The Analyst

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Keith Weiss maintained an Overweight rating on Salesforce with a $178 price target.” data-reactid=”20″>Keith Weiss maintained an Overweight rating on Salesforce with a $178 price target.

The Thesis

A strong case for 25%-plus free cash flow growth isn’t priced into Salesfore shares and that, coupled with investor concern around a slowdown in the core business, creates a “strong buying opportunity” in a core service-as-a-software asset, Weiss said in a Friday note. (See his track record here.)

The analyst said he sees a clear path for Salesforce to more than double revenues by fiscal 2023, even with merger and acquisition dilution in the near-term.

Salesforce shares have underperformed, advancing just 3% year-to-date against its software peer group thanks to M&A dilution, Weiss said.

The company earlier this summer sealed up a .7-billion acquisition of data analytics firm Tableau Software.

Salesforce enjoys a favorable competitive position, and there’s healthy customer demand across its product offerings, the analyst said.

“With enterprise IT spend focused on digital transformation, Salesforce remains one of the best secularly positioned names in software and a long-term share gainer within an estimated $200B+ Total Addressable Market.”

Price Action

Salesforce shares were down 1.84% at $140.73 at the close Monday.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Related Links:” data-reactid=”30″>Related Links:

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="KeyBanc: Salesforce Poised To Benefit From Data Opportunity After Tableau Acquisition” data-reactid=”31″>KeyBanc: Salesforce Poised To Benefit From Data Opportunity After Tableau Acquisition

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Tableau CEO On Synergies With Salesforce: The ‘Best Of Both Worlds’” data-reactid=”32″>Tableau CEO On Synergies With Salesforce: The ‘Best Of Both Worlds’

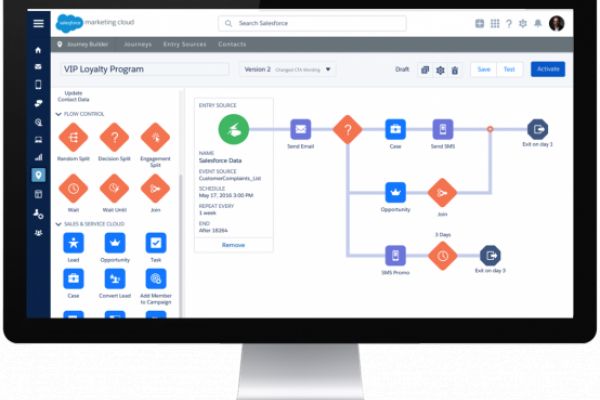

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Photo courtesy of Salesforce. ” data-reactid=”33″>Photo courtesy of Salesforce.

Latest Ratings for CRM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2019 | Maintains | Buy | ||

| Mar 2019 | Initiates Coverage On | Outperform | ||

| Mar 2019 | Initiates Coverage On | Buy |

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="View More Analyst Ratings for CRM

View the Latest Analyst Ratings” data-reactid=”37″>View More Analyst Ratings for CRM

View the Latest Analyst Ratings

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="See more from Benzinga” data-reactid=”38″>See more from Benzinga

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.” data-reactid=”43″>© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment