It is going to be another bloodbath for stocks.

The coronavirus crisis has ramped up another level with large parts of Europe on lockdown and the U.S. looking set to follow suit. Health officials have recommended a ban on public gatherings of 50 or more people, while the U.S.’s top infectious diseases expert Dr. Anthony Fauci said a national lockdown wasn’t out of the question. The Federal Reserve slashed interest rates back to zero and launched a massive bond-buying program on Sunday in a bid to prop up the economy.

But U.S. stock futures hit limit down ahead of the open on Monday, and the SPDR S&P 500 ETF tumbled SPY, +8.55% 9.6%, indicating the central bank’s dramatic intervention would do little to stop the rot.

In our call of the day, Goldman Sachs downgraded U.S. GDP forecasts and said a recession was on its way.

The investment bank’s economic research team, led by Jan Hatzius, said economic activity would “contract sharply” for the rest of March and April as consumers and businesses cut back on spending. They expected a recovery after April, though that was uncertainty, but said their new forecasts “probably” met the criteria for a recession.

They expected real GDP growth of 0% in the first quarter and a contraction of 5% in the second quarter. “This takes our 2020 GDP forecast down to +0.4%(from 1.2%). The uncertainty around all of these numbers is much greater than normal.”

The team said the prospect of a recovery and strong growth in the second half were dependent on whether social distancing and warmer weather reduces the number of virus cases, how quickly reduced infections will bring a return to normality and how effective fiscal and monetary policy turns out to be.

Goldman Sachs chief equity strategist David Kostin said, in a separate note, the S&P 500 could fall to as low as 2,000 points if the economic impact of the virus worsens but expected the index to reach 3,200 by the end of 2020.

The tweet

Former Governor of California and all-round movie hardman Arnold Schwarzenegger has issued a plea for Americans to stay at home amid the coronavirus crisis, in his own unique way.

The market

After the Dow Jones Industrial Average DJIA, +9.36% enjoyed its best day since 2008 on Friday, immediately after its worst fall since ‘Black Monday’ in 1987, U.S. stocks were set to tumble again on Monday. U.S. stock futures hit ‘limit down’ late on Sunday — falling 5% — after the Fed cut interest rates to near zero. Dow futures YM00, -4.56% were 4.6% down early on Monday, S&P 500 futures SPX, +9.29% fell 4.8% and Nasdaq futures COMP, +9.35% dropped 4.6%.

European markets also plunged at the open, as the coronavirus pandemic brought a number of countries to a complete standstill over the weekend. The Stoxx 600 SXXP, -9.27% fell 8.5%, while the French CAC PX1, -10.90% plunged almost 10% as France closed bars, restaurants, schools and universities, effectively imposing a national lockdown. Gold futures GC00, -2.87% fell 0.8% to $1,505 per ounce.

The buzz

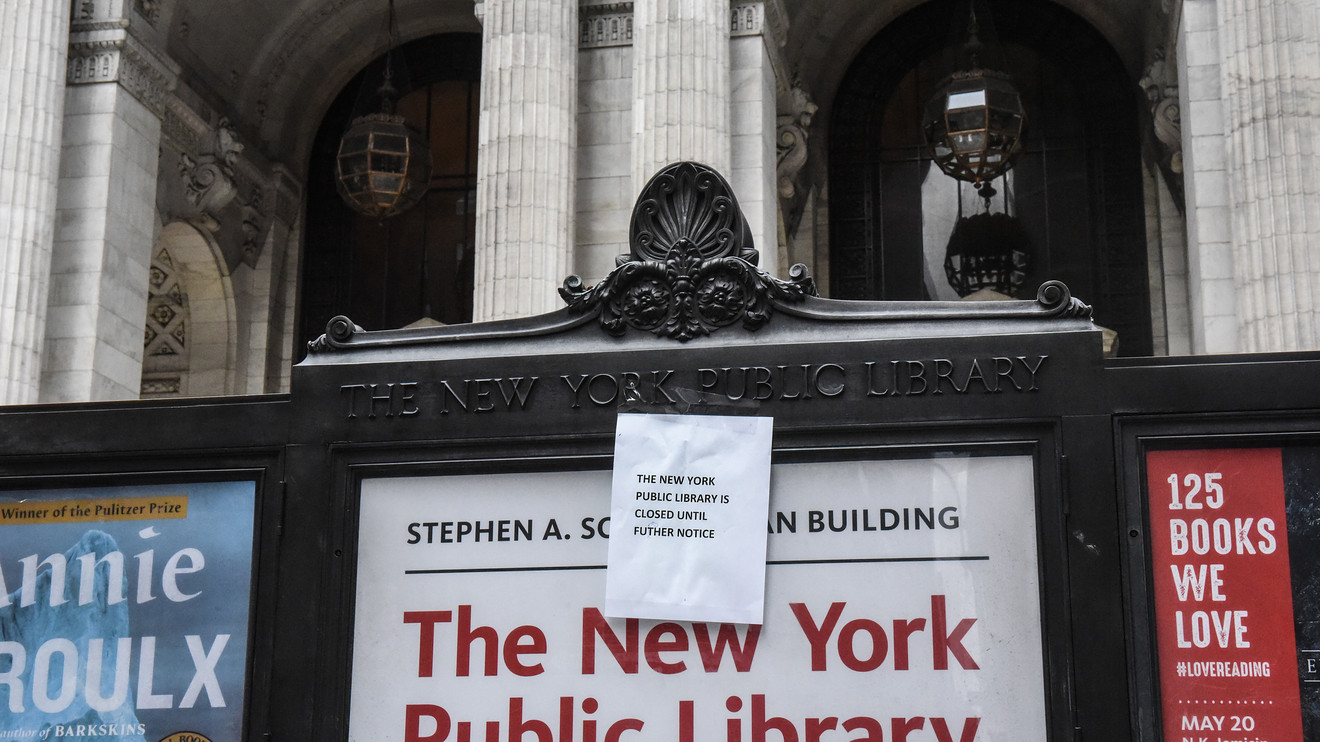

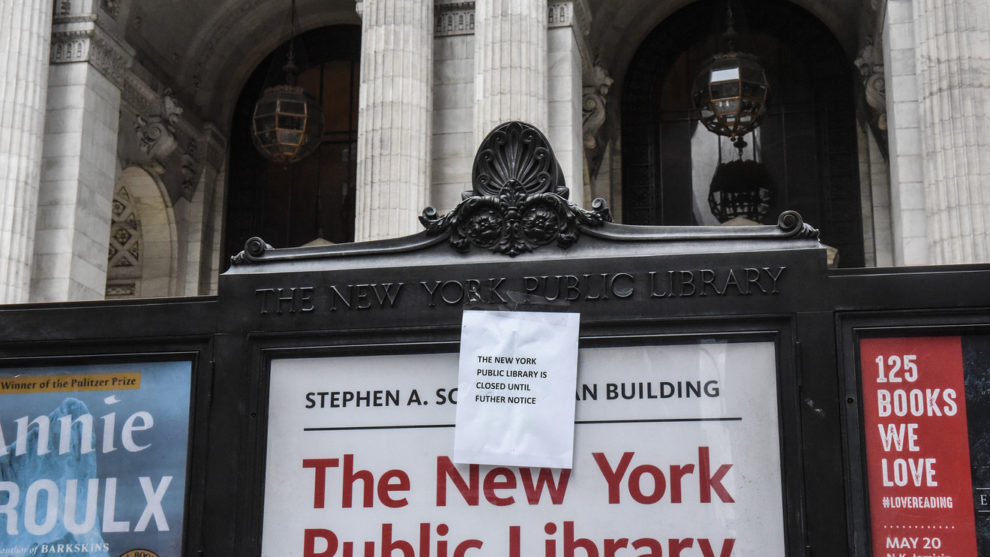

New York City will close the country’s biggest public school system on Monday, while restaurants, bars and cafes will be limited to “food takeout and delivery” from Tuesday.

United Airlines warned March revenue would be $1.5 billion lower than a year ago, as passenger numbers have fallen by one million in the first two weeks of the months compared with March 2019 due to the COVID-19 outbreak.

The Federal Reserve slashed its benchmark interest rate to a range of zero to 0.25% on Sunday and launched a $700 billion bond-buying program known as quantitative easing in a bid to protect the U.S. economy from coronavirus.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment