Too darned hot?

As much of the U.S. gets ready to face a heatwave, the appetite is just as sizzling for stocks after Fed Vice Chairman Richard Clarida and New York Fed President John Williams revved up market expectations about rate cuts. Some backpedaling on those comments is cooling things off a little, but there’s still plenty of enthusiasm out there for equities.

Hold your horses, says our call of the day, from Mike Wilson, chief investment officer of Morgan Stanley, who tells MarketWatch in an interview that investors should wait for better times to jump into this stock market. And they are coming.

“We’re not looking for the bottom to fallout like last year, but I do expect a 10% correction in the next three months,” said Wilson, whose end-year S&P target is 2,750.

One reason is that earnings estimates are still 5% to 10% too high, a factor which will weigh on stocks in the next 6 months, he says. Once those estimates come down, stocks will look a lot more attractive.

There are other obstacles for equities, such as tough technical resistance at 3,000 for the S&P 500 and the hype surrounding an expected Fed cut that may turn it into a “sell the news” type of event.

“We think there’s still some unfinished business and it’s not going to be scary, but it will be a better opportunity to buy stocks over the next three to six months, and maybe 18 months. We tell people don’t chase break outs when everyone is getting excited,” said Wilson.

As for what they will buy when that moment comes, he’s looking around.

“There are a lot of stock markets out there that have not done that well in the last 18 months. We’re looking to buy some of those markets that have really underperformed, small-caps or the cyclicals, banks or energy or value, even Europe and Japan. That’s what we will be looking to buy more aggressively than the S&P 500,” he says.

One U.S. area he’s less keen on right now are growth stocks, which he sees as too crowded, along with defensive companies such as utilities and staples. Wilson expects a “rotation away from the high-growth stocks. If the economy improves next year as we expect, you won’t have to pay such a premium for growth.”

Read: Record share of investors worry buybacks, dividends are too generous

The market

Dow YMU19, +0.28% S&P ESU19, +0.17% and Nasdaq NQU19, +0.24% futures are higher.

Gold GCQ19, +0.81% is climbing, the dollar DXY, +0.20% is up a bit and oil CLQ19, +1.41% is higher after the U.S. said it downed an Iranian drone

Read: This gold-related ETF is crushing the stock market’s gains in 2019

Europe stocks SXXP, +0.07% are higher, and Asia ADOW, +1.17% also had an upbeat session.

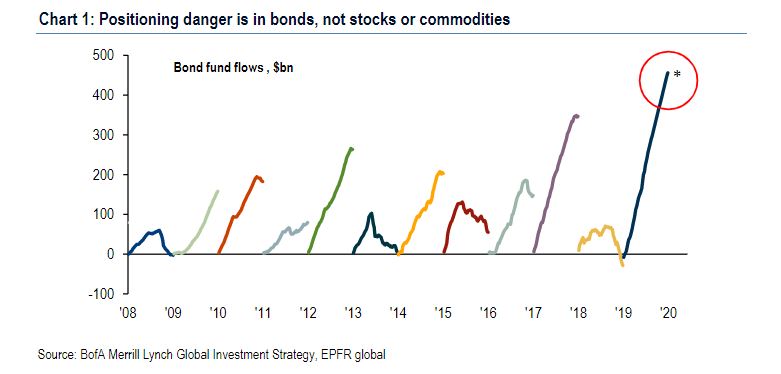

The chart

It’s the “most important flow to know,” says Bank of America Merrill Lynch, and the subject of our chart of the day. In a note, the bank says annualized inflows to bond funds are up to a record $455 billion so far in 2019. That’s huge compared to the $1.7 trillion received over the past 10 years. They say the real danger is all this money flowing into bonds rather than stocks or commodities.

The buzz

Microsoft MSFT, +0.11% shares are climbing on blowout results, but the tech giant is still lacking in one area.

In deal news, AB InBev BUD, +1.04% is selling its Aussie brewer for $11.3 billion.

Red Robin Gourmet Burgers RRGB, +1.19% shares are up on a buyout offer.

Boeing BA, -2.28% has put a price tag — $4.9 billion — on 737 Max groundings, and shares are up.

After a big earnings miss, Netflix NFLX, -10.27% faces a new threat from a U.K. streaming venture.

A son of the late Justice Antonin Scalia nominated by Trump for U.S. Labor Secretary.

Consumer sentiment data is due early, and we’ll hear from St. Louis Fed President James Bullard and Boston Fed President Eric Rosengren.

The tweet

Random reads

In a first, New York forced to cancel triathlon due to heat wave swamping the U.S.

Environmental Protection Agency refuses to ban pesticide linked to brain damage in children

The internet can’t get enough of “Top Gun: Maverick”

Videogame history. This Reddit thread has it all.

NASA celebrates 50 years since the Moon-walk

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment