The problem with coming up with a value of bitcoin is how can you arrive at one? As its critics point out, there is no intrinsic value. There are no future cash flows to discount, like a stock, because there are no cash flows at all.

One way is to come up with the cost of extraction — just as for a metal like gold or silver — using the cost of electricity and the associated computing costs required to mine a bitcoin. Another is to come up with an estimate of the global “anti-fiat” market, arriving at a market share, and then working backward.

But a third way would be through technical analysis, which involves trying to discern patterns in the charts of price and volume. Like bitcoin itself, technical analysis can be waved away as some hocus pocus that only has value because people think it has value. But if you believe in the world of Fibonacci retracement and Bollinger Bands, read on.

Louis Navellier, the chairman and founder of fund manager Navellier & Associates, says he has identified two head-and-shoulders formations that he thinks suggest bitcoin will fall below $10,000.

Navellier says when he asks individual investors about why they invested in bitcoin, it was more often than not because the price was going up. “If they bought it just because it was going up, they are also likely to sell it because it is going down. I think a break below $30,000 will lead to major downside, as the vast majority of trading in 2021 was done above that level, leading to what traders call ‘overhead supply,’” he says.

The leverage in bitcoin — sometimes as much as 100:1 — also would exacerbate any decline, he says. “When it crashes this time around, it will be more brutal due to the large number of individual investors involved,” says Navellier.

Bitcoin BTCUSD, +3.28% on Wednesday morning was trading around $34,000.

The buzz

Eric Adams, who is leading the complicated Democratic nomination race to be New York City’s next mayor, reportedly promised “economic development, bitcoin, self-driving cars and renewed business,” according to Politico’s reporter.

Apple Daily, the pro-democracy newspaper in Hong Kong, will close, after China imposed a national security law.

Morgan Stanley MS, -0.28% is reportedly barring unvaccinated workers from entering its New York City offices, reports said. While U.S. COVID-19 cases are trending lower, they are growing rapidly in a handful of states — including Missouri and Oklahoma — with low vaccination rates.

The economics calendar includes the release of preliminary U.S. purchasing managers indexes, as well as new-home sales. The flash eurozone PMI composite rose to its highest level in 15 years. Strategists at Credit Suisse say the gap between bond yields and what is implied by global manufacturing new-order PMI readings is too wide. They expect the 10-year U.S. bond yield to head toward 2% on a six-month view.

Stock futures ES00, -0.03% NQ00, +0.01% were steady, following the fourth-highest finish for the S&P 500 SPX, +0.51% on record. The yield on the 10-year Treasury TMUBMUSD10Y, 1.466% was 1.46%.

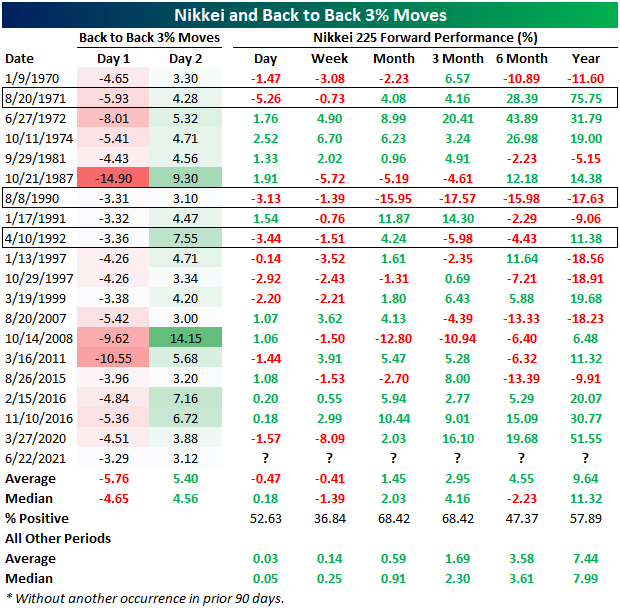

The chart

Japanese stocks have had a rocky few days, sliding over 3% on Monday and then rising over 3% on Tuesday. Analysts at Bespoke Investment chronicled just how many consecutive 3%-plus decline-followed-by-gain over the years, and the subsequent performance, for the Nikkei 225 NIK, -0.03%. The numbers suggest it is a positive sign for the ensuing 12 months.

Random reads

Procter & Gamble’s PG, +0.04% Tide is making laundry detergent for space.

Twin panda cubs were born in Tokyo’s zoo.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.