As we watch for further developments on the U.S.-Iran conflict that jolted investors awake a few days into 2020, it’s worth remembering that during this lengthy bull market, geopolitical worries have not pulled stocks off their upward path for too long.

That seemed to play out Monday, though we could always be looking at a “different-this-time” scenario. If the conflict doesn’t escalate, “markets should push higher with oil and gold prices moving lower,” South Africa-based Vestact Asset Management told clients on Tuesday.

Well before Iran-related headlines, strategists were heard advising investors to keep an eye on the global economy this year, as a healthy one is vital to keep markets rising.

That brings us to our call of the day, from strategists at investment bank Jefferies who are bullish on certain consumer discretionary companies this year. As a reminder, those companies produce goods and services purchased if households have extra income.

Strategists Sean Darby and Steven DeSanctis predicted in a note that in 2020, bigger organizations will begin to take market share from smaller to medium-sized companies. That is, those with more size, scale and technology which can use that to their advantage to reach more customers.

Companies that have been investing in technology are able to watch digital engagement and consumer data closely, and have more marketing power, say Jefferies’ strategists.

So, what are the companies with scale that they like? In beauty products, they are fans of Ulta ULTA, +0.31% ; for consumer packaged goods, Constellation Brands STZ, +0.46% ; among convenience stores, Casey’s General Stores CASY, +2.05% CASY, +2.05% ; for gaming and lodging, Eldorado Resorts ERI, +1.36% ; among mass retailers, Walmart WMT, -0.20% ; for restaurants they like McDonald’s MCD, +1.12% and Starbucks SBUX, -0.79% ; and they offer three in the hardline retail space — Home Depot HD, +0.47%, Lowe’s LOW, +0.63% and Best Buy BBY, +0.84%.

The market

After a multi-month peak, U.S. oil prices CL00, -0.79% are slipping. Dow YM00, +0.05%, S&P ES00, +0.04% and Nasdaq COMP, +0.56% futures are up just a bit, while European stocks SXXP, +0.42% are solidly higher. Asian markets ADOW, +0.74% have risen.

The chart

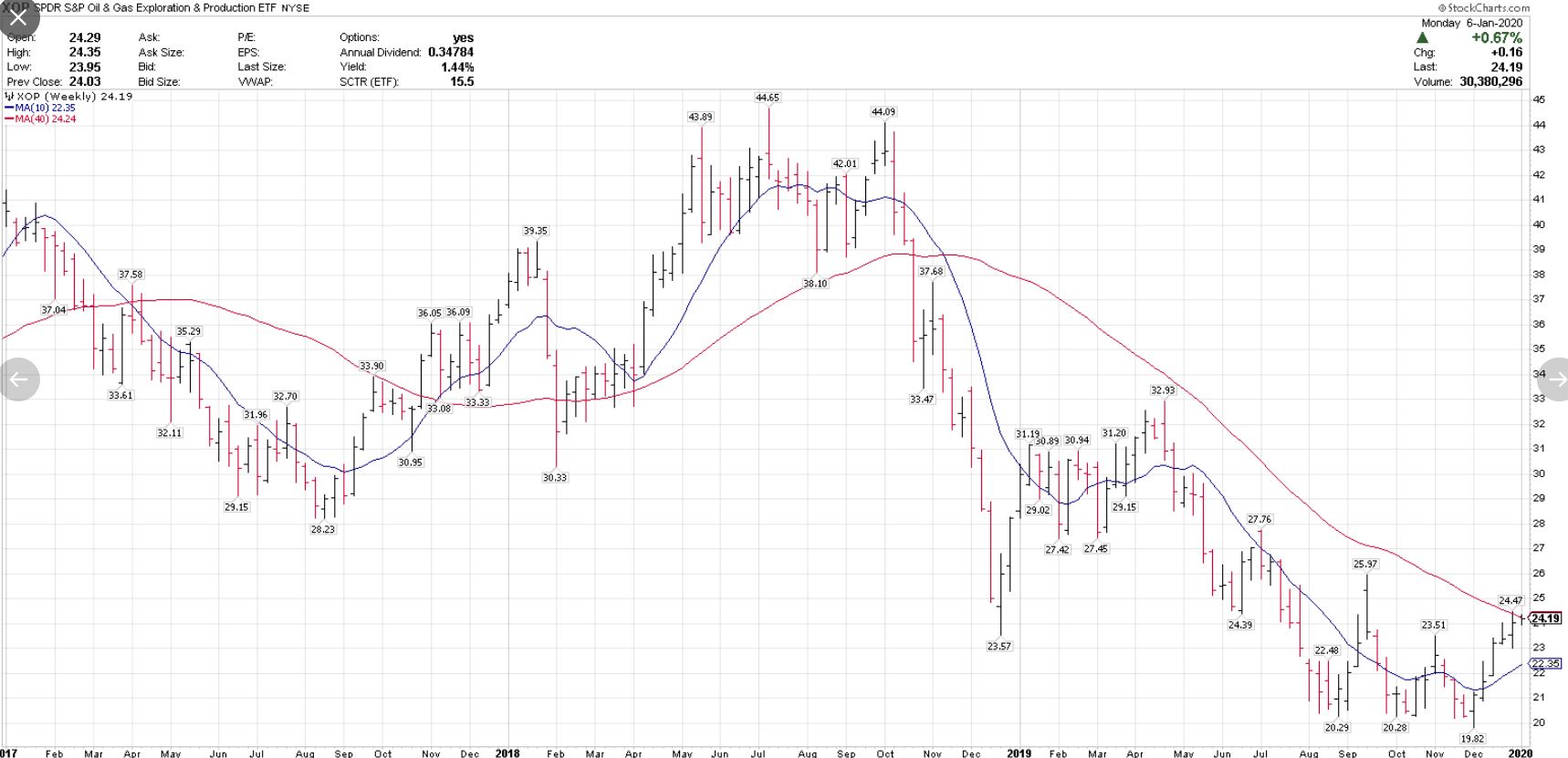

One of last year’s worst-performing sectors has been looking up, and that could keep going in 2020, says Larry Tentarelli, trader and publisher of the Blue Chip Daily Trend Report. He makes his point with this chart of the S&P Oil & Gas Exploration and Production exchange-traded fund XOP, +0.67% :

Blue Chip Daily Trend Report

Blue Chip Daily Trend Report “XOP [the S&P Oil & Gas Exploration and Production ETF] XOP, +0.67% did make an all-time low in December, and has been up five weeks in a row since then, a sign of a potential major long-term bottom,” Tentarelli writes.

He’s also positive on some related large-cap names in that sector — ConocoPhillips COP, +1.19%, BP BP, +2.63%, Halliburton HAL, +2.54%, Schlumberger SLB, +0.64%, and Transocean RIG, +1.85% — and Diamond Offshore DO, +1.57% among smaller to midcap companies.

The buzz

Iran is reportedly looking at ways to retaliate against the U.S. for the killing of its top general Qassem Soleimani. That’s as a stampede at a funeral for him reportedly killed dozens.

At a big Las Vegas tech show on Monday, ride-hailing app company Uber UBER, +0.67% unveiled a partnership for electric air taxis with South Korean auto group Hyundai Motor 005380, -0.43%, while wireless chip maker Qualcomm announced an autonomous driving system.

Also at that show, Impossible Foods upped its battle with rival plant-based burger group Beyond Meat BYND, -1.09%.

More from the Consumer Electronics Show: Intel and Advanced Micro Devices show off new wares

The tweet

Tesla TSLA, +1.93% just delivered its first made-in-China Model 3 cars. CEO Elon Musk seems upbeat:

The economy

The trade deficit, the Institute for Supply Management’s non-manufacturing index and factory orders are ahead.

Random reads

Australia bushfires may have killed over a billion animals

Money is “overrated,” says high-earning pro-basketball star

#2020tipchallenge gets real thanks to actor Donnie Wahlberg

6.5 earthquake strikes Puerto Rico

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment