Stocks were off to a slow start on Thursday, with one exception: meme stocks.

Shares in videogame retailer GameStop GME, +13.34% have risen more than 20% this week while cinema group AMC’s AMC, +95.22% stock price has nearly doubled, and both stocks are up again in the Thursday premarket.

The meme trade was in focus late January and early February because of individual investor attention on companies including GameStop, AMC, and BlackBerry BB, +31.92%. A flock of investors, largely organized on social media platform Reddit, helped squeeze the short positions of hedge funds, causing multibillion-dollar losses and some unbelievable gains for individuals that timed it right. It also epitomized a new era of investing, as individuals took advantage of crowdsourced strategy and no-fee brokerage accounts.

Our call of the day, from economist Mohamed A. El-Erian—the chief economic adviser at Allianz—is that one thing is certain as AMC stock keeps going up, and that the meme trade frenzy represents three key long-term changes in finance which must not be ignored.

“It has been tempting for some to dismiss this retail investor phenomenon as nothing more than a mob of young irresponsible gamblers treating the stock market like a casino,” El-Erian said, writing in Bloomberg. “That would be a mistake.”

First, the trend represents what the economist calls a “realignment of the investment landscape at its outer edges.” Reddit allows individual investors to coordinate effectively and intelligently, similar to the way that other social media platforms have helped activists coordinate actions.

Second, El-Erian said it illustrates how ultraloose monetary policy enables risk-taking. Cash handouts and easy leverage are the main forces, and themselves come from a shift in central bank strategy toward low interest rates and huge injections of liquidity.

“It is the same combination that has fueled the SPAC and cryptocurrency phenomena that are causing belated indigestion for a growing number of governments and central banks,” the economist added.

Plus, this essential reading: Tendies? Diamond hands? Your guide to the lingo on WallStreetBets, the Reddit forum fueling Gamestop’s wild rise

Finally, the meme stock frenzy is the latest in a series of episodes where market regulators have been too late to the game, El-Erian said. Regulators face difficult questions “for which there is no broad agreement on answers,” the economist said, ranging from investor suitability and protection to market manipulation and stability.

“Dismiss the AMC whirlwind at your peril,” El-Erian said. “It is part of a much wider phenomenon whose implications go well beyond the immediate and well beyond retail investors.”

El-Erian added that it is hard to tell what may undermine the current jump in AMC’s stock price. “What is certain is that the further the price goes up exponentially, the tenser the tug-of-war will become between new speculative buyers and those looking to sell and monetize significant returns,” the economist said.

The buzz

The U.S. imposed tariffs on the U.K., India, and four other countries on Wednesday in response to national taxes on U.S. technology companies. But the tariffs were immediately suspended for six months to leave room for international negotiation on digital services taxes.

On the U.S. economic front, investors can expect data on initial jobless claims from last week, alongside continuing jobless claims for the week of May 22. At the same time, revised figures for productivity and labor costs for the first quarter of the year are due. Later, the ISM services index for May is coming down the pipe, and Federal Reserve vice chair Randal Quarles will speak.

The Fed announced on Wednesday that it would begin selling the corporate bonds and exchange-traded funds that it bought during the pandemic. It marks a departure by the central bank from the ambitious, pandemic-era efforts to keep financial markets afloat as the economy shut down. Read Alexandra Scaggs from Barron’s for more analysis.

U.S. President Joe Biden has a plan to get 70% of Americans at least one COVID-19 vaccine shot before the July 4 holiday. It includes a pledge from beverage giant Anheuser-Busch InBev to offer free beer if the goal is met, sweepstakes free cruises and Super Bowl tickets from health store chain CVS, and on site-vaccinations at Major League Baseball games with accompanying free tickets.

Shares in Tesla TSLA, -3.01% have fallen more than 3% since The Wall Street Journal reported late Tuesday that regulators twice warned the company—in 2019 and 2020—that CEO Elon Musk’s use of Twitter violated a court order. The shares were down near 2% in the premarket.

The markets

U.S. stock market futures are pointing down YM00, -0.56% ES00, -0.68% NQ00, -0.97%, set for a weak open as investors eye a key U.S. jobs report coming Friday. Equities in Europe were broadly lower SXXP, -0.53% UKX, -0.95% DAX, -0.60% PX1, -0.49%, while Asian stocks were more mixed NIK, +0.39% HSI, -1.13% SHCOMP, -0.36%.

The chart

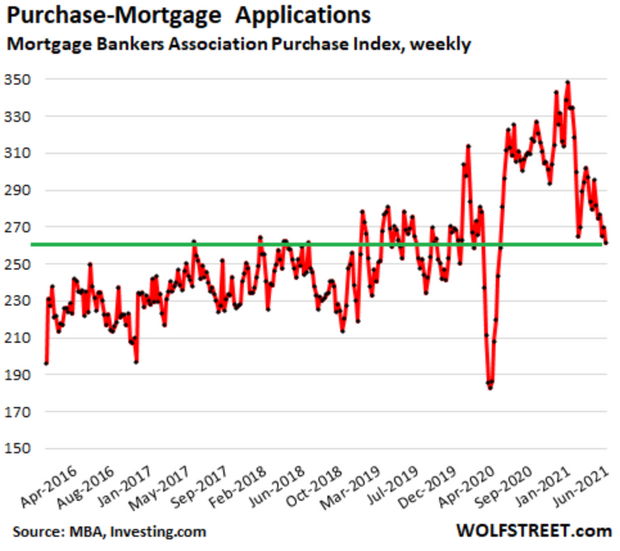

Chart via Wolf Street financial blog.

Is the red-hot housing market cooling among regular buyers? Our chart of the day, courtesy of Wolf Richter from the Wolf Street financial blog, shows that mortgage applications have dropped—even as inventory for the sale of existing homes has been rising for months.

Applications in the week to May 28 fell 4% from the week before the lowest level since May 2020, when the market was recovering from a collapse.

The tweet

Is the Fed decision the beginning of the end of loose monetary policy? Finance twitter is already debating it.

Random reads

Talk about a booster shot: Jonathan Carlyle was motivated to get his COVID-19 vaccine by Ohio’s Vax-a-Million lottery program incentive. He got the $1 million prize.

Bigger than bulls or bears: A herd of wild elephants has closed in on the major Chinese city of Kunming as authorities rushed to keep them out of populated areas.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Add Comment