A year ago, Francesco Filia of Fasanara Capital told The Wall Street Journal that, “If my analysis is right, we’re past the point of no return,” and that “nothing else will do than having cash or shorts.”

It was a big “if,” of course.

Turns out that was just one of many doom-and-gloom misfires that have been popping up across financial media during this long bull run. But recent pullbacks, including Friday’s nasty plunge on the Dow DJIA, +0.71%, have given weary bears a reasons to crow, and, yes they’re, crowing.

In its most recent report, Fasanara likened negative rates to “the magic and poisonous blood-red wishing apple, sending Snow White into deep sleep.”

The hedge fund borrowed a favorite adjective from the president, saying these are “fake” markets, “where valuations are nobody’s problem, and the structure of the market itself morphs in response, to become undiversified, passive, price- and risk-insensitive, abnormally sluggish, half asleep. In induced lethargy.”

Fasanara explained in the call of the day that the lack of liquidity could lead to an explosive move once the unwind inevitably begins.

“Unlocked hot money, retail driven, passively managed: the daily liquidity risk is highly underestimated today,” the hedge fund wrote. “With it, the so-called ‘gap risk’, especially overnight gap risk. Which bring us to the real danger in markets these days being the market itself.”

He said, at any moment, stocks could implode under their own weight.

“If a large-enough shock event takes place,” he explained in his latest outlook, “the market system may find it hard to absorb selling flows, therefore leading to a snowball effect of more selling flows and large downside gap risks.”

Fasanara said the blueprint for the next crisis isn’t 1987, 2000 or 2008. It’s the “Quant Quake” of August 2007. That’s when, leading up to the financial crisis, quant funds, including the Goldman Sachs GS, +1.49% QIS fund, lost billions of dollars as highly-correlated trading algorithms inexplicably dumped stocks.

“This time around it may be 10-fold worse, insofar as it would not be isolated to quant funds but rather sprawling across fast through the undiversified passive expensive financial network,” Fasanara warned.

The market

The Dow DJIA, +0.71% , Nasdaq COMP, +0.85% and S&P SPX, +0.67% were all bouncing back from Friday’s trade-induced selloff, after Trump said China wants to get back to the negotiating table. Gains were tempered, however, after closely followed Global Times editor Hu Xijin said calls between U.S. and Chinese officials were merely at a “technical” level.

At last check, gold GC.1, +0.48% was getting a risk-off lift and silver SI00, +1.65% was also higher. Oil CL.1, +0.63% was up almost 1% and the dollar DXY, +0.33% was in the green, as well.

Europe stocks SXXP, -0.27% turned higher midway through their session, while Asia markets ADOW, -1.74% ended in the red.

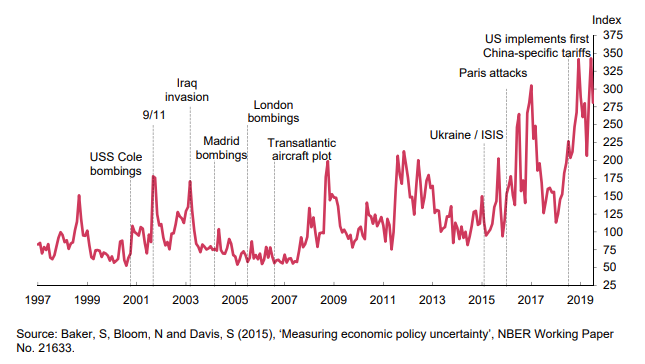

The chart

Bank of England Gov. Mark Carney used this illustration in his prepared remarks for his speech at the boondoggle in Jackson Hole to put spiking global economic policy uncertainty in perspective.

“Today, the combination of heightened economic policy uncertainty, outright protectionism and concerns that further, negative shocks could not be adequately offset because of limited policy space is exacerbating the disinflationary bias in the global economy,” Carney said in the remarks.

The buzz

Joe Walsh, a former Illinois congressman and tea party fave turned outspoken talk show host, has been relentlessly smack-talking Trump all over Twitter TWTR, +0.42%, and now he’s putting his money where his mouth is. Walsh announced Sunday he’ll challenge for the Republican nomination in 2020.

A top Iranian official made a surprise visit Sunday to the G-7 summit, accepting an invitation from French President Emmanuel Macron as world leaders gather and debate how to handle the country’s nuclear ambitions.

The quote

“In many ways this is an emergency. I could declare a national emergency. when they steal and take out and intellectual property theft anywhere from $300 billion to $500 billion a year and when we have a total lost of almost a trillion dollars a year for many years” — Donald Trump, talking at the G-7.

The tweet

The economy

Lots of data this week, but nothing on the schedule is all that earth-shattering. The second-estimate of second-quarter GDP is on the list but we won’t see that until Thursday. As for Monday, the Chicago Fed National Activity Index hits at 8:30 a.m. Eastern, along with July durable goods numbers.

Random reads

Traveling in 2050 will be different. Really different.

Salmon are dying in Alaska because of the heat.

Boy in a bubble watches world through his window, and the world delivers.

Andrew Luck unexpectedly retires and draws boos from fans including one infamous supporter who begged him to reconsider on Twitter:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment