One way to look at what the market is saying about the economic recovery is to simply observe that the S&P 500 SPX, +0.64% has jumped 49% from the lows of March and is only 2% below where it stood in mid-February, when the coronavirus began spreading outside of China.

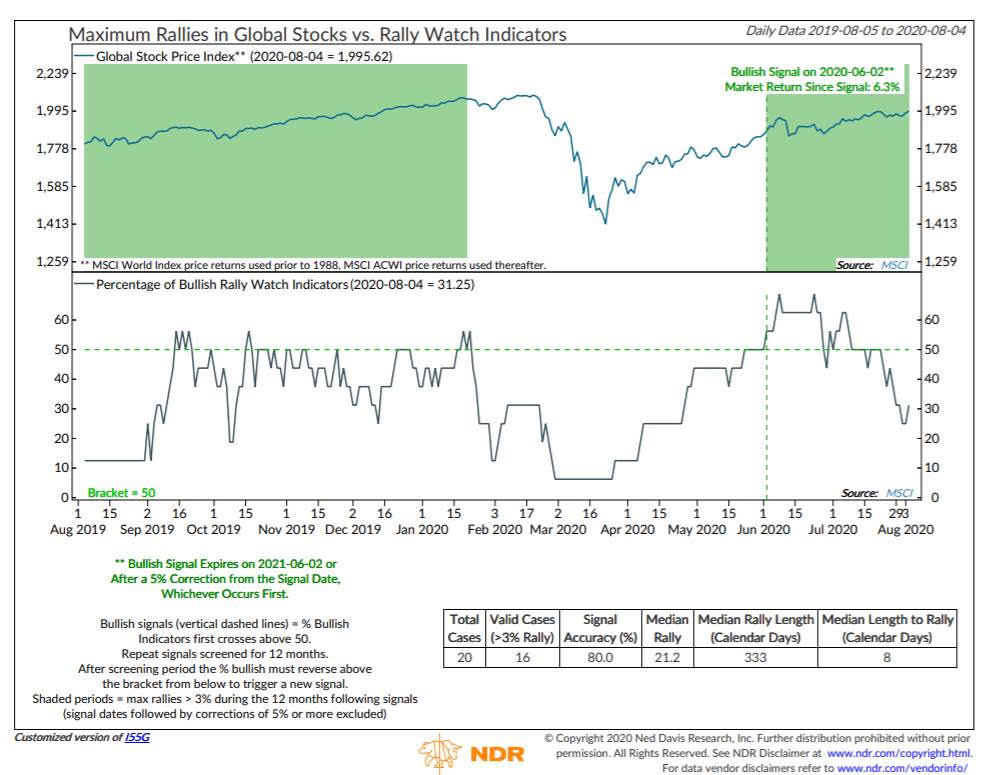

Beneath the surface, however, things aren’t looking as great, as market breadth has declined. The percentage of what Ned Davis Research calls its “Rally Watch” indicators — things like the percentage of stock markets above their 50-day moving averages — has declined. Meanwhile, valuations have gotten more stretched.

Tim Hayes, chief global investment strategist at Ned Davis Research, says the rise in gold GC00, +0.73%, elevated stock VIX, +2.74% and high-yield corporate bond market volatility, and the fall in bond yields TMUBMUSD10Y, 0.522% are all signs that confidence in the economic recovery is waning.

“There’s talk now about whether they going to extend these [unemployment] benefits — will Congress come up with something or not? But the point is, if the economy doesn’t respond to all this liquidity, you have a different environment than what you had in 2009 to 2018,” he says.

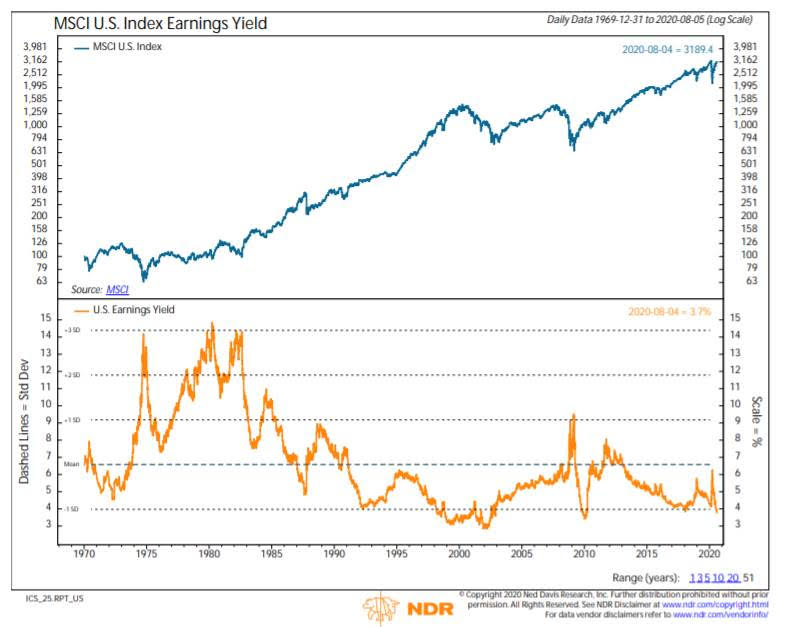

Earnings yields are the opposite of price-to-earnings, so lower yields equal higher valuations.

The firm is still recommending its benchmark allocation to stocks, 55%, and is overweight bonds at 45%.

“From 2009 to 2018, we went through a couple of setbacks, but basically we had a secular bull market, double-digit annualized returns of stocks, responding to this massive liquidity infusion that has effectively reflated the global economy,” Hayes says. “One of the characteristics of a secular bear market is you get negative annualized returns. I mentioned early 2018 a couple of times, but since then, a lot of the indexes have negative annualized returns,” he says.

If the economy doesn’t show signs of picking up and market breadth improve, it could contribute to a potential reallocation out of equities, Hayes says.

The buzz

U.S. jobless claims data will be in the spotlight after the Labor Department reported two straight weeks of rising first-time claims. The New York Federal Reserve’s household debt report is due at 11 a.m. Eastern.

Negotiations on a stimulus package are still “trillions” of dollars apart, according to White House chief of staff Mark Meadows.

Costco Wholesale COST, +0.05% reported its July same-store sales jumped 13%. Streaming device maker Roku ROKU, -0.61% and videogame maker Zynga ZNGA, -1.17% also reported upbeat financials, due to the pandemic keeping people at home.

Fastly FSLY, -6.24% may slide as the cloud-based online content services company identified video-sharing platform TikTok as its largest customer following an earnings beat.

Bausch Health Cos. BHC, +2.47% shares soared after the company said it is planning to spin off its eye-care business into a separate public company

Rocket Cos. RKT, , the parent of Quicken Loans, priced shares at $18, below its target range, as its initial public offering is expected to begin trade.

The market

After Wednesday’s 373-point surge in the Dow industrials DJIA, +1.39%, U.S. stock futures ES00, -0.21% YM00, -0.18% wobbled and recently were trading lower.

Oil CL.1, -0.75% futures fell while gold GC00, +0.73% and silver SI00, +4.40% futures rose.

The British pound GBPUSD, +0.41% rose after the Bank of England held interest rates steady.

The chart

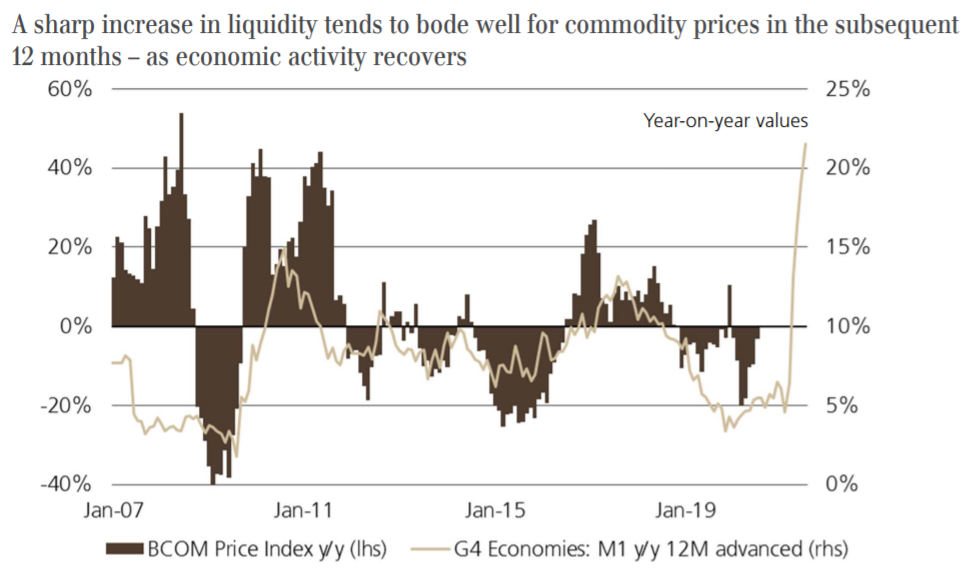

UBS charts how commodity prices typically respond to increases in liquidity. So far, prices have moved off their lowest levels but haven’t gained outright. The analysts expect broadly diversified commodity indexes to appreciate by about 15% over the next 12 months, and say cyclical commodities such as crude oil are poised for the greatest gains.

Random reads

The investment chief of the California Public Employees’ Retirement System resigned without explanation.

Here’s the calculator to show how much richer billionaires are.

Researchers have found a new electrocatalyst that converts carbon dioxide and water into ethanol with very high energy efficiency and low cost.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Add Comment