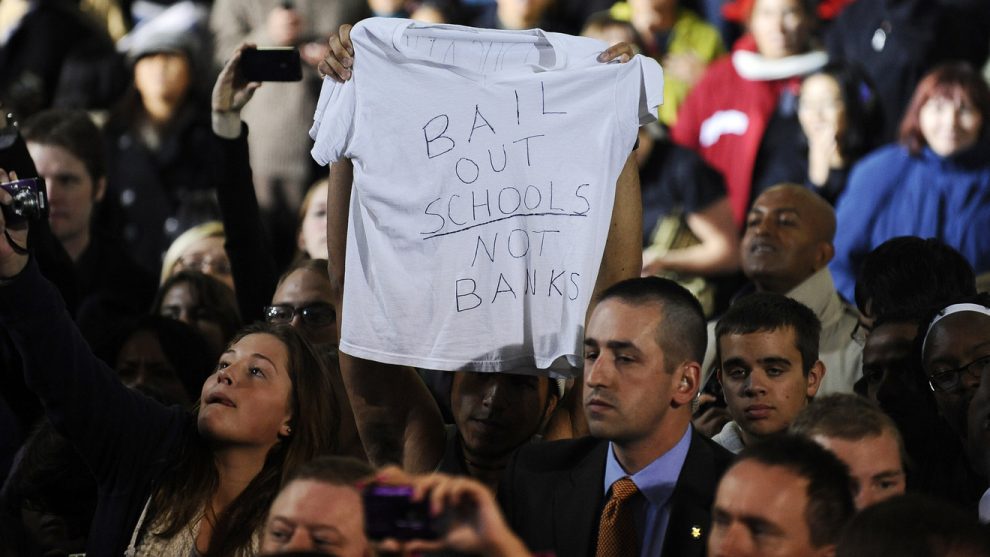

NCAN’s report is the latest sign that a major contributor to our nation’s $1.5 trillion student-loan problem is a lack of affordable college options for students and families. That reality has pushed most of the major contenders for the Democratic nomination for president to propose a plan that would make at least two years of public college free.

The situation may be even bleaker than it appears

And the situation is likely even bleaker than the report portrays. To determine whether a school is affordable, NCAN assumed students would have access to resources that aren’t always available to them.

The organization defines a college as affordable for low-income students if they can pay tuition, afford to live and have $300 available in case of emergencies through a combination of grants (including the Pell grant), loans, expected family contribution — the amount colleges ask families pay based on their finances — and funds from a work-study job and a summer job.

‘There are still so many affordability gaps and so many unaffordable institutions nationwide — it’s discouraging.’

In reality, it can be challenging for students to meet these requirements. For example, families don’t always have the funds to make their expected family contribution — in fact, it’s not uncommon for low-income students to support their families while in school — and work-study jobs aren’t widely available, especially at community colleges.

(The formula also assumes students are attending college in-state and in the case of four-year schools, living on campus. In the case of community colleges, it assumes students are living off-campus but not with family).

Despite these assumptions, “There are still so many affordability gaps and so many unaffordable institutions nationwide — it’s discouraging,” DeBaun said.

The challenges community colleges and their students face

Community college officials are observing this trend in real time, said Matthew Reed, the vice president for learning at Brookdale Community College in Lincroft, N.J.

Community-college students across the country are struggling to afford to live while they’re in school. Roughly 70% of community college students who responded to a survey distributed by the Hope Center for College Community and Justice at Temple University said they’d experienced food insecurity, housing insecurity or homelessness in the previous year.

At Brookdale, officials have worked to ease students’ challenges by opening up a food pantry and expanding their database of open educational resources or textbooks students can access online for free.

“We’ve been attacking the problem on several fronts as have other community colleges,” Reed said. “The biggest issue is flat funding from the state and county.”

That’s pushed the burden of paying for school further onto students and families, even as the school has worked to slash costs, including by cutting staff, Reed said.

The public conversation surrounding college affordability, which often assumes that students are struggling to pay for school because they’re not hunting for the most affordable option, misses this reality, he said. One reason: The frame of reference for many pundits and policy makers is when they went to college decades ago.

“If you’re just looking back at ‘when I was 18,’ you might grumble about ‘well, if they didn’t have cell phones, today’s students could afford college,’” Reed said. “You’re missing the point. Back then the state covered a much larger portion of the budget.”

“If you’re making $9 an hour and trying to live here, and eat here and drive here and pay tuition and buy books, that’s hard,” he said.

Young, meanwhile, is now a student at City College, a public four-year school in New York City, Young’s financial calculus has become even more complicated. Her financial aid isn’t enough to cover her total cost and she has an outstanding balance at the school that she estimates is between $4,000 and 5,000 for three semesters at the school (one which starts in the fall).

“I wish I could tell younger me that [college] is not as cheap and accessible as I thought it would be,” she said.

Add Comment