Either the rare-earth minerals scare was an excuse for nervous investors to cash in on some of this year’s still-solid equity gains, or we’ve reached a shaky new stage in the Sino-U.S. trade war.

In any case, some calm looks ready to return a day after a selloff that was caused by a vague threat from China, and more angst over U.S. growth.

The People’s Republic appeared to suggest it might use its rare earths, a vital high-tech ingredient, as a trade-war weapon. That’s even amid some fierce rhetoric. A China official actually used the words “naked economic terrorism” earlier Thursday.

What else have we seen? A distinct pickup in chatter over the last 24 hours or so from some big names in finance. They have been sounding off about the trade tussle and voicing their own unease over markets.

“Right now we are seeing brinkmanship negotiations, so it is a risky time,” warned Ray Dalio, the founder of Bridgewater, the world’s biggest hedge fund in a fresh blog post. Even more dire was comments from Pimco’s Scott Mather, who spoke of the “riskiest credit markets ever” and warned that central banks have no ammunition to fight a coming slowdown.

Thankfully, our call of the day, from Morgan Stanley’s chief executive James Gorman, is not suggesting that anyone should start stockpiling canned goods. But he does see the market psyche, or mind-set, as fairly “fragile” right now, thanks in part to trade talks that have gone off the rails a little.

“It’s hard to make the case right now for the S&P 500 to move significantly higher, and it’s relatively easy to make the case for it doing the reverse,” said Gorman, who told Bloomberg that stocks have been “running at a record high,” but are up against “more negative news than positive news.”

He said right now more people think equities are headed lower and the U.S. is facing a likely recession, which means downbeat headlines will cause financial markets to react more. And while the probable risk is that stocks are headed lower, he said we can relax a little because the “magnitude” is not likely to be too big.

“I don’t think we’re looking at a collapse [in equities]. I think we’re just looking at taking some of the excitement out of the markets that has been building in the last six months. The trade talks happen to be the catalyst driving that right now,” he said. If officials on both sides can get back to the table and “get us back on track, this could turn very quickly in terms of sentiment,” he said.

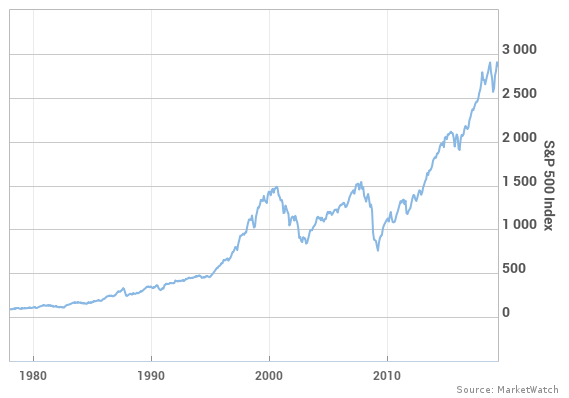

As for retail investors trying to navigate this mess? Do nothing, says Gorman. “I tell them the same thing all the time. The markets go up and down. Long term, if you stand back from a chart of the markets, certainly in the U.S. and global equity markets over the last 50 years, it’s a straight line from bottom left to top right.”

MarketWatch

MarketWatch

But move in closer, Gorman says, and you get a lot of “saw-tooth” bouncing up and down. “Right now I wouldn’t encourage people to move one way or the other. There’s too much uncertainty. There’s nothing to be gained from trying to be clever at this point in time. leave that to the professionals. The retail investor should hold for the long run.”

Read: Here’s the damage done to the stock market since Trump’s May 5 trade tweet

The market

The Dow DJIA, +0.30% , S&P 500 SPX, +0.49% and Nasdaq COMP, +0.59% futures point to a bounce after Wednesday’s action that saw stocks finish off lows, but still deep in the red. Read more in Market Snapshot.

The yield on the 10-year bond TMUBMUSD10Y, +0.27% has come off a 20-month low, while the dollar DXY, +0.10% is steady. Gold GCM19, -0.11% is down, while oil prices CLN19, +0.31% are mixed.

Europe stocks SXXP, +0.45% traded mostly, while Asian equities were mixed. China stocks SHCOMP, -0.31% finished slightly lower, while South Korea’s Kospi 180721, +0.77% rebounded 0.7%.

The economy

Gross domestic product for the first quarter was revised down to 3.1% from 3.2% for the first quarter. Weekly jobless claims rose slightly to 215,000, while the U.S. trade deficit in goods rose 0.3%. Pending home sales are still to come. See preview of the rest of the week’s data here.

The quote

“This kind of deliberately provoking trade disputes is naked economic terrorism, economic chauvinism, economic bullying.” — That was China’s Vice Foreign Minister Zhang Hanhui in comments Thursday as Sino-U.S. tensions continue to simmer.

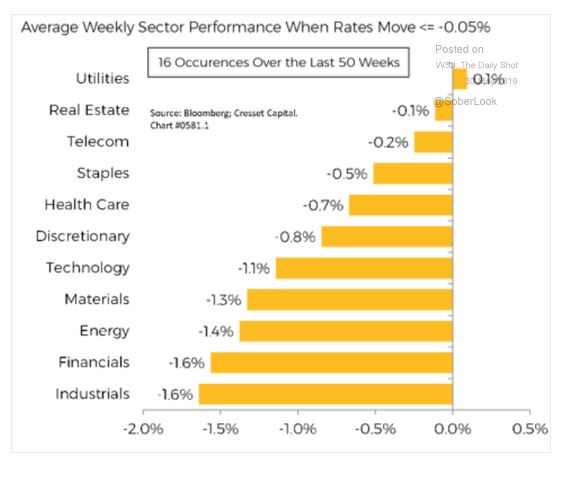

The chart

Our chart of the day from Jack Ablin, chief investment officer at Cressit Wealth Advisors (h/t The Daily Shot) reveals which equity sectors suffer the most when Treasury yields drop by, for instance, at least five basis points.

Yields, which move inversely to price, have been plunging lately on worries about the economy and trade tensions. The yield on the 10-year Treasury bond is down 30 basis points since late April.

Read: Here’s why stock-market bulls should fear the slump in Treasury yields

The buzz

We’re getting some results from retailers, with Dollar General DG, +7.39% shares getting a lift from upbeat news on earnings, and shares of Burlington Stores BURL, +9.58% down after same-store sales disappoint. J. Jill JILL, -50.69% also took a tumble after the women’s clothing retailer posted weak profit sales and a downbeat outlook.

Disney DIS, +0.56% Chief Executive Robert Iger said the entertainment giant could yank productions from Georgia if the state’s new abortion ban is implemented. Netflix NFLX, +0.86% has also said it would rethink entire operations in the state, and some actors and actresses are boycotting the state. Louisiana, meanwhile, joined the list of those passing strict abortion bans late Wednesday.

The Energy Department used the words “freedom gas”and “molecules of U.S. freedom” instead of natural gas, and were promptly rewarded with mockery.

French automaker Renault RNO, -1.48% has gotten a big share boost from news of a pending tie-up with Italy’s Fiat Chrysler FCAU, -1.18% FCA, -0.74% But a whole different marriage may be in the works.

Random reads

Former vice president and environmental activist Al Gore tells Harvard to clean up its fossil fuel investments

7 dead, 21 tourists missing after South Korea tour boat sinks in the Danube River

Out of sight? The hubbub over the USS John McCain

Sons of pro NBA greats LeBron James and Dwayne Wade will be on the same high school basketball team

Four gross ‘red flags’ to watch out for when you dine out, say chefs of Reddit

Fearing English ‘hooligans’, some Madrid bars will shut for the UEFA Champions League game Saturday

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment